Hotline:0755-22277778

Tel:0755-22277778

Mobile:13826586185(Mr.Duan)

Fax:0755-22277776

E-mail:duanlian@xianjinyuan.cn

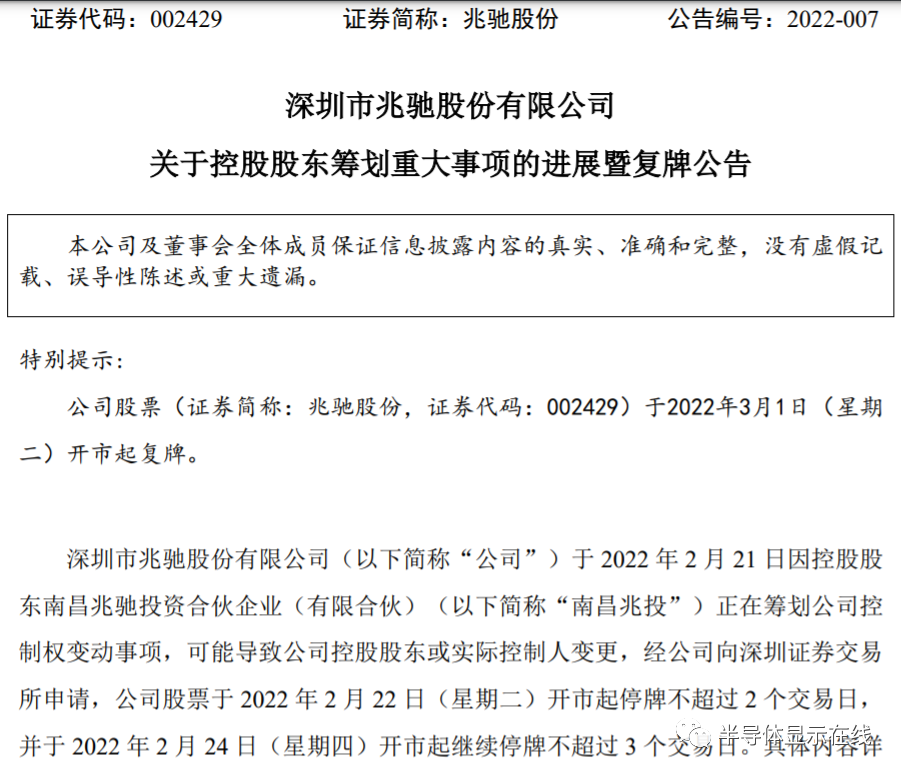

On the evening of February 28th, Zhaochi Shares (002429), which had been suspended for five trading days, announced that its controlling shareholder Nanchang Zhaotou and its concerted action person Gu Wei had signed a "Share Transfer Framework Agreement" with Shenzhen Capital Operation Group Co., Ltd. and its wholly-owned subsidiary Shenzhen Yixin Investment Co., Ltd. According to the company's application to the Shenzhen Stock Exchange, the company's stocks will resume trading from the opening of the market on March 1, 2022 (Tuesday)

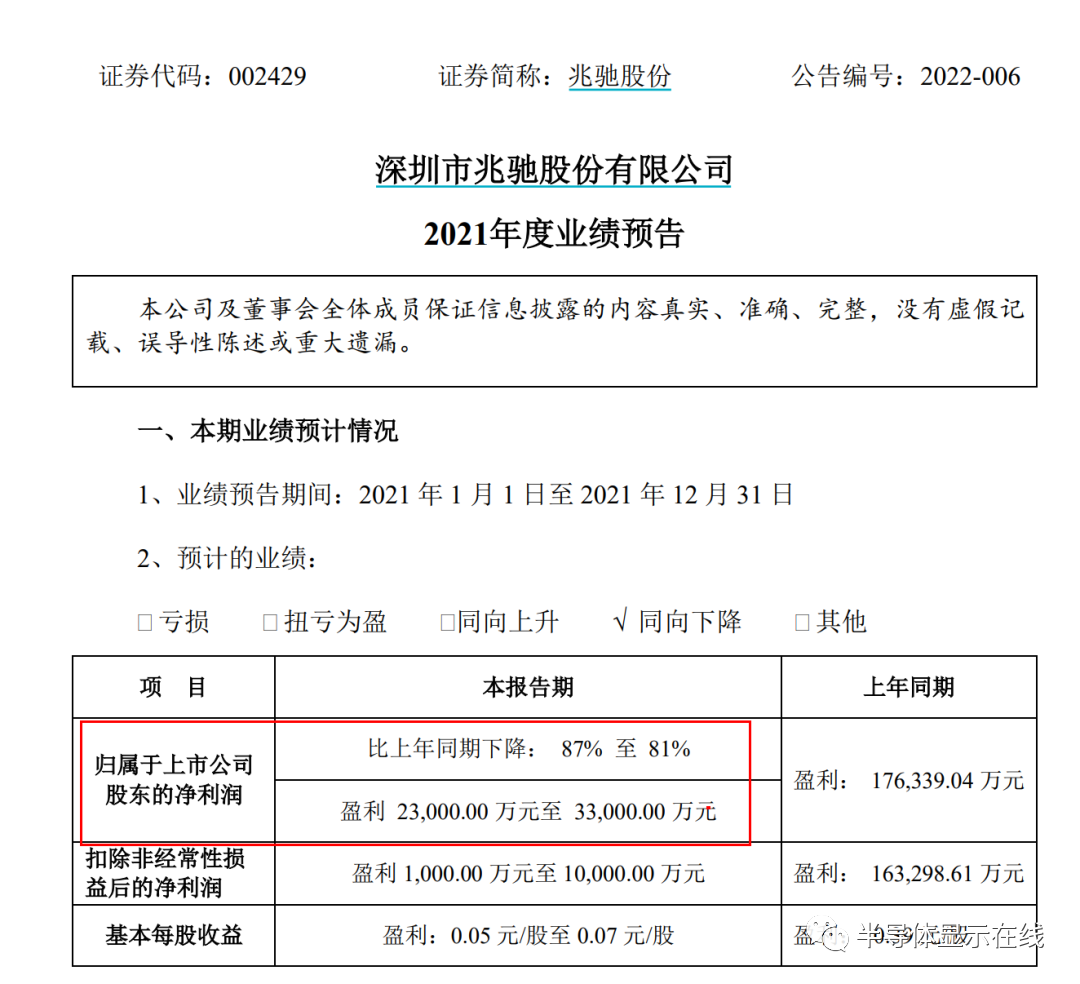

At the same time, the company also disclosed its 2021 performance forecast, with a projected profit of 230 million to 330 million yuan, a year-on-year decrease of 87% to 81%, mainly due to the provision for impairment of accounts receivable of Evergrande Group and its member companies.

However, the company has disclosed a plan to reduce the risk of debt defaults by Evergrande Group and its member companies. The announcement shows that after the implementation of the plan, the company's holdings of commercial acceptance bills and accounts receivable of Evergrande Group and its member enterprises have been reduced to 5.9916 million yuan.

This may mean that the "crisis" of Zhaochi Corporation has been overcome.

The acquirer is Shenzhen State owned Assets

According to the data, Zhaochi Co., Ltd. was established in 2005, starting with ODM manufacturing, mainly engaged in the research and development, manufacturing, sales, and service of home audiovisual and electronic products. Zhaochi Corporation initially engaged in the DVD business, and later extended its business to TV set-top boxes. In 2009, its set-top box sales reached the world's top. Public data shows that in 2020, Zhaochi Holdings ranked second globally in TV ODM.

The recipient of this offer, Shenzhen Capital Operation Group Co., Ltd., is a specialized state-owned asset auxiliary performance platform and state-owned capital operation platform established by the Shenzhen State owned Assets Supervision and Administration Commission to promote the transformation of state-owned asset management from asset management to capital management, and to advance the overall capital operation strategy of Shenzhen's state-owned assets.

Public information shows that Shenzhen Capital Operation Group Co., Ltd. is the management entity of the "Establishing a Stable Development Fund for Private Enterprises with a total scale of 100 billion yuan" task, which is one of the "Four Hundred Billion" plans to support the development of the private economy in Shenzhen. It is also the market-oriented implementation entity of the special fund support policy for emerging industries in Shenzhen. Through various means such as the integration of production and finance, capital market integration, and promotion of mixed ownership, Shenzhen Capital effectively supports the mutual benefit and common growth of multiple ownership economies, serving the stable and healthy development of the city's real economy. The controlled equity participation enterprises cover many fields such as green buildings, intelligent manufacturing, new energy, securities, insurance, funds, guarantees, etc., and have formed an industrial layout mainly focused on emerging industries and financial services.

Divestment of assets and resolution of risks involving Evergrande

In June 2018, Zhaochi Corporation announced its intention to form a strategic partnership with Evergrande Real Estate Group Co., Ltd. and its affiliated companies in the fields of real estate projects and strategic procurement business. Afterwards, Evergrande became an important partner of Zhaochi Corporation. In the second half of 2021, real estate giant Evergrande fell into a liquidity crisis, as the company was implicated due to holding large commercial acceptance bills and accounts receivable from Evergrande Group and its member companies.

According to the plan disclosed by Zhaochi Group today to reduce the risk of debt default caused by Evergrande Group and its member companies, the company has used methods such as divesting Zhaochi's supply chain and purchasing 44.6154% equity of Kunming Fengtai.

The assets of Zhaochi Supply Chain include commercial acceptance bills issued by Evergrande Group and its member companies totaling approximately 2.827 billion yuan. As of December 3, 2021, Zhaochi Supply Chain has received a capital increase of 3 billion yuan and has completed the registration capital change procedures for capital increase and share expansion. The company's shareholding ratio has been changed from 100% to 14.7727%, and Zhaochi Supply Chain has become a participating subsidiary and is no longer included in the company's consolidated financial statements. Zhaochi Supply Chain has already repaid all of the company's debts after receiving the capital increase, and there is no creditor debtor relationship between the company and Zhaochi Supply Chain.

On December 8, 2021, the company signed a "Equity Transfer Agreement" with Beirongxin, and according to the agreement between the two parties, the company paid a total of RMB 2.90 billion in cash through commercial acceptance bills and accounts receivable transfer issued by Evergrande Group and its member enterprises for this equity transfer. On February 28, 2022, the company received a commitment letter from its controlling shareholder Nanchang Zhaochi Investment Partnership Enterprise (Limited Partnership) (hereinafter referred to as "Nanchang Zhaotou"). If Zhaochi Shares fails to purchase 44.6154% equity of Kunming Fengtai, in order to minimize the impact on the company, Nanchang Zhaotou promises to acquire the debt (including commercial acceptance bills and accounts receivable) between Zhaochi Shares and Evergrande Group and its member enterprises at a price not lower than the assessed value.

In addition, the company made provisions for impairment of accounts receivable of Evergrande Group and its member enterprises in 2021. As of now, the company holds commercial acceptance bills and accounts receivable of 5.9916 million yuan from Evergrande Group and its member enterprises, and the risk may have been cleared.

Stable market position in TV ODM and LED fields

In fact, before stepping on Evergrande, the operating performance of Zhaochi Corporation had significantly improved in recent years. Maintain a leading position in the television ODM field for a long time. In the first three quarters of 2021, the company achieved a net profit of 1.577 billion yuan, a year-on-year increase of 41.83%. In the past three years, the net profit after deducting non recurring gains and losses achieved by the company is basically consistent with the trend of net profit changes.

According to the public information, Zhaochi has been deeply engaged in LCD TV ODM business. In 2011, it began to expand the LED industry chain to the upstream and vertically integrated layout. At present, it has formed three major businesses: smart display business (LCD TV design and manufacturing Internet operation), smart home networking business (network communication, loT intelligent terminal) and LED whole industry chain business (LED chip, LED packaging, LED application).

In the field of smart displays, with home displays as the core, it extends to diversified scenarios such as office, business, education, and healthcare. Specific products include LCD TVs, computer monitors, and learning all-in-one machines. The company is a leader in LCD TV ODM, with a global market share of 9.41% in 2020, ranking second in the industry. In recent years, by continuously increasing the proportion of intelligent LCD TVs, it accounted for over 90% of overseas TVs in 2020.

The smart home networking mainly includes 5G communication and IoT (Internet of Things). The company's Sub-6 distributed 5G micro base station has successfully entered the trial production stage, actively expanding the market for 10G PON and Wi Fi 6 related products. The core product, the digital set-top box, is evolving towards intelligent terminals, aiming to create an ecosystem of "5G IoT". In 2020, the revenue of this business reached 1.98 billion yuan,

In addition, the entire LED industry chain of Zhaochi Corporation is also poised to take off. It is reported that Zhaochi Co., Ltd. has established branches in Shenzhen, Nanchang, Beijing, Wuhan and other placeselectromagnetic shielding materialAnd devices, conductive and heat-conducting adhesives, heat-conducting materials and devices

The R&D center has mastered and reserved multiple technologies in core areas such as 4K/8K, regional dimming, full spectrum healthy lighting, ultra-high light efficiency, quantum dot On chip packaging, Mini/MicroLED, etc., and has obtained qualifications such as national high-tech enterprise, Guangdong Engineering Technology Research and Development Center, and Shenzhen Enterprise Technology Center. In the first three quarters of 2021, the growth rate of the company's research and development expenses reached 39.49%. At present, Zhaochi Corporation has entered the high-end product field such as MiniLED backlight and MiniRGB direct display. Among them, MiniLED chips have the ability to produce in small batches, and the red and yellow light project is currently actively developing positive and inverted RGB products, which have entered the trial production stage.

Advanced Institute (Shenzhen) Technology Co., Ltd, © two thousand and twenty-onewww.avanzado.cn. All rights reservedGuangdong ICP No. 2021051947-1 © two thousand and twenty-onewww.xianjinyuan.cn. All rights reservedGuangdong ICP No. 2021051947-2