Hotline:0755-22277778

Tel:0755-22277778

Mobile:13826586185(Mr.Duan)

Fax:0755-22277776

E-mail:duanlian@xianjinyuan.cn

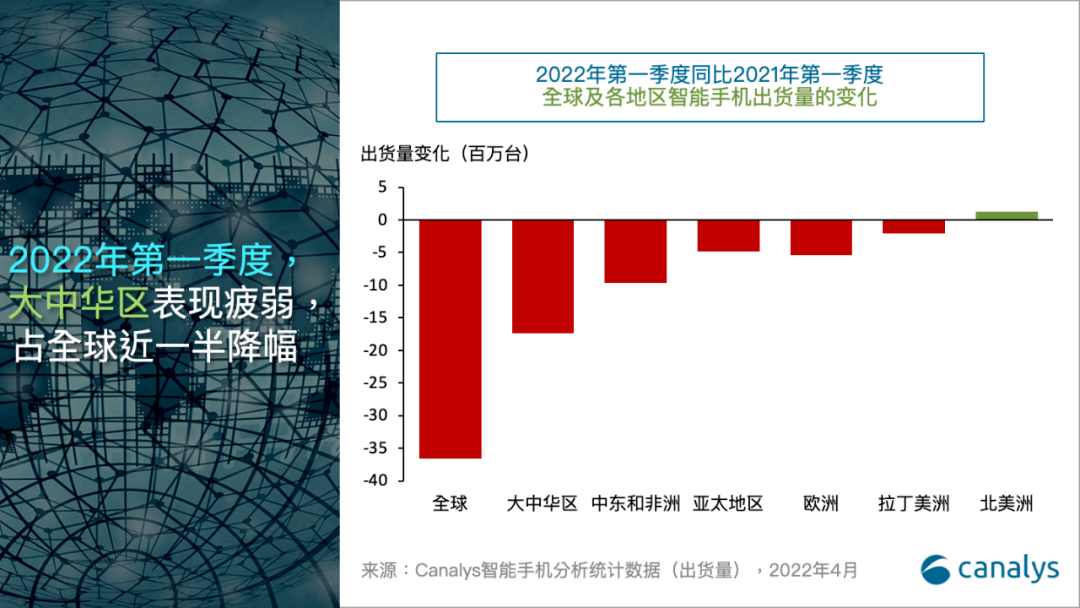

Recently, Canalys' report showed that in the first quarter of 2022, global smartphone shipments reached 311.2 million units, a year-on-year decrease of 11%. Previously, IDC's report showed that global smartphone shipments in the first quarter of 2022 decreased by 8.9% compared to the same period last year. Another market research firm, Counterpoint Research, released a report showing that in the first quarter of 2022, global smartphone shipments decreased by 7% year-on-year and 12% month on month due to factors such as component shortages and repeated outbreaks of the pandemic. As the world's most important smartphone market, the Chinese market performed weakly in the first quarter of this year, lagging behind the global market. And North America is the only region to achieve shipment growth this quarter, reflecting a strong consumer market.

According to Canalys' data, in the first quarter of 2022, the performance of the smartphone market in Chinese Mainland continued to lag behind the global market, with only 75.6 million units shipped, down 18% year on year and 13% month on month. Recently, SMIC released its Q1 2022 report. During the earnings conference call held on May 13th, SMIC CEO Zhao Haijun stated that global smartphone sales will decrease by at least 200 million units in 2022, and the majority of affected brands will be Chinese. Recently, it was reported in the market that major domestic smartphone brands in China have reduced orders by about 170 million units on the basis of their 2022 shipment targets. MediaTek has lowered its annual chip shipment expectations. With the passage of time and the sluggish market, related rumors seem to be gradually being confirmed.

Canalys research analyst Runar Bj ø rhovde said, "North America was the only region to achieve shipment growth this quarter, which reflects a strong consumer market. Although the steady growth performance is mainly attributed to strong consumer demand for Apple's iPhone 13 series and Samsung's newly launched Galaxy S22 series, manufacturers such as Lenovo, TCL, and Google are still continuing to tap into LG's original carrier market share

According to Canalys' report, Samsung regained its crown in the first quarter of 2022 after updating its product portfolio for the year, with shipments reaching 73.7 million units, still down 4% from a year ago, and a market share of 24%, ranking first. With the strong demand for the iPhone 13 series in the market and the launch of the new iPhone SE model, Apple achieved a steady growth of 8%, with shipments reaching 56.5 million units, ranking second. Xiaomi, OPPO, and Vivo entered the top five with shipments of 39.2 million, 29 million, and 25.1 million units, respectively, and market shares of 13%, 9%, and 8%.

Overseas stall

Markets outside of China have gradually recovered from the pandemic. Samsung's shipment volume is very representative. It almost disappeared from the Chinese market, but in the first quarter of 2022, global shipment volume only declined by 4%, which is a double-digit decline compared to domestic manufacturers; A more significant contrast is Apple, whose shipments in the Chinese market have declined, but global shipments have grown by as much as 8%.

[Platform recommends high-quality suppliers]

Domestic manufacturers have taken Samsung's market, but they cannot shake Apple in the slightest. According to Canalys data, North America is the only region with an increase in shipments, mainly driven by demand for the iPhone 13 and Samsung's flagship Galaxy S22. Huawei has spent nearly 10 years shaping its high-end image in overseas markets and once suppressed Apple, a success that is difficult to replicate.

The global competition situation is clear, this is a cost-effectiveness war. The market share of mid to low end products continues to fluctuate dramatically in various markets. Taking India, which has the most significant overseas shipment volume, as an example, Xiaomi and OV both experienced double-digit declines in the first quarter of 2022, while Samsung and realme grew, with the latter increasing by as much as 40%. The market share of OPPO series has actually surpassed Xiaomi and Samsung.

In fact, the demand in emerging markets like India is not weak, the key is who can supply as soon as possible. Almost all mobile phone components in the Indian market are imported from Shenzhen. In the first quarter, Shenzhen and Dongguan were affected by the epidemic shutdown, resulting in insufficient supply. Realme has relatively sufficient stock and is the fastest to recover from the shortage.

But for Xiaomi, in the case of insufficient raw materials, they must first maintain a product line with higher gross margins, and can only temporarily sacrifice their market share in India.

For manufacturers who prioritize cost-effectiveness, material preparation will become the Achilles' heel. According to 9to5mac, analysts have warned that the price of iPhone 14 outside the United States will rise in the future due to supply shortages. According to foreign media reports, the price increase may reach up to $100.

Xiaomi and realme, which prioritize cost-effectiveness, have no room for maneuver. If they cannot guarantee supply, they can only continue to compress their already meager gross profits.

If the shortage problem can be alleviated over time, the geopolitical gray rhino incident will become even more severe. In April, Xiaomi India was frozen by Indian law enforcement agencies for up to 55.5 billion rubles. Although this matter was quickly resolved, there is deeper anxiety hidden behind it.

India is a complex market with diverse player identities, and the government and manufacturers have their own thoughts. In the 2020 Production Linked Incentive Scheme (PLI) for the Large Electronic Manufacturing Industry, it was announced to invest INR 400 billion in the electronic manufacturing industry, including smartphones, over the next five years. Apple, Samsung, Foxconn, and other companies are all on the list, but Xiaomi, OPPO, and Vivo are not included.

As we enter 2022, the geopolitical impact is continuing to expand. Amidst suspicion, domestic Android giants are stepping into a world of growing hostility and division.

Advanced Institute (Shenzhen) Technology Co., Ltd, © two thousand and twenty-onewww.avanzado.cn. All rights reservedGuangdong ICP No. 2021051947-1 © two thousand and twenty-onewww.xianjinyuan.cn. All rights reservedGuangdong ICP No. 2021051947-2