Hotline:0755-22277778

Tel:0755-22277778

Mobile:13826586185(Mr.Duan)

Fax:0755-22277776

E-mail:duanlian@xianjinyuan.cn

Optical thin film is a secondary process of coating, surface evaporation, lamination, composite, and stretching on an optical base film, endowing it with certain functions and high added value. The cost of optical base film accounts for 70% of the cost of optical film, and its quality largely determines the quality of optical film. It is required to have high transmittance, low haze, high smoothness, low thermal shrinkage, high surface smoothness, and small thickness tolerance.

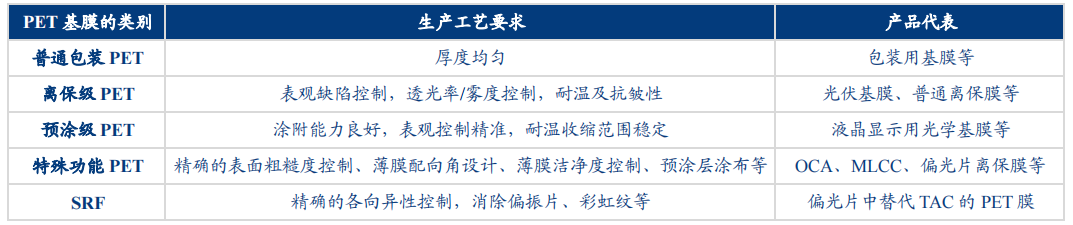

According to different production difficulties, PET base films are divided into five categories: ordinary packaging and release grade PET have lower process requirements; The pre coated PET process requires high requirements, including good coating ability, precise apparent control, and stable temperature shrinkage range. This type of PET is mainly used to prepare optical base films for liquid crystal display panels; Special functional PET refers to optical functional films such as OCA, which can be further processed and coated on the basis of optical base film to give specific functions MLCC、 Polarizing film release film, etc. The PET film used in this process requires precise control of surface roughness, design of film alignment angle, control of cleanliness, and pre coating application; The most difficult production is SRF, which is a PET film that can replace polarizing film TAC. It requires precise control of anisotropy and elimination of polarizing film, rainbow patterns, etc. At present, in China, Double Star New Materials, Changyang Technology, Dongcai Technology, Yuxing Co., Ltd., Hefei Lekai, Hengli Petrochemical, Jizhi Technology, and Dadongnan have made layouts in pre coated and special functional grade PET. There is currently no PET film in China that can replace polarizing film TAC film.

Figure 1: Types of PET base film

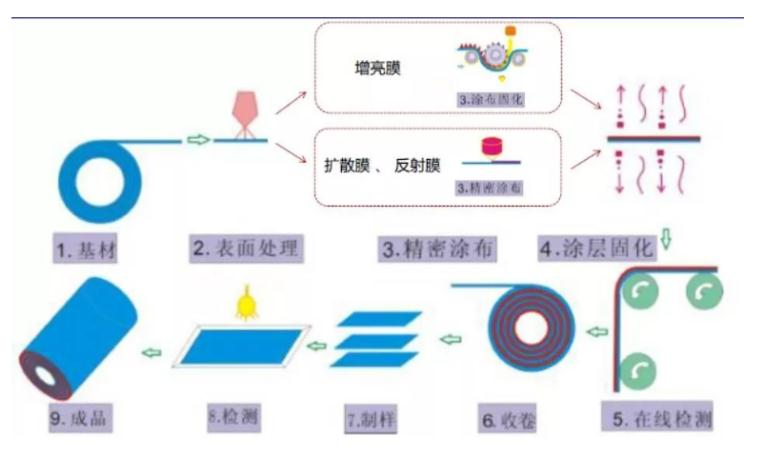

Figure 2: Optical grade thin film industry chain

Figure 3: The main steps of processing optical base film into optical film

Figure 4: Main optical base film materials

At present, the optical base film market is highly monopolized, mainly because Japanese companies supply the world, while American, South Korean and Taiwan, China companies have some supply, while Chinese Mainland has less production, and there are fewer base film companies with small capacity.

According to Xinsijie's data, the global demand for optical grade PVA film in 2019 will be 280 million square meters, and the market size will reach 6.72 billion yuan at the price of 24 yuan/square meter. The global market is monopolized by Japanese enterprises, and Keli and Synthetic Chemistry of Japan occupy 70% of the global market share, while Chinese Mainland's main supplier is Wanwei High tech, with an existing capacity of 5 million square meters per year and 7 million square meters per year under construction. It is expected to be put into production in the middle of 2022, and the domestic alternative space will reach 85 million square meters per year.

TAC optical film. According to the data of Liding Industrial Research Center, the global demand for TAC optical film has reached 1.152 billion square meters. At the price of 25 yuan/square meter, the market scale has reached 28.81 billion yuan. Fuji, Konica Minolta and Rayon of Japan occupy 80% of the global market share. There are only two major suppliers in Chinese Mainland. New fiber new materials and Hefei Lucky have the capacity of 10 million square meters respectively. Hefei Lucky has about 100 million square meters of production lines (including optical polyester film, high-performance polyester film, TAC film, optical functional film, etc.).

PMMA optical film, with Sumitomo and Toyo Steel occupying 98% of the market share in Japan. In China, Daoming Optical has some production capacity mainly supplying the company's own micro prism film and composite board production. Shuangxiang Co., Ltd. has 80000 tons of production capacity that can be applied to the LED field; COP optical films are mainly supplied by Japan's Rayon, and there is currently no production capacity in China.

At present, PET base film is mainly controlled by enterprises in the United States, Japan and South Korea. Among enterprises in Chinese Mainland, Kangdexin, Hefei Lekai, Yuxing Co., Ltd. and Double Star New Material Co., Ltd. have been laid out earlier, and then Dongcai Technology, Changyang Technology, Dadongnan, Sidik, Jiemei Technology, etc. have gradually entered the market. PET optical base film is the most commonly used main substrate for the preparation of various optical functional films, with a wide range of applications.

Figure 5: Main suppliers of optical base film

Display industry: In the era of intelligence and the Internet of Things, there is a strong demand for screens, and the global display industry's shipment area is steadily increasing. DSCC predicts that the shipment area of display panels will exceed 300 million square meters by 2025. In addition, display panels are a highly technology intensive industry, and the new flat panel display technology has given rise to new application scenarios, driving the demand for optical functional films. This field has undergone four technological iterations, from traditional CRT to LCD and then to OLED, and now it has developed into ultra-thin and flexible displays, opening up a new round of technological revolution. New display technologies such as OLED/QLED/Mini LED/Micro LED are gradually improving, driving the demand for optical films such as brightness enhancement films, reflective films, diffusion films, quantum dot films, ITO conductive films, OCA optical adhesive films, etc.

Advanced Institute (Shenzhen) Technology Co., Ltd, © two thousand and twenty-onewww.avanzado.cn. All rights reservedGuangdong ICP No. 2021051947-1 © two thousand and twenty-onewww.xianjinyuan.cn. All rights reservedGuangdong ICP No. 2021051947-2