Hotline:0755-22277778

Tel:0755-22277778

Mobile:13826586185(Mr.Duan)

Fax:0755-22277776

E-mail:duanlian@xianjinyuan.cn

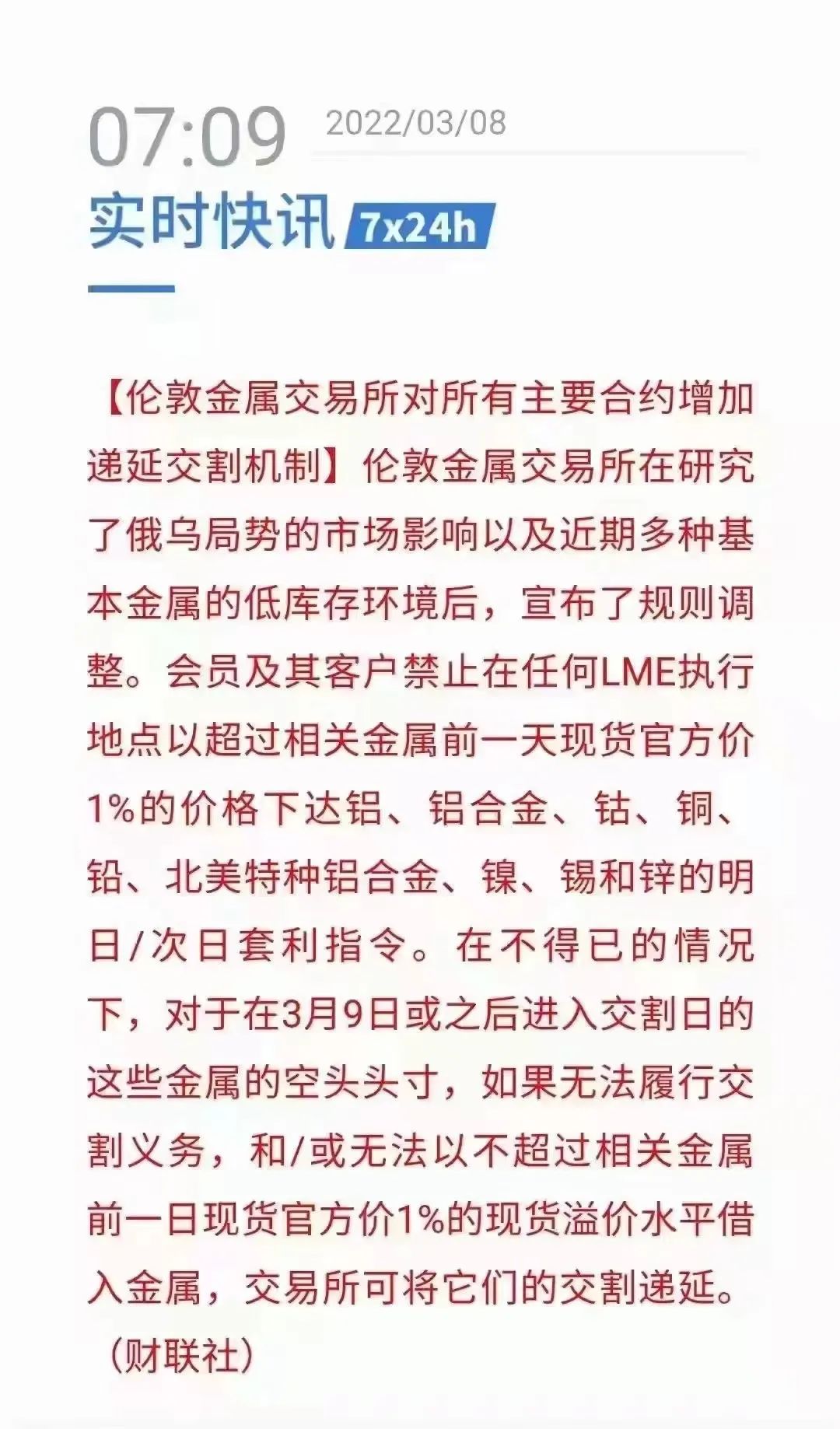

On March 8th, the LME nickel futures contract price rose from $29770/ton on the 7th to $101365/ton, with a cumulative increase of over 230% in two days.

Subsequently, the London Metal Exchange (LME) suspended nickel trading, and LME aluminum, LME lead, LME zinc, and LME tin plummeted sharply.

Affected by London nickel, Shanghai nickel rose by the daily limit up. On March 8th, the domestic commodity futures market closed, and the main contract for Shanghai nickel continued to close at 228810 yuan/ton. The news of Qingshan Group being squeezed into warehouses in China continues to ferment.

The first financial reporter dialed the company's official website phone number, and the operator said that they have been connecting since this morning, and there have been constant media calls inquiring about the details of the incident. "The relevant issues have been reported to the leadership for handling, and there is currently no progress.

In the past two days, it has been reported in the market that Qingshan Group holds a short position in a 200000 ton nickel futures contract, which has been squeezed by foreign traders due to a lack of spot goods that cannot be delivered. Previously, foreign media reported that Glencore holds a 60% long position in LME nickel futures.

Subsequently, Xiang Guangda, Chairman of the Board of Directors of Qingshan Industrial, exclusively responded to Yicai: "Foreigners have indeed taken some actions and are actively coordinating. Today, we received many phone calls, and relevant national departments and leaders are very supportive of Qingshan." Xiang Guangda, Chairman of the Board of Directors of Qingshan Industrial, responded to First Financial on the afternoon of March 8th, saying that Qingshan is an excellent Chinese enterprise with no problems in terms of position and operation.

According to Hou Yanjun, General Manager of Shenzhen Houshi Tiancheng Investment, in an interview with the media, the specific process is as follows:

As a major customer of Russian nickel mines, Qingshan Group adopted hedging trading in London and issued a short order for 200000 tons of nickel to reduce contract risks caused by price fluctuations. This is a normal operation.

Then London suspended Russia's delivery qualifications

3. Qingshan Group is unable to provide inventory corresponding to empty orders and has been targeted by Glencore, leading to forced warehousing

4. Subsequently, Lunni rose by 90% overnight, coupled with leverage, Qingshan Group's hedging order this time may result in a loss of several years' profits, and they only need a few keystrokes to absorb the hard-earned money of China Metallurgical Group.

5. Qingshan Group is a major partner of Huayou Cobalt Industry, and this incident has already affected Huayou Cobalt Industry. Within minutes of opening, Huayou Cobalt Industry plummeted to the limit down. Due to the high proportion of nickel ore in new energy vehicles, other lithium ore raw materials may also be killed. Therefore, Tianqi Lithium Industry and a large number of new energy companies in Ningde Times plummeted today, affecting the entire resource stock company, including a large number of copper, aluminum, and zinc delivery units from overseas countries.

Qingshan Holdings replied to the media that they are preparing materials and will make a unified public response afterwards.

Will commodities continue to rise?

Other commodities, such as LME zinc, LME lead, LME tin, LME copper, LME copper, LME aluminum and other basic metals, have all surged.

Source: Wind

In the domestic commodity futures market, in addition to Shanghai Nickel 2204 hitting the daily limit, Stainless Steel 2204, Shanghai Tin 2205, and Asphalt 2206 hit the daily limit.

Source: Wind

Regarding the nickel forced short market, Shenyin Wanguo Futures stated that based on historical trends, the duration of forced positions is often relatively short. If the forced liquidation is successful and the short positions are largely flattened, there will be a new round of upward trend in the market; If the bears replenish the margin and raise sufficient delivery products before delivery, there is a probability of a reverse collapse in the market. For regular investors, it is no longer suitable for Shanghai Nickel to continue participating in the short term. At present, the significance of looking at the medium-term fundamentals is not significant anymore. The price surge is more due to bulls speculating on the Russian nickel supply crisis in the changing situation between Russia and Ukraine, taking advantage of the situation to push for a bearish trend. The trend of nickel prices in the external market is likely to have triggered a stampede of bears, and it cannot be ruled out that the price may fall in the short term.

Hengtai Futures believes that the main reason for the rise in nickel prices this time is due to the game of funds, which has deviated from the fundamentals. According to reports, this rally may be due to a multinational trading giant forcing a large nickel producer to bear short positions. It is understood that most of the production lines of a large nickel producer are located abroad and may engage in hedging operations on LME, which has a certain degree of credibility.

Financial harvest is everywhere, and even the slightest mistake can be taken away by capital. Under extreme market conditions, we will popularize the overall strategic layout of Qingshan Holdings before this event to all investors.

Qing Shan Holdings under the 'Demon Nickel'

Last night, Xiang Guangda may have stayed up all night. He is the head of Qing Shan Holdings, a Fortune 500 private enterprise, and one of the most mysterious and low-key tycoons in Zhejiang, with assets worth hundreds of billions of yuan.

The following is an old article from Bloomberg on February 15th titled "Big Shot Traders vs. Mysterious Nickel Stockholders" (picture added by Zhejiang Stock).

In the Chinese commodity circle, he is a well-known "big shot" - he owns the world's largest nickel production enterprise and never worries about betting heavily on the next direction of the market.

Now Xiang Guangda is becoming the focus of the market, and in recent years he has continuously caused significant fluctuations in the market on an important element of global environmental change.

According to insiders, on the one hand, Xiang and some of his business partners have accumulated a large number of short positions in the nickel derivatives market to hedge against the risk of possible price drops in the nickel production process.

On the other hand, data from the London Metal Exchange shows that there is an unidentified nickel inventory holder who holds at least half of the inventory on the London Metal Exchange (LME) as of February 9, 2022.

As the market's interest in this LME nickel holder increases, Xiang finds himself in an unusual situation: he is standing on the opposite side of the trend.

The price of nickel soared by over 25% last year and reached a historic high in the past decade last month. The demand for nickel in the electric vehicle battery market has significantly increased, and market indicators show that nickel supply is in a tight situation. LME nickel inventory has fallen to a new low since 2019, while the premium of spot prices to March contracts has reached a new high.

LME is a bit crowded, "said Jim Lennon, a senior commodity consultant at Macquarie Securities in London.

This incident highlights the significant influence of a few participants in the nickel market, as Elon Musk has mentioned that the shortage of nickel raw materials is one of the biggest obstacles affecting the production of electric vehicle batteries. In recent years, Xiang has become a key figure in the price fluctuations of the nickel market. In 2019, he injected a significant price increase by significantly withdrawing spot goods from LME warehouses. In 2021, he announced that he had found a cheaper way to produce nickel for new energy in Indonesia, which briefly triggered a decline in nickel prices.

It is currently unclear how much risk the rise in nickel prices poses to Xiang's holdings in Qingshan Holdings Group Co., Ltd. But if the upward trend continues, the company's short positions may offset some of its production profits. Qing Shan declined to comment despite multiple inquiries and requests.

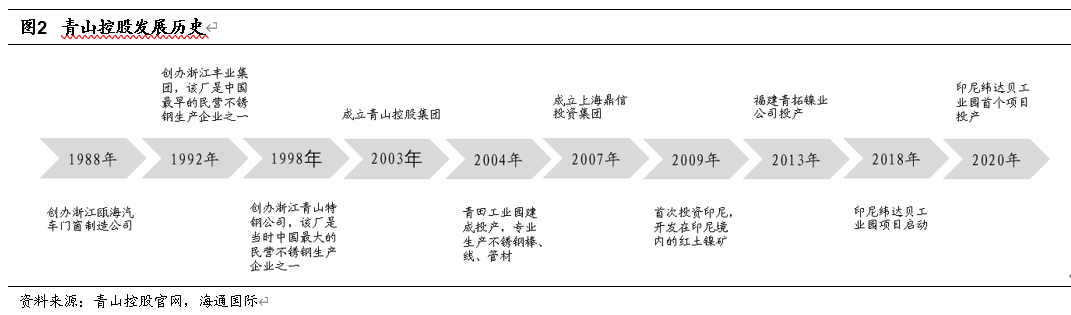

This company, founded by Xiang and his wife He Xiuqin, began in the late 1980s when they were engaged in the production of automotive door and window frames in the eastern Chinese city of Wenzhou. The company became a leading enterprise in the industry due to its pioneering large-scale use of nickel pig iron to produce stainless steel. Nickel pig iron is a semi refined product and a low-cost alternative to metallic nickel in the production of stainless steel.

Last year, Qingshan Company announced plans to use alternative processes to produce battery grade nickel using raw materials previously used for stainless steel production, which caused significant fluctuations in the nickel market last year.

The company is currently operating three high ice nickel production lines with a monthly production capacity of approximately 3000 tons. Its goal is to achieve an annualized production of 100000 tons by October 2022. If successful, Qingshan will solve one of the biggest bottlenecks in battery production and may bring downward pressure to nickel prices.

According to a source familiar with the matter, the company began establishing short positions last year, partly to hedge against production growth and believed that the upward trend in nickel prices would dissipate. The production cost of Qingshan in Indonesia is less than $10000 per ton, while the LME benchmark price exceeds $23000.

This is one of the production facilities of Qingshan in Indonesia.

However, at present, there is almost no indication that the nickel market price will decline. Goldman Sachs predicted last month that nickel demand would exceed supply by 30000 tons this year, higher than the earlier estimate of 13000 tons.

According to daily data from the London Stock Exchange, this unidentified inventory holder holds 50% to 80% of the nickel warehouse receipts monitored by LME. Holders of LME warehouse receipts can withdraw spot goods based on the receipts, and the positions reported by the exchange are concentrated within a range rather than precise numbers.

This position has been maintained for nearly a month, which is a relatively long period of time, indicating that inventory holders are either very optimistic about the nickel market or may be stockpiling for their future spot supply contracts. I think part of the reason for this is that due to the rapid growth of the battery market, the market is a bit panicked and hoarding, "Lennon said.

The most important question is whether Xiang will continue to compete with long positions or close short positions. A challenge faced by this Chinese tycoon is that his nickel products do not meet the delivery conditions of the London Metal Exchange (LME) futures contract, so his short positions in futures are not a perfect hedge against the products he produces. This means that if he is forced to increase margin or move positions, these short positions will consume a significant amount of his cash flow.

There is some indirect evidence indicating that the item is not yet ready to give up. As the holdings of LME futures contracts expiring before March DATE decrease, the holdings of forward futures contracts are increasing. This may also indicate that Xiang and his companions are prepared for a long-term battle.

One article on understanding Qingshan Holdings

The London Metal Exchange (LME) experienced a sharp rise in nickel prices, and rumors about domestic Qing Shan Holdings Group being forced to hold short nickel futures contracts have spread. This article is an introduction to Qing Shan Holdings by Haitong International.

Qingshan Holdings is a private enterprise specializing in stainless steel production, which has formed a full industry chain layout from nickel mining, nickel iron smelting to stainless steel smelting, stainless steel continuous casting billet production, and stainless steel plate, rod and wire processing. At the same time, it produces raw materials, intermediate products and new energy batteries in the field of new energy, mainly used in energy storage systems and electric vehicles.

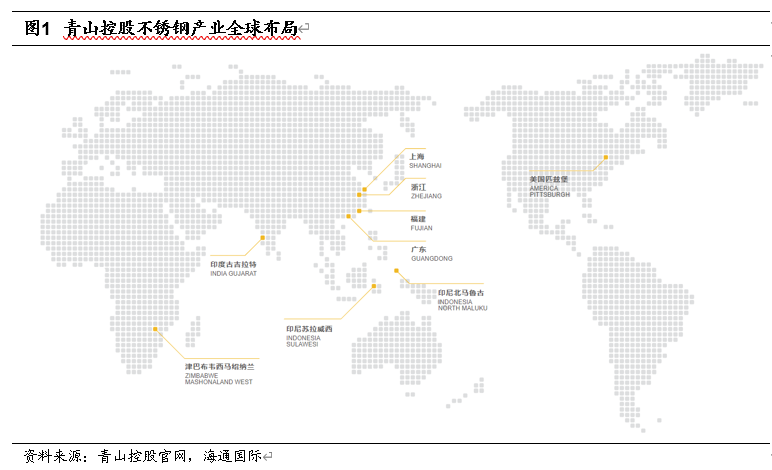

At present, the company's stainless steel production bases are located in major coastal areas such as Fujian, Guangdong, and Zhejiang in China, and overseas in Indonesia, India, the United States, and Zimbabwe, with 8 major production bases.

The company's main business includes stainless steel and the new energy industry chain. According to the company's disclosure, its nickel equivalent production will reach 600000 tons in 2021, 850000 tons in 2022, and jump to 1.1 million tons by 2023.

Upstream resources: Nickel iron business, layout of Indonesian laterite nickel ore

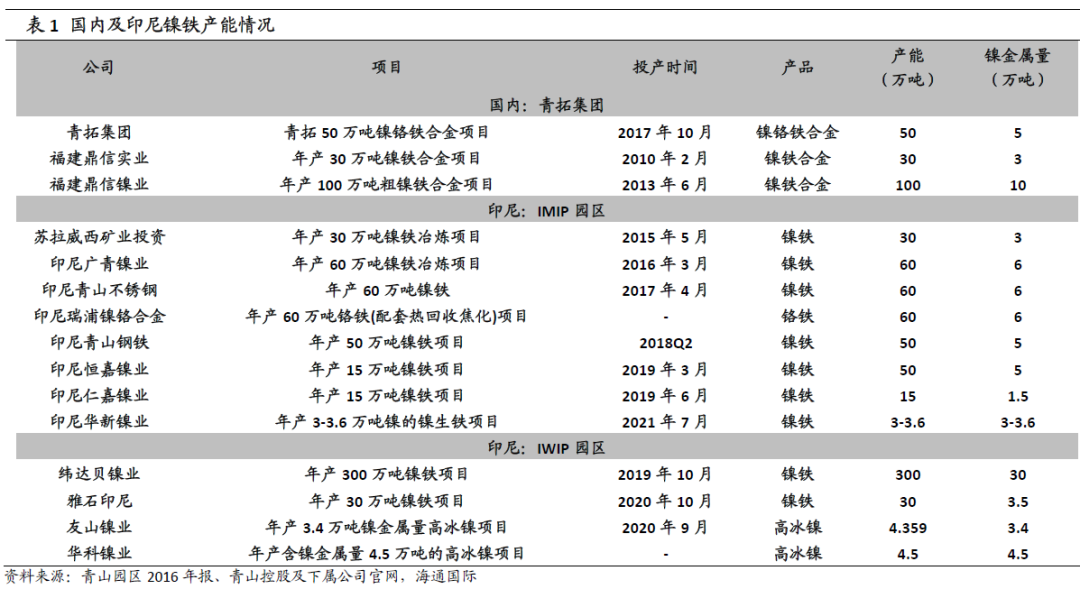

Qingshan Holdings' nickel iron business in China is mainly laid out through Fujian Qingtuo Group. At present, Qingtuo Group has formed an annual production capacity of 1.8 million tons of nickel alloy. Foreign business is achieved through Indonesia's Qingshan Industrial Park (IMIP) and Weidabei Industrial Park (IWIP), with a total production capacity of over 3.5 million tons per year.

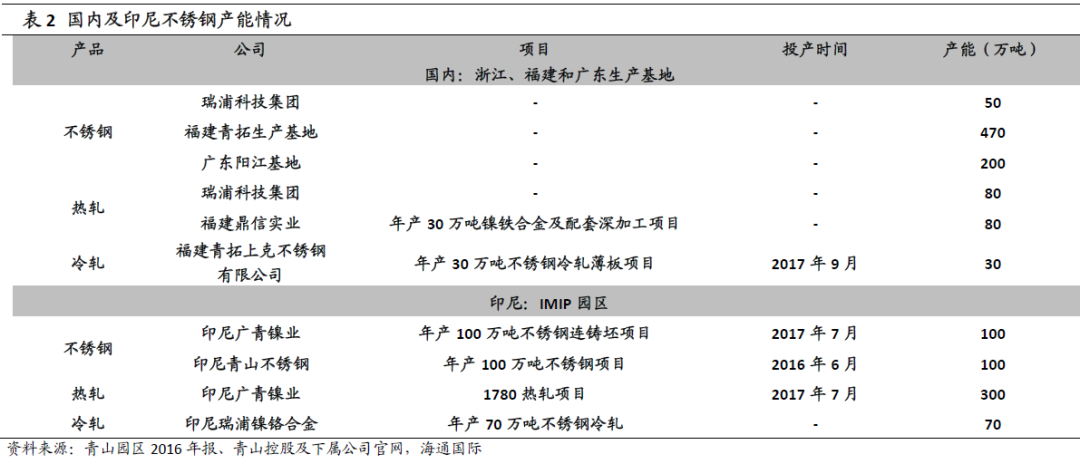

Downstream traditional business: stainless steel production

In 2020, Qingshan Holdings' stainless steel crude steel production reached 10.8 million tons, with a production capacity exceeding 10 million tons. According to the company's official website, Qingshan Holdings established the world's first RKEF-AOD stainless steel integrated production line in March 2008 and began to lay out stainless steel production bases in China thereafter. At present, the company has three major production bases in Zhejiang, Fujian, and Guangdong in China, mainly producing stainless steel rough steel, hot rolling, cold rolling, etc. The overseas stainless steel layout is mainly distributed in the Qingshan Industrial Park in Indonesia, and the basic integration of stainless steel production has been achieved.

Development focus: Layout of new energy

Given the rapid growth of the new energy vehicle industry, Qingshan Group, relying on its abundant upstream resource advantages, began to lay out the new energy industry in 2017, and strives to build a new energy full industry chain of "nickel cobalt mineral resource mining wet metallurgy precursor positive electrode material battery application" from both upstream nickel mining and downstream new energy product manufacturing. At present, the company has partnered with Huayou Cobalt and Greenmei to develop laterite nickel ore in Indonesia for the construction of a new energy battery nickel resource raw material manufacturing system; Joining hands with XCMG Group to enter the new energy vehicle industry. In addition, a high ice nickel supply agreement was signed with Huayou Cobalt and Zhongwei Shares, stipulating that Qingshan Industrial will supply 60000 tons of high ice nickel to Huayou Cobalt and 40000 tons of high ice nickel to Zhongwei Shares within one year starting from October 2021.

Qingshan Holdings: Stainless Steel Leading Enterprise

(1) Introduction to Company Basic Information

Rooted in the stainless steel industry and expanding into the field of new energy. Qingshan Holdings is a private enterprise specializing in stainless steel production. It has formed a full industry chain layout from nickel ore mining, nickel iron smelting to stainless steel smelting, stainless steel continuous casting billet production, and stainless steel plate, rod and wire processing. At the same time, it produces raw materials, intermediate products and new energy batteries in the field of new energy, mainly used in energy storage systems and electric vehicles. It is one of the world's largest nickel iron and stainless steel producers and a leading enterprise in domestic stainless steel and nickel iron resources.

Stainless steel production bases are located both domestically and internationally. At present, the company's stainless steel production bases are located in major coastal areas such as Fujian, Guangdong, and Zhejiang in China, and overseas in Indonesia, India, the United States, and Zimbabwe, with 8 major production bases. Domestically, it includes production bases in Qingtuo, Fujian, Yangjiang, Guangdong, and Qingtian, Zhejiang. Overseas, it has the Morowali Industrial Park (IMIP) in Indonesia, the Widabe Industrial Park (IWIP) in Indonesia, and the A&T Stainless in Pittsburgh, USA LLC、 Gujarat Industrial Park in India and Central African Smelting Production Base in Zimbabwe.

Qingshan Holdings started in the 1980s and successively established companies such as Zhejiang Ouhai Automotive Door and Window Manufacturing Company and Zhejiang Qingshan Special Steel Company. It was registered and established as the largest group company in June 2003. Afterwards, Shanghai Dingxin Investment Group, Qingtuo Group, Yongqing Group, Yongqing Technology and other companies were successively established. Currently, five major group companies have been formed, with more than 300 subsidiaries under their jurisdiction.

As of September 2018, the registered capital of the company was 2.8 billion yuan. Dingxin Investment holds 23.70% of the company's equity, making it the largest shareholder. Xiang Guangda and Qingshan Management hold 22.30% and 11.50% of the shares respectively, while Xiang Guangguang and other natural persons hold a total of 42.50% of the shares. The actual controller of the company is a natural person named Xiang Guangda.

(2) Our main business includes stainless steel and new energy industry chain

Made of stainless steel. Qingshan Holdings started in the stainless steel industry, mainly engaged in nickel chromium ore mining and stainless steel production business. At present, the company has formed an industrial chain that runs through the upstream, midstream, and downstream of stainless steel, and has a production capacity of over 10 million tons of stainless steel crude steel and 300000 tons of nickel equivalent nickel iron. According to the company's disclosure, its nickel equivalent production will reach 600000 tons in 2021, 850000 tons in 2022, and jump to 1.1 million tons by 2023.

New energy battery business. Relying on its abundant upstream resource advantages, Qingshan began to enter the new energy industry in 2017, striving to build a complete new energy industry chain of "nickel cobalt mineral resource extraction wet smelting precursor positive electrode material battery application". At present, the company has partnered with Huayou Cobalt and Greenmei to develop laterite nickel ore in Indonesia for the construction of a new energy battery nickel resource raw material manufacturing system; Joining hands with XCMG Group to enter the new energy vehicle industry. In addition, a high ice nickel supply agreement was signed with Huayou Cobalt and Zhongwei Shares, stipulating that Qingshan Industrial will supply 60000 tons of high ice nickel to Huayou Cobalt and 40000 tons of high ice nickel to Zhongwei Shares within one year starting from October 2021.

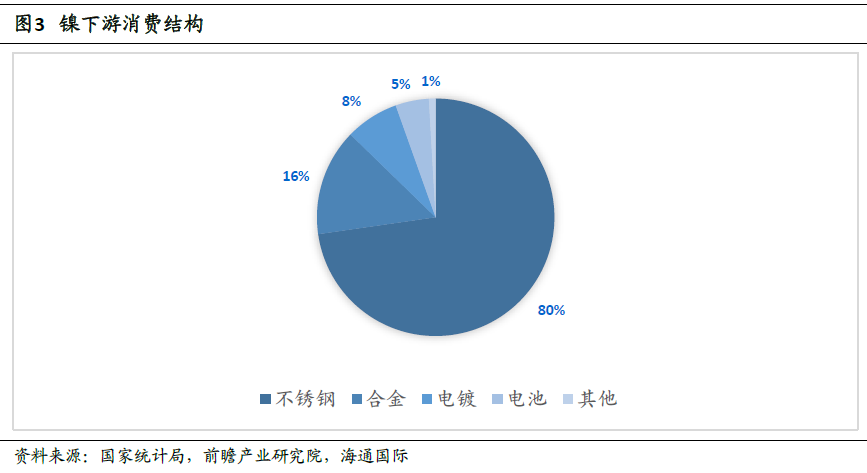

Upstream resources: Nickel iron business, layout of Indonesian laterite nickel ore

The demand for nickel ore is expected to continue to grow. At present, stainless steel is the largest consumer area of nickel in the consumption structure, accounting for 80%, batteries account for 5%, and other industries use nickel for 15%. In the field of positive electrode materials for ternary batteries, high nickel materials have broad market prospects due to their high energy density and lower price compared to cobalt. With the rapid growth of the new energy vehicle industry, it is expected to significantly promote the demand for nickel resources in high nickel ternary materials.

Domestic projects

Qingshan Holdings' nickel iron business in China is mainly laid out through Fujian Qingtuo Group. Qingtuo Group is one of the five major groups under Qingshan Industrial, with 26 subsidiaries including Dingxin Industrial, Qingtuo Nickel Industry, Qingtuo Industrial Co., Ltd., Dingxin Technology, and Qingtuo Logistics. At present, Qingtuo Group has formed an annual production capacity of 1.8 million tons of nickel alloy.

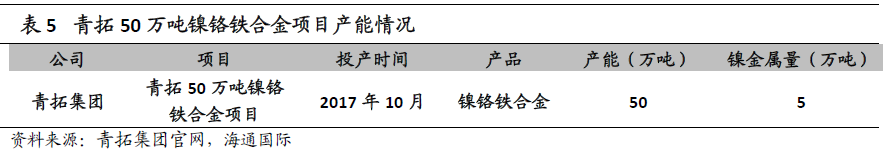

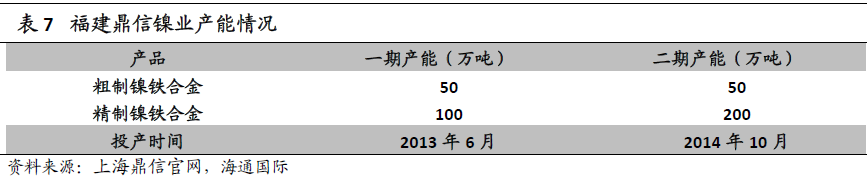

(1) Qingtuo 500000 ton nickel chromium iron alloy project

The Qingtuo 500000 ton nickel chromium iron alloy project is one of the Qingtuo 400 series projects, with a total investment of 1.25 billion yuan and a land area of 400 acres. Construction began in May 2016 and trial production was completed in November 2017. After the construction of a production line with an annual output of 500000 tons of nickel chromium alloy and full production capacity, it can achieve an annual output value of over 2 billion yuan. The nickel alloy in this project has a nickel content of 2% and a chromium content of 4%.

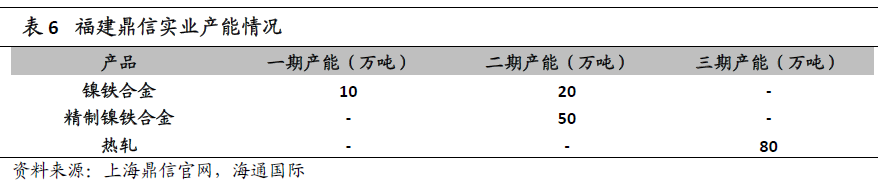

(2) Fujian Qingtuo Production Base: Fu'an Qingtuo Series Project

Qingtuo Group settled in Fu'an Wanwu Peninsula, Ningde City, Fujian Province in 2008. The leading industries in Wanwu Industrial and Trade Concentration Zone of Fu'an City include stainless steel industry, port logistics industry, equipment manufacturing industry, and energy industry. At present, the Qingtuo series project in Fu'an City has formed an annual production capacity of 1.3 million tons of nickel iron, with the main production units including Fujian Dingxin Industry and Fujian Dingxin Nickel Industry.

1. Fujian Dingxin Industrial Co., Ltd

Fujian Qingtuo Group established Fujian Dingxin Industrial Co., Ltd. in June 2008 in Fu'an City. Fujian Dingxin Industrial Co., Ltd. is constructing a 300000 ton nickel iron alloy and supporting deep processing project with an annual nickel production of 11% in the Wanwu Peninsula Industrial Concentration Zone of Fu'an City. The project will be constructed in three phases, with the first phase being the annual production of 100000 tons of crude nickel iron alloy; The second phase is a construction project that aims to produce 200000 tons of crude nickel iron alloy annually and combine the production capacity of the first phase to refine it into 500000 tons of refined nickel iron alloy; The third phase of the project includes the hot rolling, annealing, acid washing, and high nickel ore pretreatment of 800000 tons of stainless steel coils.

2. Fujian Dingxin Nickel Industry Co., Ltd

Fujian Dingxin Nickel Industry Co., Ltd. has built an annual production capacity of 1 million tons of crude nickel iron alloy and deep processing supporting projects. The overall project production capacity is: 1 million tons of crude nickel iron alloy and 3 million tons of refined nickel iron alloy (1 million tons of refined nickel iron alloy containing 8% nickel, 1 million tons of refined nickel iron alloy containing 4% nickel, 700000 tons of refined nickel iron alloy containing 1% nickel, and 300000 tons of refined nickel iron alloy containing 0.5% nickel).

The project is divided into two phases. The first phase aims to produce 500000 tons of crude nickel iron alloy annually and refine it into 1 million tons of nickel iron alloy; The second phase project aims to produce 500000 tons of crude nickel iron alloy annually and refine it into 2 million tons of nickel iron alloy.

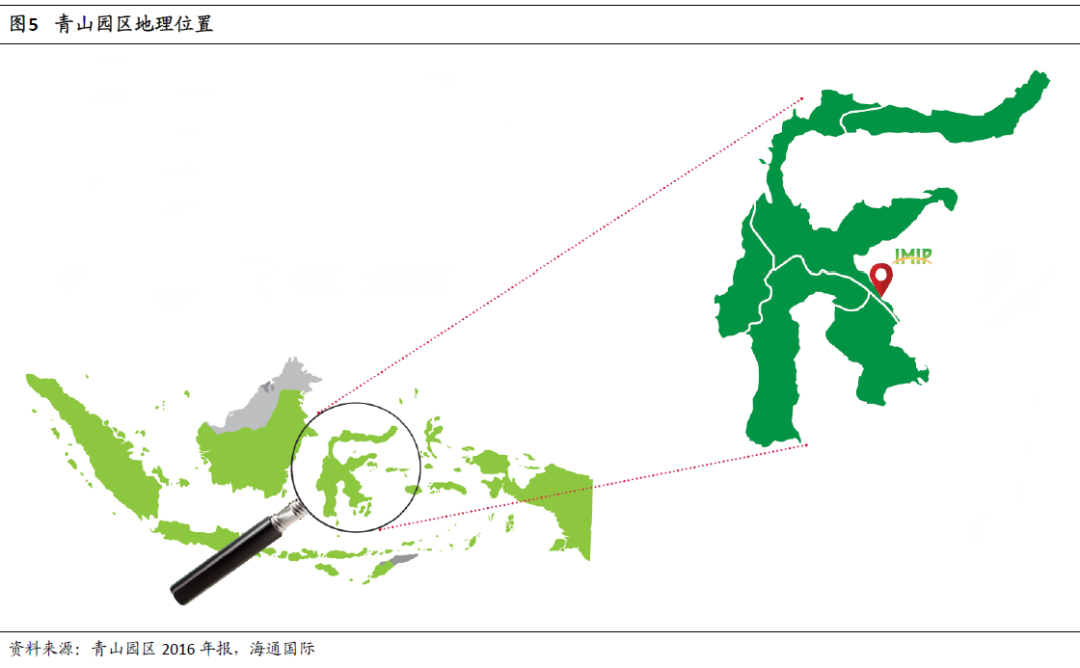

China Indonesia Integrated Industrial Park Qingshan Park (IMIP)

Qingshan Park is located in Morowali County, Central Sulawesi Province, Indonesia, covering an area of over 2000 hectares. It is adjacent to the inter provincial highway, about 1 kilometer away from the coast, about 60 kilometers away from Morowali County, and about 260 kilometers away from Kendari City.

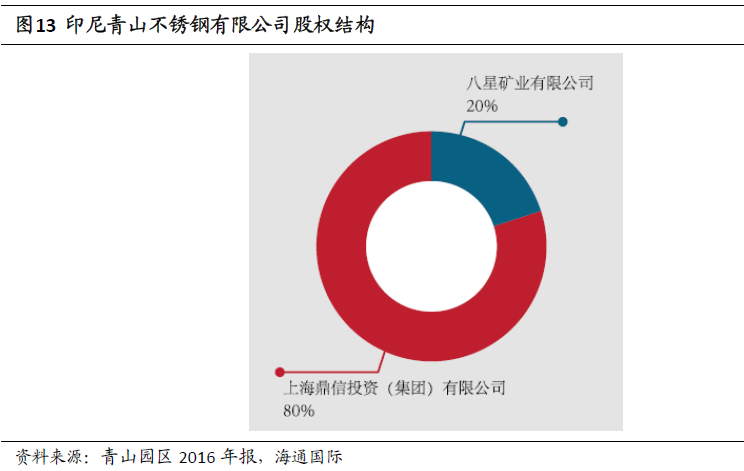

The land owner and park manager of the park are Indonesia Economic and Trade Cooperation Zone Qingshan Park Development Co., Ltd., which is jointly established by Shanghai Dingxin Investment (Group) Co., Ltd. and Indonesia Eight Star Group Co., Ltd., holding 66.25% and 33.75% of the shares respectively.

The Qingshan Industrial Park in Indonesia is an industrial park with nickel mining and smelting, stainless steel deep processing, and steel rolling production as the main industries, supplemented by thermal power generation. The goal of the park is to become an integrated industrial park for the comprehensive development and utilization of nickel, chromium, and iron resources with "nickel iron+stainless steel" as the main body, gradually forming a complete industrial chain from upstream raw material nickel ore mining, nickel iron smelting, stainless steel smelting, to downstream rod and wire processing, steel pipe manufacturing, precision wire processing, dock transportation, international trade, etc.

As of October 2020, 16 companies have settled in the Qingshan Industrial Park in Indonesia.

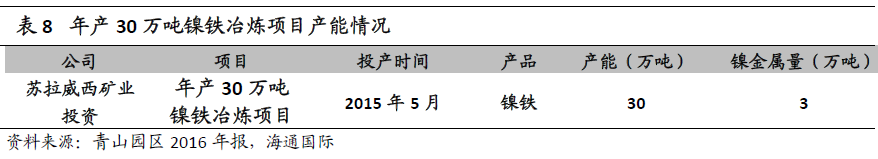

(1) Sulawesi Mining Investment Co., Ltd. SMI

Sulawesi Mining Investment Co., Ltd. was established in October 2009 as a joint venture between Shanghai Dingxin Investment (Group) Co., Ltd. and Indonesia Eight Star Investment Co., Ltd. Its main business is to develop nearly 47000 hectares of laterite nickel ore in Morowali County, Sulawesi Island, Indonesia.

At the same time as mining development, the company has also prepared for the construction of a nickel iron smelting plant project, namely SMI's annual production of 300000 tons of nickel containing 10% -11% nickel iron smelting and supporting 2x65MW thermal power generation project ("SMI project"), which is the first project to enter the Qingshan Park in Indonesia.

The SMI project adopts the rotary kiln electric furnace process (RKEF) and has four RKEF production lines. It uses Indonesian laterite nickel ore with a nickel content of 1.8-2.0% to produce nickel iron with a nickel content of 10% -11%. The production capacity can reach 300000 tons per year, with a nickel metal content of 30000 tons. The project started construction in July 2013, completed trial production in January 2015, and officially started production in May 2015.

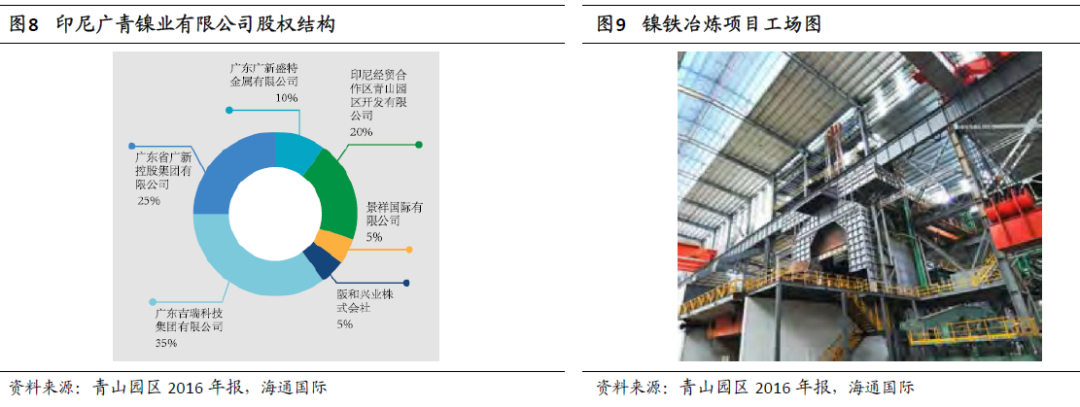

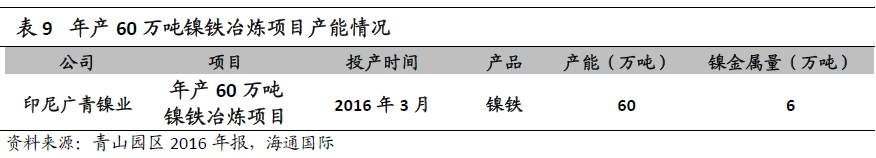

(2) Indonesia Guangqing Nickel Industry Co., Ltd. GCNS

Indonesia Guangqing Nickel Industry Co., Ltd. is the second project to enter the China Indonesia Comprehensive Industrial Park Qingshan Park. It was jointly established by Guangdong Guangxin Holdings Group Co., Ltd., Guangdong Jirui Technology Group Co., Ltd., Indonesia Economic and Trade Cooperation Zone Qingshan Park Development Co., Ltd. in August 2014.

The company has invested in the construction of a 2x150MW thermal power project with an annual output of 600000 tons of nickel iron, 1 million tons of stainless steel, 2 million tons of stainless steel hot rolling, and supporting facilities in Morowali County, Central Sulawesi Province, Indonesia, with a total investment of 1.035 billion US dollars.

For the annual production of 600000 tons of nickel iron smelting and its supporting 2x150MW thermal power generation project, the company has built 8 RKEF nickel iron smelting production lines with a land area of 86 hectares, a total investment of over 1 billion US dollars, and an annual production capacity of 60000 tons of nickel equivalent nickel iron alloy of 600000 tons.

The project started construction on May 2, 2014, and began trial production on December 5, 2015. The nickel iron project was put into operation in April 2016, and the nickel iron refining project underwent trial production in June 2016 and has met the expected design requirements.

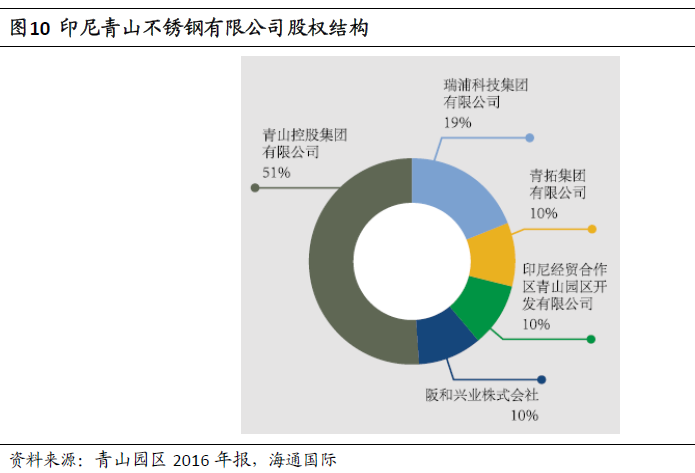

(3) Indonesia Qingshan Stainless Steel Co., Ltd. ITSS

Indonesia Qingshan Stainless Steel Co., Ltd. was established in December 2014 as a joint venture between Qingshan Holdings Group Co., Ltd., Ruipu Technology Group Co., Ltd., and Indonesia Economic and Trade Cooperation Zone Qingshan Park Development Co., Ltd.

The company has invested in the construction of a 600000 ton annual nickel iron and 1 million ton stainless steel smelting plant, as well as a 2 × 350MW coal-fired power plant project in Morowali County, Central Sulawesi Province, Indonesia.

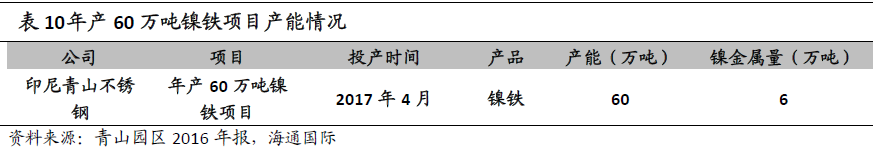

The company's annual production of 600000 tons of nickel iron project has 8 RKEF nickel iron smelting production lines, with a nickel metal capacity of 60000 tons, divided into two phases of construction. The first phase of the 300000 ton nickel iron project has been electrified and put into trial production in December 2016. Another 300000 ton project was completed and put into operation in April 2017.

(4) Indonesia Rupu Nickel Chromium Alloy Co., Ltd. IRNC

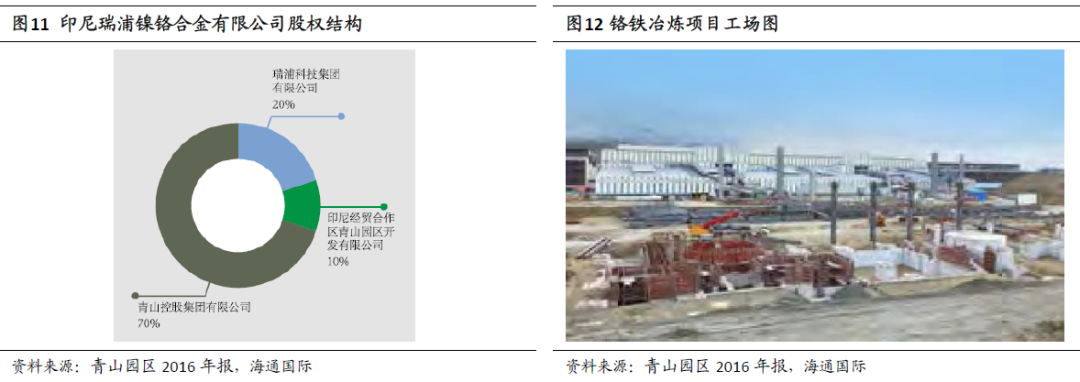

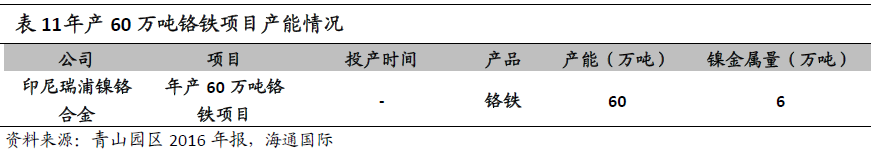

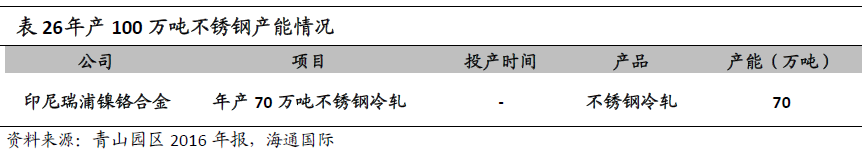

Indonesia Ruipu Nickel Chromium Alloy Co., Ltd. was established in February 2016 as a joint venture between Qingshan Holdings Group Co., Ltd., Ruipu Technology Group Co., Ltd., and Indonesia Economic and Trade Cooperation Zone Qingshan Park Development Co., Ltd. The main projects include an annual output of 600000 tons of ferrochrome (supporting heat recovery coking) and 700000 tons of stainless steel cold rolling project (IRNC project).

The IRNC project covers an area of 40 hectares and adopts an optimized vertical furnace/rotary kiln oxidation pellet closed ferrochrome electric furnace smelting process. It uses South African chromite ore to smelt ferrochrome, with an annual production capacity of 600000 tons of ferrochrome and a nickel metal content of 60000 tons. The project also adopts a clean heat recovery horizontal coking process, with a construction capacity of 600000 tons of heat recovery coking to meet the demand for high-quality carbonaceous reducing agents in the smelting project in Qingshan Park.

The total investment of the project is 460 million US dollars. It started construction in May 2016 and completed trial production in the second quarter of 2018. However, according to Roskill, the operating capacity of the Qingshan ferrochrome plant is currently only 300000 tons per year, with a production capacity of only 200000 tons in 2020.

(5) TSI, Indonesia Qingshan Steel Co., Ltd

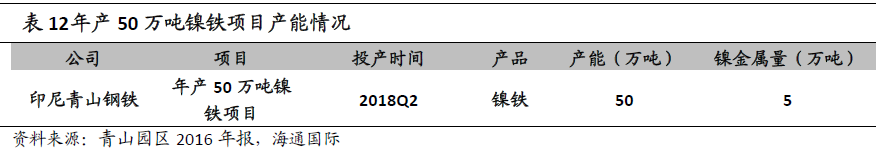

Indonesia Qingshan Iron and Steel Co., Ltd. was established in December 2016 as a joint venture between Shanghai Dingxin Investment (Group) Co., Ltd. (holding 80% of the shares) and Indonesia Baxing Mining Co., Ltd. It has invested in the construction of a 500000 ton annual nickel iron project (TSI project).

The TSI project adopts mature blast furnace smelting technology, which has the characteristics of low cost, low energy consumption, high output, mature process, and low technical risk. The nickel iron products produced by the project will be supplied directly to the existing stainless steel smelting project in Qingshan Park using hot charging and hot delivery methods to produce 200 series stainless steel, thus forming a more complete industrial chain.

The TSI project has an annual production capacity of 500000 tons of nickel iron and a total investment of approximately 119 million US dollars. Construction began in December 2016 and production began in the second quarter of 2018.

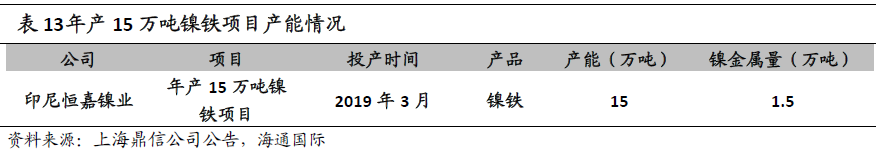

(6) Indonesia Hengjia Nickel Industry HNI

Indonesia Hengjia Nickel Industry was established in January 2018 as a joint venture between Nickel Mines Limited (holding 80% of the shares) and Shanghai Dingxin (holding 20% of the shares).

Hengjia Nickel Industry in Indonesia has an annual production capacity of 150000 tons of nickel iron project, and has legal mining rights for a 6249 hectare nickel mine located in Morowali County, Central Sulawesi Province, Indonesia. It also has two 42000 kVA production lines. The first production line is a cooperative construction project in Qingshan Park, Indonesia, signed in 2017 by the company (60%) with Shanghai Dingxin (20%) and Shanghai Wanlu (20%) for a total investment of 200 million US dollars. The second production line is an investment project in the MoU cooperative construction of a smelting plant, which was signed again by NML and Shanghai Dingxin in June 2018.

The company's annual production of 150000 tons of nickel iron project started construction on February 10, 2018 and was officially put into operation and reached production in March 2019.

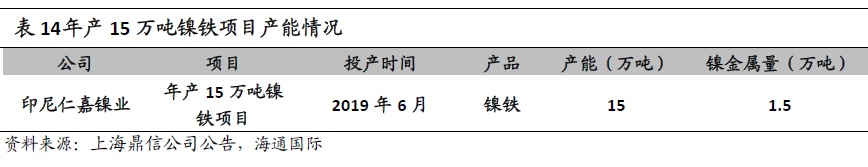

(7) Indonesia Renjia Nickel Industry RNI

Indonesia's Renjia Nickel Industry was established in August 2018 as a joint venture between Nickel Mines Limited (holding 80% of the shares) and Shanghai Dingxin (holding 20% of the shares). The company has an annual production capacity of 150000 tons of nickel iron project, which was officially put into operation and reached production in June 2019.

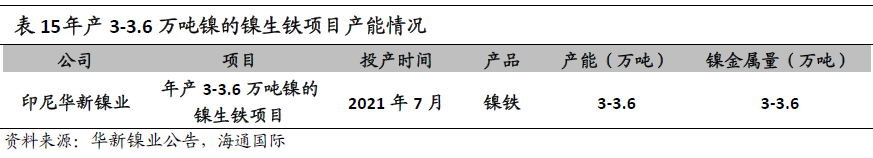

(8) Indonesia Huaxin Nickel Company WNII

Indonesia Huaxin Nickel Company is a joint venture established by Huaxin Lihua (holding 50% of the shares), Indonesia NEWHono Investment Private Limited, Perlux Investment Private Limited, and other companies. It has also built a nickel pig iron project with an annual output of 30000 to 36000 tons of nickel in Qingshan Park.

The total investment of the project is 500 million US dollars, of which the construction cost is 350 million US dollars, and the annual production capacity is 30000 to 36000 tons of nickel. In July 2021, the 40 # electric furnace located in the Qingshan Industrial Park in Indonesia was successfully put into operation, which means that all four electric furnaces of Indonesia Huaxin Nickel Industry have been completed and put into operation smoothly.

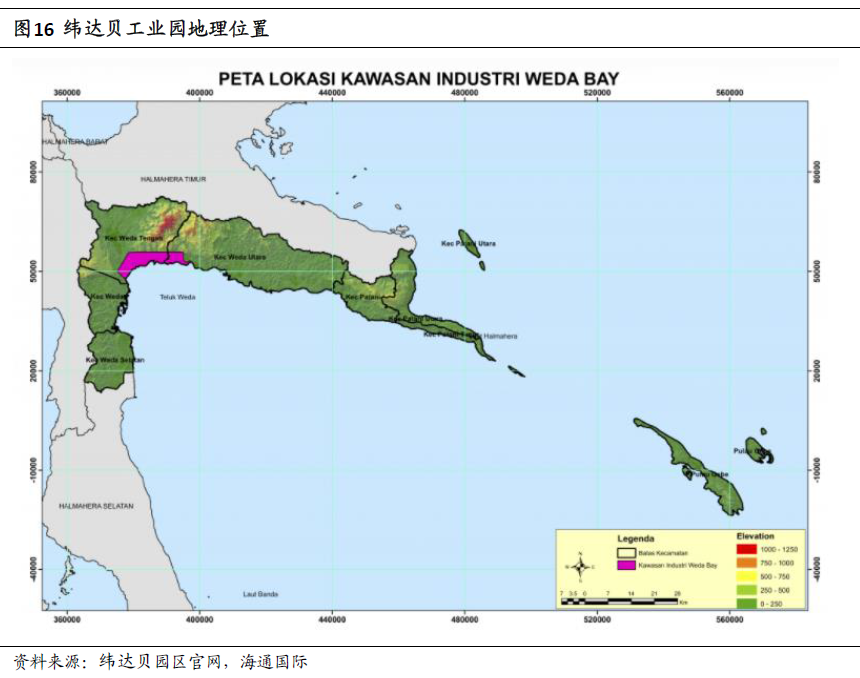

Weidabei Industrial Park (IWIP)

The Weidabei Industrial Park is located in Weida County, Central Halmahera Region, North Maluku Province, Indonesia. It is the second industrial park built by Qingshan Group in Indonesia after the Qingshan Morowali Industrial Park. The first phase of the industrial park began operation in the first quarter of 2020.

Weidabei Industrial Park focuses on building an industrial cluster led by the nickel iron industry chain, and is the first comprehensive industrial zone in Indonesia aimed at utilizing minerals to produce and process raw materials for electric vehicle batteries.

(1) Weidabei Nickel Industry Company WBN

Weidabei Nickel Industry Company was jointly established by Qingshan Group and Eramet, with Qingshan Group owning 57% of the shares. The project will be taken over by Qingshan Group for the construction and operation of processing infrastructure, with Eramet responsible for mining operations. The joint venture has a nickel ore refining and processing plant, which adopts pyrometallurgy/RKEF technology and has an annual production capacity of 3 million tons of nickel iron.

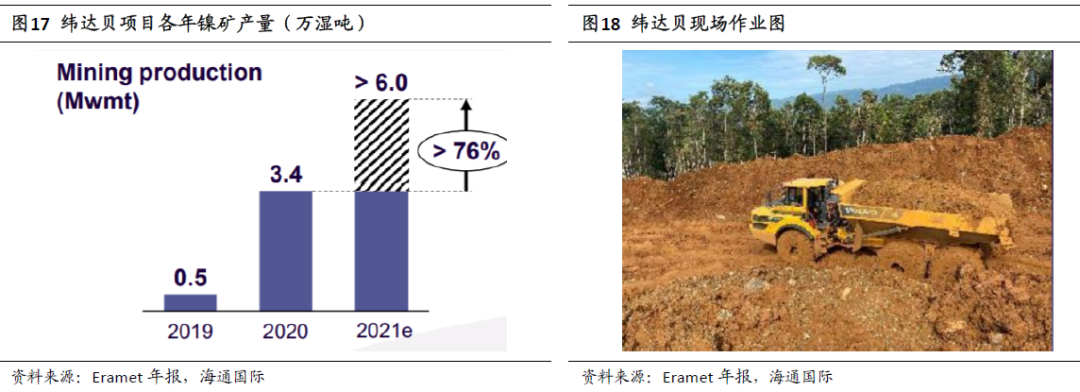

The Weidabei project's nickel ore is expected to have a lifespan of up to 50 years and will begin operations in October 2019. The first phase of Weidabei Nickel Industry project was fully put into operation in May 2020, producing 3.4 million wet tons of nickel ore in 2020, of which Qingshan Group's equity production was 1.9 million wet tons. According to production guidelines, the project plans to produce over 6 million wet tons of nickel ore in 2021.

(2) Yashi Indonesia Investment Co., Ltd

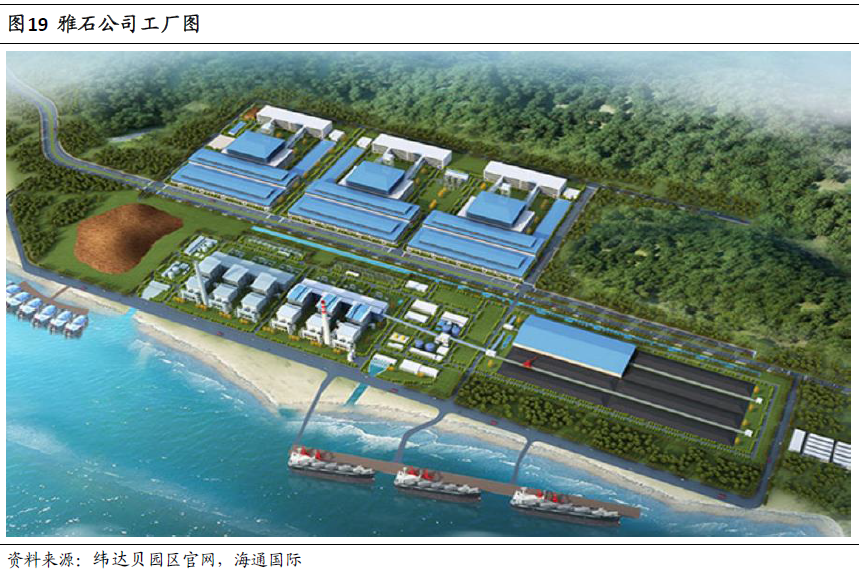

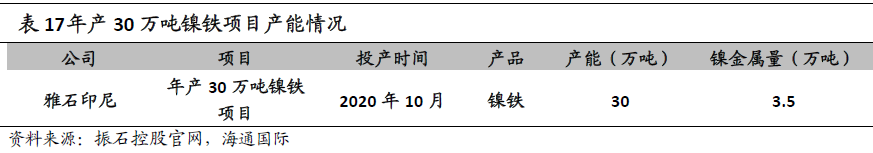

Yashi Indonesia Investment Co., Ltd. was established in 2018 as a joint venture between Zhenshi Holdings Group Co., Ltd., Shanghai Dingxin Investment (Group) Co., Ltd., and Zhejiang Huajun Investment Co., Ltd. The main construction includes an annual production of 300000 tons of nickel iron project.

The first phase of the Yashi project consists of four nickel iron smelting production lines, which can achieve an annual output of 35000 tons of nickel metal equivalent after full operation. The project officially started construction on March 15, 2019, and in October 2020, Yashi Indonesia's annual production of 300000 tons of nickel iron project was fully put into operation.

The main construction of the Yashi Phase II project of Zhenshi Group is the completion of an annual production line of 35000 tons of nickel metal and the supporting construction of a 1X250MW coal-fired power plant. At present, the project has been registered with the government department.

(3) Indonesia Youshan Nickel Industry Co., Ltd

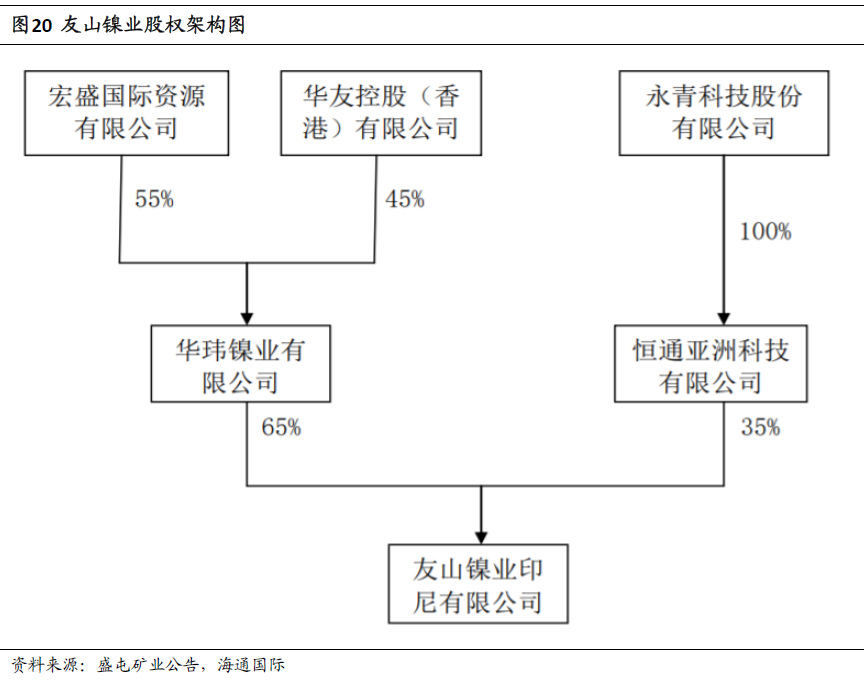

Indonesia Youshan Nickel Industry Co., Ltd. is a joint venture established by Huayou Group, Qingshan Group, and Shengtun Mining. Qingshan Group owns 17.85% of Youshan Nickel Industry through its subsidiary Hengtong Asia Technology Co., Ltd. established in Hong Kong.

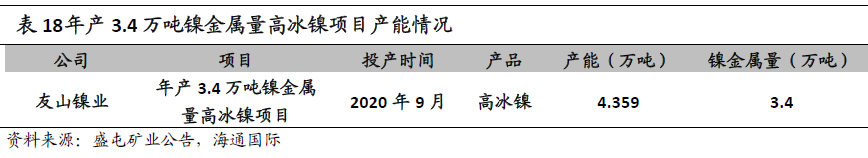

Youshan Nickel Industry has built a high ice nickel project with an annual output of 34000 tons of nickel metal in the Weidabei Industrial Zone. The project is located south of the provincial road and the nickel ore export terminal, with convenient transportation. The project is a pyrometallurgical system, with the construction of 4 drying rotary kilns, 4 roasting rotary kilns, and 4 ore thermal electric furnaces. It is expected to produce 43590 tons of high-grade nickel with a nickel content of 34000 tons annually. According to the feasibility study of the project, the construction period is two years, and it will be put into operation in September 2020. After the first year of operation, the production capacity will reach 70%, and the second year will reach the design capacity, with a production period of 16 years.

(4) Huake Nickel Indonesia Co., Ltd

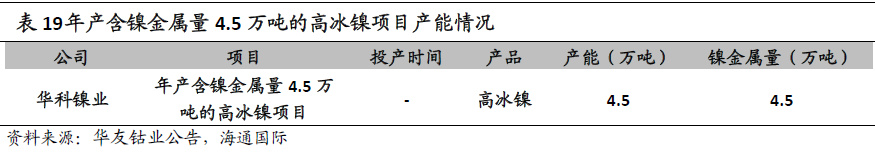

Huake Nickel Indonesia Limited is a joint venture established by Qingshan Group and Huayou Cobalt, with Qingshan Group holding a 30% stake. Huake Nickel Industry has constructed a high ice nickel project with an annual output of 45000 tons of nickel containing metal.

The construction of the high ice nickel project includes 4 drying kilns, 4 roasting rotary kilns, 4 ore thermal electric furnaces, 4 P-S converters and supporting facilities, as well as the construction of a 250MW coal-fired power plant. In March 2021, the first column of the 6th boiler of Huake Nickel Industry in Indonesia's Weidabei 6 × 250MW thermal power generation project began to be hoisted, marking the installation stage of the boiler steel structure of Huake Nickel Industry Power Plant.

Downstream traditional business: stainless steel production

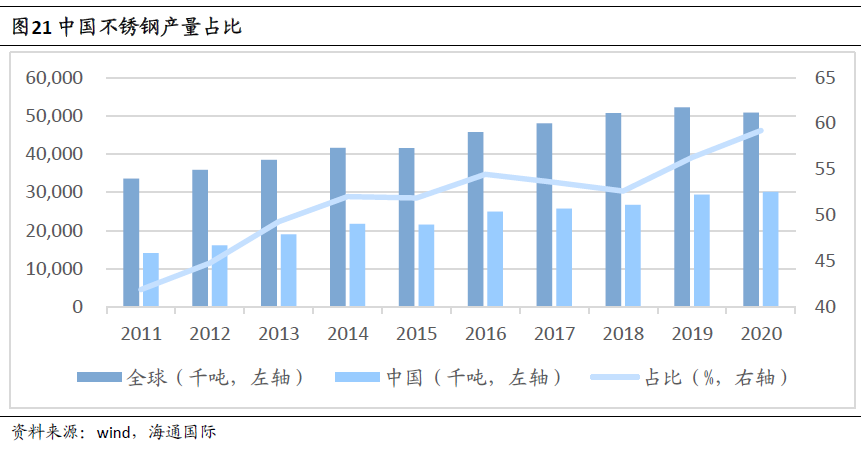

Qingshan Holdings' stainless steel market share exceeds one-third. According to Wind's statistical data, global stainless steel crude steel production declined slightly in 2020, but overall maintained an upward trend. In 2020, the total production of stainless steel crude steel in China was 30.139 million tons, a year-on-year increase of 2.51%, accounting for nearly 60% of the global total. Among them, Qingshan Holdings' stainless steel crude steel production reached 10.8 million tons, accounting for approximately 35.8% of the supply in the Chinese market.

in China

According to the company's official website, Qingshan Holdings established the world's first RKEF-AOD stainless steel integrated production line in March 2008 and began to lay out stainless steel production bases in China thereafter. At present, Qingshan Holdings has three major production bases in Zhejiang, Fujian, and Guangdong in China, mainly producing stainless steel rough steel, hot rolling, cold rolling, etc.

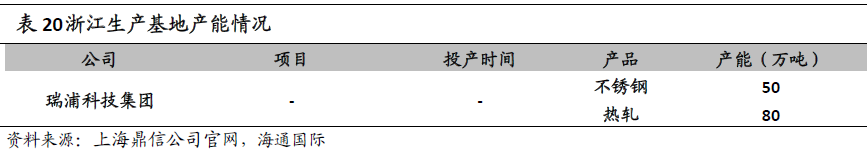

(1) Zhejiang Production Base

Qingshan Industrial Zhejiang Production Base is located in Qingtian County, Lishui City, Zhejiang Province, and is the stainless steel long material production base of Qingshan Industrial. The main production unit of the base is Ruipu Technology Group, which has an annual steelmaking capacity of 500000 tons of stainless steel and two advanced rod and wire hot rolling production lines with an annual rolling capacity of 800000 tons.

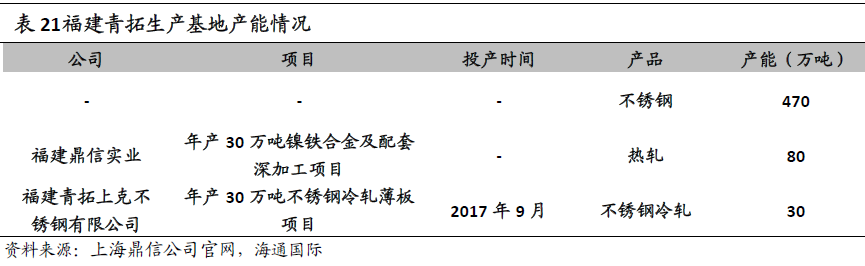

(2) Fujian Qingtuo Production Base

In terms of stainless steel production, Qingtuo Group has currently formed an annual production capacity of 4.7 million tons of stainless steel, 800000 tons of stainless steel hot rolling, and 300000 tons of cold rolling.

Among them, the annual production of 300000 tons of cold-rolled stainless steel sheet project is constructed by Fujian Qingtuo Shangke Stainless Steel Co., Ltd. Fujian Qingtuo Shangke Stainless Steel Co., Ltd. was established in August 2016, jointly founded by Qingtuo Group and Shanghai Krupp Stainless Steel Co., Ltd. The project started construction in September 2016, and the first production line was completed and put into trial production in September 2017. It was fully completed and reached production capacity by the end of July 2018.

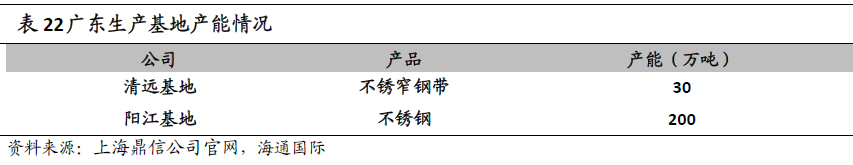

(3) Guangdong Production Base

The Guangdong production base of Qingshan Industrial is located in Qingyuan City and Yangjiang City, Guangdong Province. It is the main narrow strip steel production base of Qingshan Industrial and a large-scale stainless steel steelmaking base using nickel iron/stainless steel integrated production technology. The main production units include Qingyuan Base and Yangjiang Base.

China Indonesia Integrated Industrial Park Qingshan Park (IMIP)

(1) Indonesia Guangqing Nickel Industry Co., Ltd. GCNS

The GCNS project of Indonesia Guangqing Nickel Industry Co., Ltd. adopts the "RKEF AOD integrated process", which uses RKEF technology to produce nickel iron molten iron, and the nickel iron molten iron is hot charged and sent directly to the AOD furnace for stainless steel smelting, thus achieving continuous integrated production of stainless steel.

The GCNS project includes two stainless steel production projects, one for producing stainless steel continuous casting billets and the other for stainless steel hot rolling.

Among them, the annual production of 1 million tons of stainless steel continuous casting billets project has a total investment of 120 million US dollars and covers an area of 9 hectares. It started construction in March 2015, completed trial production in June 2016, and officially started production on July 6, 2017.

The other project is the 1780 hot rolling project. The project covers an area of about 10 hectares and produces 3 million tons of hot-rolled black skin steel coils annually. It started construction on December 18, 2015 and was officially put into operation on July 9, 2017.

(2) Indonesia Qingshan Stainless Steel Co., Ltd. ITSS

In addition to the 600000 ton annual nickel iron project, Indonesia Qingshan Stainless Steel Co., Ltd. also has a 1 million ton annual stainless steel project under construction. The project adopts RKEF AOD integrated technology and started construction in July 2015. It was put into operation in June 2016.

(3) Indonesia Rupu Nickel Chromium Alloy Co., Ltd. IRNC

Based on the long-term development strategy of Qingshan Park and the trend of upstream and downstream integration, Indonesia Ruipu Nickel Chromium Alloy Co., Ltd. has built a 700000 ton stainless steel cold rolling project. The chromium iron products of the project are directly smelted into stainless steel by other projects in Qingshan Park, greatly reducing production costs.

Development focus: Layout of new energy

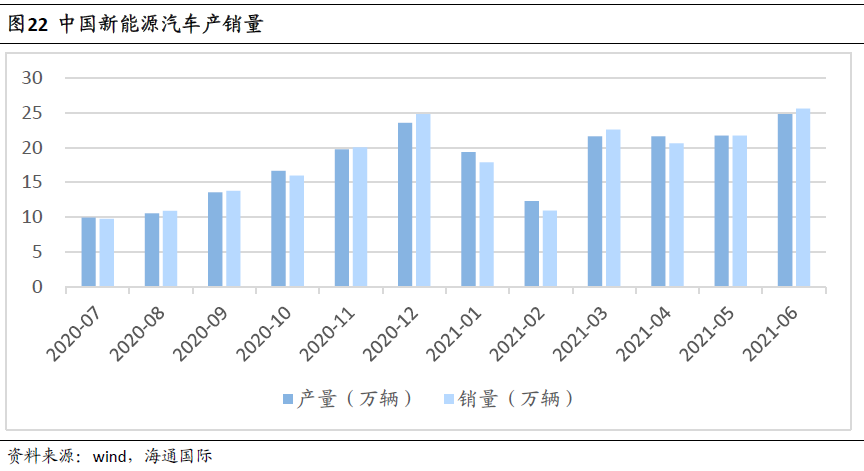

New energy vehicles will be the main demand for nickel downstream in the future. According to Wind's statistical data, the production and sales of new energy vehicles in China have remained relatively stable every month. Since March 2021, the production and sales volume has exceeded the scale of 200000 vehicles per month and maintained a continuous growth trend. Given the rapid growth of the new energy vehicle industry, Qingshan Group, relying on its abundant upstream resource advantages, began to layout the new energy industry in 2017, and strives to build a complete new energy industry chain from both upstream nickel mining and downstream new energy product manufacturing.

upstream

(1) Huayue Nickel Cobalt (Indonesia) Co., Ltd. HYNC

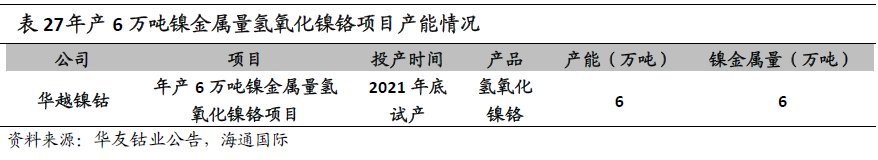

Huayue Nickel Cobalt (Indonesia) Co., Ltd. was established in December 2018 as a joint venture between Huayou Cobalt, Qingchuang International, Woyuan Holdings, and LONG SINCERE in Indonesia. The joint venture company has built a nickel cobalt hydroxide project with an annual output of 60000 tons of nickel metal.

The Huayue Nickel Cobalt (Indonesia) Wet Process Project is located in Qingshan Industrial Park, Morowali County, Sulawesi Island, Indonesia. It uses the most advanced third-generation high-pressure acid leaching process internationally to extract nickel cobalt hydroxide from laterite ore. The project started construction in March 2020, under the overseas general contracting of China Chemical Engineering, and was implemented in two stages. The first phase is to construct a wet smelting project for laterite nickel ore with an annual output of 30000 tons of nickel metal; The second phase is the wet smelting project of laterite nickel ore, which aims to expand production to an annual output of 60000 tons of nickel metal. The total planned investment for the project is 1.28 billion US dollars, and it is expected to be completed and put into trial production by the end of 2021.

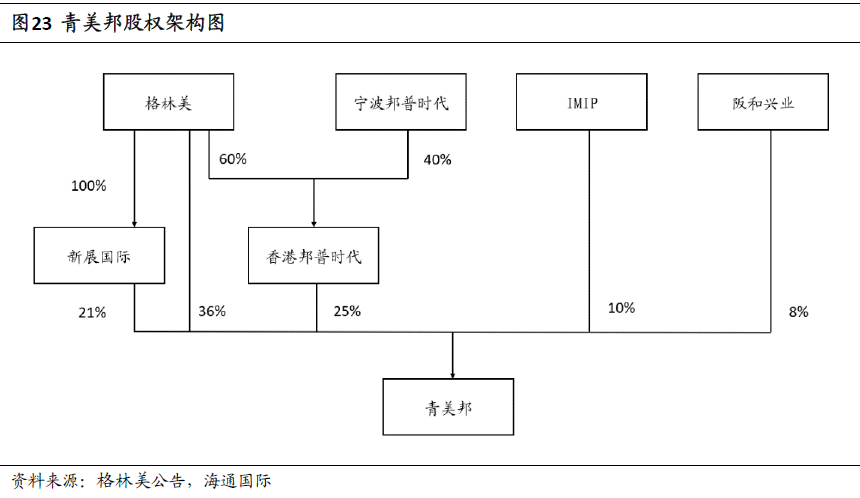

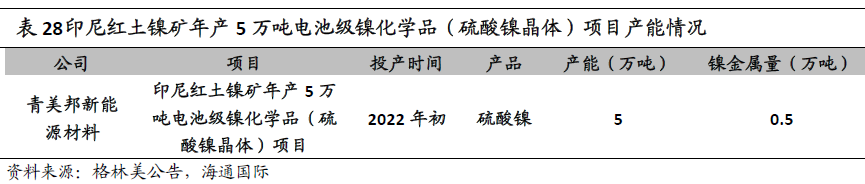

(2) Qingmei Bang New Energy Materials Co., Ltd. QMB

Qingmei Bang New Energy Materials Co., Ltd. was established in January 2019, consisting of Greenmei, Ningbo Bangpu IMIP、 Established as a joint venture between Hankou and Xingye, with IMIP holding a 10% stake. Qingmei Bang has built a 50000 ton battery grade nickel chemical (nickel sulfate crystal) project for Indonesian laterite nickel ore in Qingshan Park.

The Qingmei Bang project adopts wet chemical smelting technology for laterite nickel ore, with the core process being high-pressure acid leaching (HPAL). In May 2021, three 560m ³ high-pressure reactors (core equipment for high-pressure acid leaching) were delivered. The project is planned to complete all construction projects within 2021 and be put into operation in early 2022. After the completion of the Indonesia Nickel Resources Qingmei Bang project, the "Power Battery Ternary Positive Electrode Material Project" will first be configured to meet the nickel cobalt raw material requirements of the nickel resources project.

(3) Zhongwei Corporation

Zhongwei Corporation and Qingshan Holdings signed a strategic cooperation agreement on November 26, 2020, introducing Shanghai Jingmao Investment Co., Ltd., a subsidiary of Qingshan Holdings, to participate in the company's IPO strategic placement. Qingshan Holdings has chosen Zhongwei Corporation as its partner for the nickel resource development project, sales, and expansion plan in Indonesia's industrial park. These projects are expected to supply Zhongwei Corporation with a total nickel metal equivalent of 300000 to 1 million tons from 2021 to 2030, accounting for about 10% -20% of the company's average annual nickel metal usage in the future, to assist Zhongwei Corporation in further improving its industrial chain.

In March 2021, Qingshan Industrial signed a high ice nickel supply agreement with Huayou Cobalt and Zhongwei Shares. The three parties have jointly agreed that Qingshan Industrial will supply 60000 tons of high ice nickel to Huayou Cobalt Industry and 40000 tons of high ice nickel to Zhongwei Shares within one year starting from October 2021.

downstream

(1) New energy production project

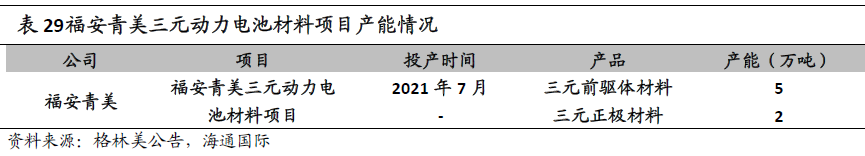

Qingshan Group collaborates with Greenmei to build a ternary power battery material project. Fu'an Qingmei Energy Materials Co., Ltd. is a joint venture established by Yongqing Technology and Greenmei, with Yongqing Technology owning 40% of the shares. The joint venture company has established the Fu'an Qingmei ternary power battery material project.

The initial goal of the project is to produce 50000 tons of ternary precursor materials for power batteries and 20000 tons of ternary positive electrode materials for power batteries annually. In the future, the product structure will be adjusted and the production scale will be expanded according to global market needs. According to the company announcement, a production capacity of 20000 tons was put into operation in July 2021, and the following 30000 tons will be put into operation within the year.

Build XCMG Qingshan New Energy Industry Base and enter the field of new energy vehicles. Qingshan Group signed a project with XCMG Group in December 2020 to jointly build the XCMG Qingshan New Energy Industrial Base. The total investment of this project is about 5.5 billion yuan. The base is mainly engaged in the research and development, production, sales, and service of new energy vehicles, power batteries (cells, battery packs), motor and electronic control systems, and other components.

(2) Ruipu Energy Co., Ltd

Ruipu Energy Co., Ltd. was established in 2017 and is the first enterprise invested and laid out by Qingshan Holdings in the field of new energy based on its abundant mineral resources. It is also the only lithium battery company it owns.

Ruipu Energy mainly produces square aluminum shell ternary lithium batteries and iron lithium batteries with VDA and MEB standard sizes, covering the fields of power and energy storage. Its cooperative enterprises include SAIC GM Wuling, Sany, Dongfeng, etc.

At present, Ruipu Energy has established two major bases, Wenzhou Manufacturing Base and Shanghai R&D Center. The Wenzhou Manufacturing Base is located in Binhai Park, Longwan District, Wenzhou City. It has built four mass production lines and one pilot line, with a total annual production capacity of 6GWh. The Wenzhou Phase II 20GWh factory will be put into operation gradually in mid-2021, and the Phase III 20GWh is expected to be put into operation in 2022, achieving a total annual production capacity of 46GWh.

On April 23, 2021, Ruipu Energy planned a total investment of over 30 billion yuan to build the Ruipu New Energy Industry Base project in the North Bay Area of Wenzhou. The project will complete investment in 2026 and be fully put into operation in 2027. After reaching full capacity, the annual production capacity will reach 100 GWh.

To further expand production capacity, on March 31, 2021, Qingshan Holdings invested 10.3 billion yuan to build a power and energy storage lithium-ion battery and system manufacturing base in Nanhai District, Foshan City. After completion, the annual production capacity can reach 30 GWh, becoming the largest lithium-ion battery production base in the local area.

Ruipu Energy's current production capacity plan has reached 176GWh, with the goal of reaching 200GWh of production capacity by 2025.

Advanced Institute (Shenzhen) Technology Co., Ltd, © two thousand and twenty-onewww.avanzado.cn. All rights reservedGuangdong ICP No. 2021051947-1 © two thousand and twenty-onewww.xianjinyuan.cn. All rights reservedGuangdong ICP No. 2021051947-2