Hotline:0755-22277778

Tel:0755-22277778

Mobile:13826586185(Mr.Duan)

Fax:0755-22277776

E-mail:duanlian@xianjinyuan.cn

Is there still a shortage of silicon material in May? Will 182 silicon wafers be abundant? Is the battery still tight? What are the component requirements? How is the overall market situation recently? This article takes you to understand the supply and demand relationship of the entire industry chain in May through big data!

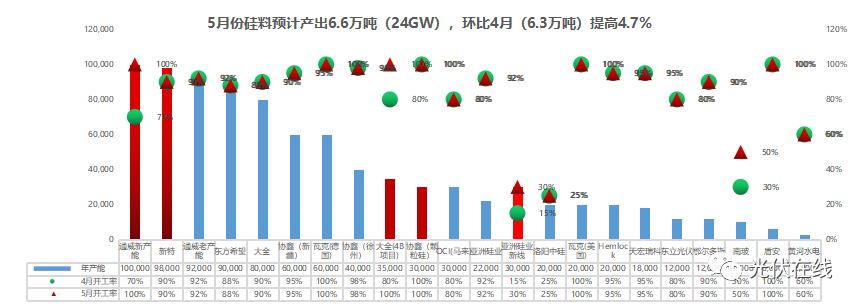

Let's take a look at the output of the silicon material process:

We conducted an analysis of the operating rates and output of 22 mainstream silicon material factories worldwide in May, and estimated a total output of approximately 66000 tons (24GW) of silicon material in May. An increase of 4.7% compared to April! The overall output has slightly increased, and the operating rate of 155000 tons of new production capacity from Tongwei, Xiexin, and Daquan has climbed to 100%! The main maintenance manufacturers in May were the bases of Xiexin (Xinjiang, Xuzhou). Compared to the booming battery production downstream (24GW, mentioned later), there is still a shortage of silicon materials. A significant change in the silicon material sector in May was the improvement of the Shanghai epidemic situation. About 10000 tons of overseas silicon materials affected by the previous epidemic will be circulating in the market. Therefore, this part of the circulating silicon materials will alleviate the shortage of silicon materials to some extent. However, compared to the huge production capacity of crystal pulling and silicon wafers, silicon materials are still insufficient.

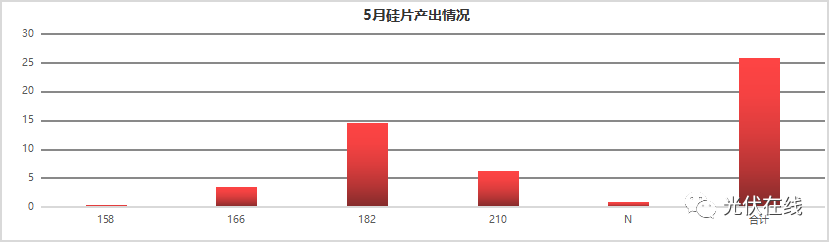

The domestic 630 projects have started delivery one after another, and the demand for 182 and 210 large sizes has recently increased again. Due to factors such as a sudden decrease in downstream demand and inverted battery costs, a large number of crystal pulling and silicon wafer factories have converted 166 sizes to 182 sizes, as well as a small number of 210 sizes. Recently, 182 silicon wafers have shown a slight surplus phenomenon. And the quality problem of the crucible that affected the crystal pulling process in the early stage has been solved, resulting in a slight increase in the production capacity utilization rate of the crystal pulling factory. Combined with the circulation of silicon materials in the market at Shanghai Port, the output of pulling crystals and silicon wafers will continue to increase in May.

But in May, there was also a one week power outage for maintenance at a certain factory, resulting in a shortage of silicon materials and a reduction in 182 silicon wafer output. Maintenance at other factories also affected the output of some 182 silicon wafers. In the short term, there will not be a significant surplus of 182 silicon wafers. With the release of circulating silicon materials, the output of silicon wafers will gradually increase, and it is expected that there may be a surplus situation in June. Of course, the final decision will also depend on the increase in downstream demand. According to a survey on the output of silicon wafers in May, the expected output of silicon wafers in May is 25.5GW, with 182 accounting for 58% and 210 accounting for 24%. The specific output of each size is as follows:

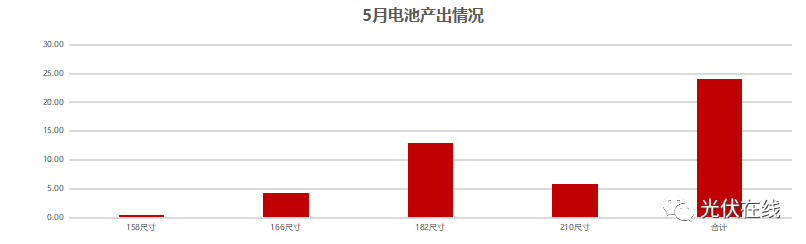

In May, battery prices continued to rise, and currently the mainstream price of 182 batteries has reached around 1.19, which indirectly reflects that battery supply is still tight. Although some major component manufacturers in the current period have reduced their external battery procurement. But with unique cost advantages, small factories in the second and third tier, as well as high priced orders from abroad, still support the strong demand for batteries!

The current effective 182 battery production capacity in the industry chain is all at full capacity, and it seems that 182 batteries are still in high demand. For 210 batteries, with the maturity of the industrial chain and the advantage of high cost-effectiveness, the demand for 210 batteries has also slightly increased. For example, this month, there were also first tier battery manufacturers upgrading 182 batteries to 210 production lines. Due to the uncertainty of battery technology this year, the main focus is on transforming production capacity, with less new production capacity.

In the current situation of concentrated demand explosion, the effective large-scale production capacity of the battery sector has become a short-term supply bottleneck, so the production and supply of large-sized batteries will continue to be tight. This relationship is expected to continue until TOPCON and other N-type high-efficiency batteries are effectively implemented in bulk this year, easing the battery shortage situation! The battery output continued to increase in May, with 182 accounting for 54% and 210 accounting for 25%. The specific research summary of different sizes of output is as follows:

May has always been a golden period for domestic and international installation, with terminal demand only increasing and not decreasing!

The concentrated outbreak of centralized and distributed demand in China: From January to May this year, the total bidding volume for components has reached 69GW, far exceeding last year's (42GW), an increase of 57% compared to 2021; As 630 approaches, large central and state-owned enterprises have started power plant projects, and components have begun to be delivered in bulk; Industrial, commercial, and household projects will also be launched in batches according to the installation pattern of previous years.

The Russia Ukraine war intensifies Europe's demand for new energy, and global inflation stimulates demand for photovoltaic installations! Since the beginning of this year, overseas countries such as India, Europe, the United States, Brazil, and the Asia Pacific region, such as Japan and South Korea, have been the main demand countries for photovoltaics. A large amount of foreign demand has reversed the traditional off-season phenomenon in the first quarter, and in the second quarter, overseas demand will continue to increase due to the impact of the international situation.

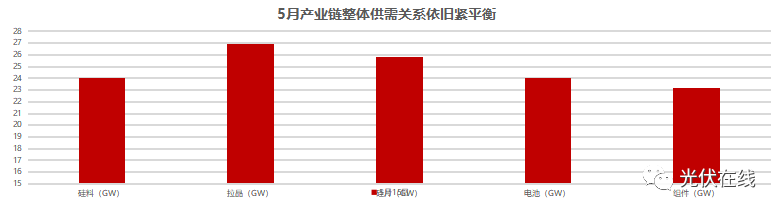

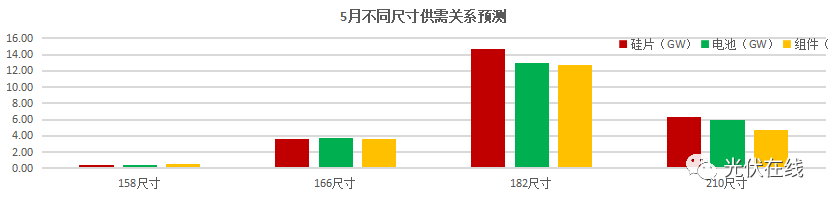

After discussing the above four issues, we will now summarize the supply and demand relationship of the entire industry chain in May into a chart:

Summary: Despite the arrival and circulation of 3.6 GW at Shanghai Port, the supply and demand relationship of the entire industry chain remained tense in May due to the transmission of production cycles! The prices of the industrial chain will continue to remain high! In June, it is expected that there will be a slight surplus of silicon wafers due to the conversion of incoming silicon materials into silicon wafers. However, June is still the peak season for demand growth, and the specific supply-demand gap can be seen in the analysis of June.

We will summarize the output and supply and demand of different sizes into one graph, as follows:

(1) 158 size: The supply and demand of 158 size continue to decrease, mainly produced by a few small custom manufacturers;

(2) 166 size: 166 silicon wafers, batteries, and components are all produced by stable and tightly balanced manufacturers, but there is a structural shortage of silicon wafers;

(3) 182 size: Upstream pulling crystal silicon wafer cells continue to increase slightly, and there may be a slight surplus of silicon wafers, but the supply of battery components remains tight;

(4) 210 size: The output of both upstream and downstream of the 210 industry chain has slightly increased, and the supply and demand are relatively fixed and stable.

Recent market forecast: There will be a shortage of silicon materials in the current month. Due to overseas silicon shipments to Hong Kong, the shortage of silicon materials will ease, and the output of silicon wafers will continue to increase. With the current high operating rate and price impact of batteries and components, it is difficult for the demand in the middle and lower reaches to continue to increase, and there may be a surplus of silicon wafers. The price increase of silicon wafers has no driving force, and silicon wafers may slightly decrease in price. At that time, components will be forced to lower the price of batteries based on the price of silicon wafers. However, the current release of new battery production capacity is limited, and with the support of a large demand, battery prices are relatively firm!

Advanced Institute (Shenzhen) Technology Co., Ltd, © two thousand and twenty-onewww.avanzado.cn. All rights reservedGuangdong ICP No. 2021051947-1 © two thousand and twenty-onewww.xianjinyuan.cn. All rights reservedGuangdong ICP No. 2021051947-2