Hotline:0755-22277778

Tel:0755-22277778

Mobile:13826586185(Mr.Duan)

Fax:0755-22277776

E-mail:duanlian@xianjinyuan.cn

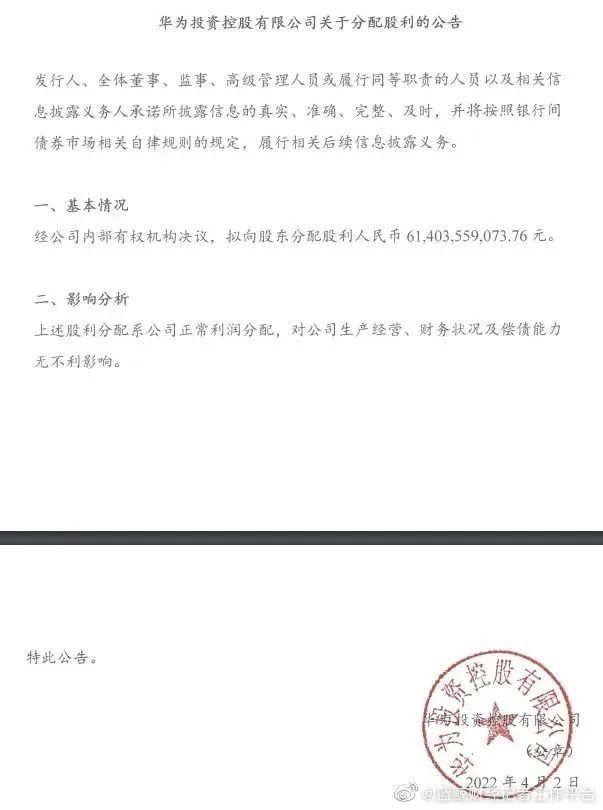

On April 2nd, Huawei Investment Holding Co., Ltd. announced that it plans to distribute a dividend of RMB 61.4 billion to shareholders through a resolution of its internal authorized institutions.

On April 2nd, according to the website of the Shanghai Clearing House, Huawei Investment Holding Co., Ltd. announced that it plans to distribute a dividend of RMB 61.4 billion to shareholders through a resolution of its internal authorized institutions.

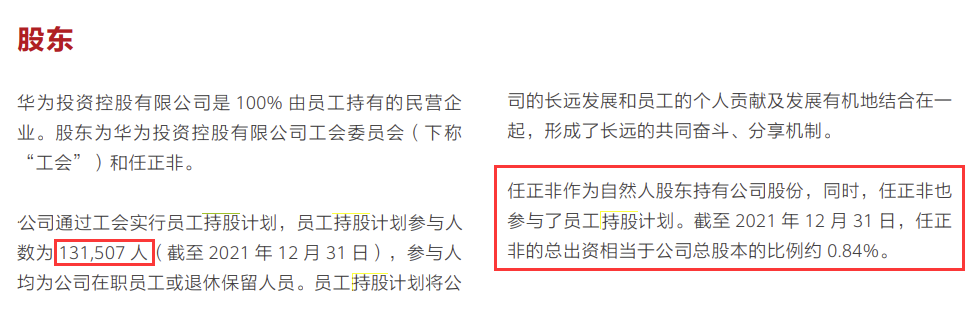

According to the data, Huawei currently has approximately 195000 employees, of which over 6 employees hold shares. According to Huawei's 2021 financial report, Huawei is a private enterprise 100% owned by its employees. The shareholders are the Trade Union Committee of Huawei Investment Holdings Limited (hereinafter referred to as the "Trade Union") and Ren Zhengfei. Among them, the number of participants in the employee stock ownership plan was 131507 (as of December 31, 2021). Huawei founder Ren Zhengfei holds 0.75% of Huawei's equity as a natural person shareholder. Meanwhile, Ren Zhengfei also participated in the employee stock ownership plan. As of December 31, 2021, Ren Zhengfei's total capital contribution is equivalent to approximately 0.84% of Huawei's total share capital.

That is to say, in this dividend, Ren Zhengfei alone can receive about 516 million yuan. The remaining 131506 employees participating in Huawei's employee stock ownership plan (excluding Ren Zhengfei) can receive 99.16% of the dividends, which is 463000 yuan per capita. If Ren Zhengfei is also included, then for this dividend, all employees who participate in Huawei employee shareholding will receive an average dividend of 467000 yuan per person.

On April 2nd, according to WCCFTech, semiconductor manufacturing company TSMC has increased its shipments of its 5nm process technology series. This is the most advanced technology in TSMC's product portfolio, and the factory hopes to move towards 3nm technology later this year. DigiTimes claims that the increase in production is aimed at boosting orders from several companies in the personal computing industry, especially after reports of production issues at Samsung's foundries in South Korea.

Samsung and TSMC are the only two companies in the world that provide chip manufacturing services to third parties. In this duopoly situation, TSMC holds a strong leading position due to its consistent reliable delivery and regular technological upgrades.

According to a report by DigiTimes, TSMC has increased its production of 5nm technology from 120000 pieces per month in the early days to 150000 pieces per month, marking a 25% increase in production. This growth is due to orders from customers outside of consumer electronics companies Apple and MediaTek.

Before TSMC reported an increase in 5nm product production, there were rumors earlier this week that chip designer AMD's Zen4 desktop CPU lineup would enter mass production as early as this month. According to reports, the Zen4 processor adopts TSMC's 5nm manufacturing technology and is expected to enter the market within 4 to 5 months after production is completed.

In addition to the 5nm production progress, DigiTimes also reported that customers have a strong interest in TSMC's 4nm process series. The 4nm technology is a variant of the 5nm node, which is part of TSMC's N5 lineup.

Among the companies showing interest in 4nm, there is also an American semiconductor design company, Nvidia. Digitimes reported that Nvidia has paid a huge sum of money to TSMC to retain its 4nm production capacity, most of which is expected to go to TSMC's strongest customer, Apple.

In addition to NVIDIA, Qualcomm has also shown a strong interest in 4nm technology. This is due to production issues at Samsung's foundries, which reportedly are seeking alternatives as Samsung's chip manufacturing technology cannot provide sufficient revenue. In the semiconductor industry, production refers to the number of chips in silicon wafers that can pass quality control testing. The higher the yield, the less semiconductor procurement costs the company needs to pay to factories such as TSMC or Samsung.

The Digitmes report also believes that in addition to the strong process output, another reason why Nvidia has made this change is the brand image of its Taiwan, China factory. Many observers generally believe that TSMC has given AMD more manufacturing advantages than its larger competitor Intel, while Nvidia is seen as seeking goodwill redemption. Compared to AMD relying on companies like TSMC to meet its manufacturing needs, Intel uses its own facilities and has been working hard to scale up its operations recently.

Finally, TSMC's 3nm manufacturing process will still be put into production later this year. The variant entering production is called 'N3B', and Digitims expects an initial production volume of between 40000 and 50000 pieces per month. After 'N3B', there will soon be an advanced variant called 'N3E', expected to enter production in 2023.

You should know that the high-end series chips of chip design giants are already struggling in advanced processes of 7nm and below. Moreover, advanced manufacturing processes have become the "money making password" for leading contract manufacturers such as TSMC. In 2021, TSMC's total revenue was NT $1587.42 billion (approximately RMB 365.83 billion), of which the combined revenue of 5-nanometer and 7-nanometer accounted for 50% of the total revenue, which can be said to shoulder half of TSMC's revenue. However, with the increasing demand for high-performance computing, the battle of chip manufacturing has gradually spread from 5nm to 3nm. The 'gunshots' of the 3nm battle have already begun.

Advanced Institute (Shenzhen) Technology Co., Ltd, © two thousand and twenty-onewww.avanzado.cn. All rights reservedGuangdong ICP No. 2021051947-1 © two thousand and twenty-onewww.xianjinyuan.cn. All rights reservedGuangdong ICP No. 2021051947-2