Hotline:0755-22277778

Tel:0755-22277778

Mobile:13826586185(Mr.Duan)

Fax:0755-22277776

E-mail:duanlian@xianjinyuan.cn

On January 17, 2022, titanium dioxide giant Longbai Group (002601. SZ) announced that its controlling subsidiary, Hubei Baili Wanrun New Energy Co., Ltd., plans to invest in the construction of an annual output of 150000 tons of electronic grade lithium iron phosphate project. The total investment of the project is 2 billion yuan.

Longbai Group stated that the project will utilize the company's titanium dioxide by-products, combined with the company's experience in powder material research and production, to continuously implement the two basic requirements of "large chemical industry" and "low cost" in industrialization, prepare high value-added iron phosphate materials, and further produce lithium iron phosphate, which will help the company form a more complete industrial system, actively promote the company's integration into the new energy material production and manufacturing supply chain, and enhance the company's comprehensive competitiveness.

On January 18, 2022, Longbai Group saw a slight increase of 0.81%, with a stock price of 27.24 yuan and a latest market value of 64.87 billion yuan. It is worth mentioning that since February 2021, the stock has been fluctuating downwards from a high of 51.68 yuan per share, with a cumulative decline of over 30% so far.

01 Continuously increasing investment in new energy

In recent years, the wave of electrification in the automotive industry has swept the globe, and sales of new energy vehicles have been increasing year by year. The strong demand for power batteries will undoubtedly lead to a huge demand for upstream lithium battery materials.

According to data from the Power Battery Alliance, the cumulative installed capacity of power batteries in China for the whole year of 2021 was 154.5 GWh, a year-on-year increase of 142.8%. The total installed capacity of lithium iron phosphate batteries was 79.8GWh, accounting for 51.7%, with a cumulative year-on-year increase of 227.4%. Both the installed capacity and growth rate exceeded that of ternary batteries.

According to GGII data, the global demand for power batteries is expected to reach 1100 GWh by 2025. In terms of lithium iron phosphate cathode materials, the global demand is expected to exceed 3 million tons by 2025, and the demand for negative electrode materials will also reach 2 million tons.

Faced with the huge demand potential of the lithium iron phosphate market, power battery manufacturers and lithium battery material related manufacturers have entered the market one after another. According to incomplete statistics from TrendForce Consulting, there were over 50 domestic lithium battery cathode material expansion projects in 2021, with more than 60% of the projects related to lithium iron phosphate and precursor iron phosphate materials.

Among them, there have been a large number of chemical companies crossing the border, especially phosphorus chemical and titanium dioxide companies, which have begun to aggressively layout lithium battery materials, and Longbai Group, the leader in titanium dioxide, is one of the representatives.

On August 12, 2021, Longbai Group released multiple announcements, officially announcing its entry into the lithium iron phosphate industry. The announcement shows that the company will invest in the industrialization of lithium-ion battery materials with an annual output of 200000 tons, iron phosphate with an annual output of 200000 tons, and artificial graphite negative electrode materials with an annual output of 100000 tons. The total amount of the project is 4.7 billion yuan.

On November 29, 2021, Longbai Group announced another investment of 3.5 billion yuan to build a 200000 ton/year integrated project for lithium battery negative electrode materials in Jiaozuo. In December of the same year, Longbai Group announced that it had signed an investment contract with the Nanzhang County Government of Xiangyang City, intending to invest 2 billion yuan to build a 150000 ton battery grade lithium iron phosphate project.

In addition, with the annual output of 150000 tons of electronic grade lithium iron phosphate project invested in this project, according to incomplete statistics, in less than half a year, Longbai Group has accumulated an investment of about 12.2 billion yuan in the field of lithium battery materials, with a production capacity planning of nearly 1 million tons.

While deploying production capacity, Longbai Group has made substantial progress in the business development of lithium battery materials. On December 10, 2021, Longbai Group signed a strategic cooperation framework agreement with BAK Battery. The agreement stipulates that BAK Battery will purchase lithium battery positive and negative electrode materials from the company between 2022 and 2024, with an annual purchase quantity of no less than 5000 tons, 8000 tons, and 10000 tons for both materials.

At present, Longbai Group's new energy material projects under construction have production capacity of 100000 tons of iron phosphate and 150000 tons of lithium iron phosphate in Xiangyang base, 200000 tons of lithium iron phosphate in Qinyang base, and 100000 tons of battery negative electrode and 200000 tons of iron phosphate in Jiaozuo base.

Everbright Securities stated that the demand for new energy batteries has broad prospects, and the new energy material projects actively invested and constructed by Longbai Group are expected to fully enjoy the development dividends of the new energy industry and form new performance growth points.

02 The advantages of the entire industry chain are highlighted, and there is room for growth?

Data shows that lithium iron phosphate materials are mainly composed of phosphorus, iron, and lithium, and the precursor iron phosphate currently accounts for 20% -30% of the cost of lithium iron phosphate materials.

Titanium dioxide is located upstream of lithium iron phosphate, and a waste called ferrous sulfate is generated during the production process. It can be used to prepare precursor iron phosphate and form the ferrous sulfate iron phosphate lithium iron phosphate industry chain on this basis.

Therefore, titanium dioxide enterprises producing lithium iron phosphate have certain technological accumulation and cost advantages. In fact, this is also the biggest advantage of Longbai Group's layout of lithium iron phosphate materials.

According to the data, Longbai Group is mainly engaged in the production and sales of titanium dioxide, sponge titanium, zirconium products, sulfuric acid and other products. The current annual production capacity of the company's titanium dioxide is 1.01 million tons, making it a leading domestic titanium dioxide enterprise with the largest production capacity in Asia and the third largest in the world.

In addition, since the listing of Longbai Group in 2011, the company has continuously increased its efforts in integrating industrial chain resources, and has formed a transformation and upgrading of the entire industrial chain from titanium concentrate titanium chloride slag chlorination titanium dioxide sponge titanium alloy.

In terms of performance, although the company is already a rising star in lithium batteries, due to the insufficient release of lithium battery material production capacity, the company's performance growth is still mainly based on traditional business (titanium dioxide business), followed by iron-based products and sponge titanium products. Currently, the revenue and net profit proportion of titanium dioxide business exceed 70%.

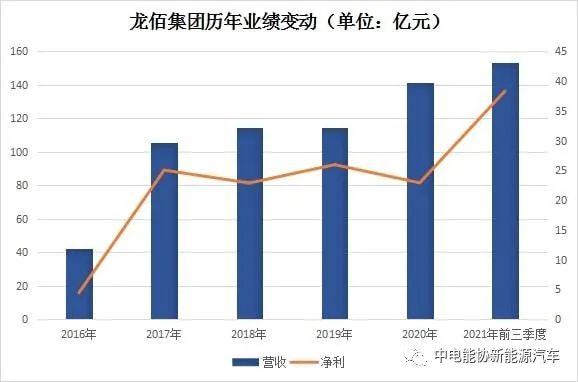

In recent years, Longbai Group's performance has been relatively stable. From 2018 to 2020, the company's revenue was 10.554 billion yuan, 11.42 billion yuan, and 14.164 billion yuan, respectively, with year-on-year growth of 1.94%, 8.2%, and 24.03%; The net profit attributable to the parent company was 2.286 billion yuan, 2.594 billion yuan, and 2.289 billion yuan, respectively.

Longbai Group expects to achieve a net profit attributable to the parent company of 4.577-5.721 billion yuan for the full year of 2021, a year-on-year increase of 100% -150%.

Longbai Group stated that the downstream demand for titanium dioxide in China continued to recover in 2021, while the expansion of sulfuric acid production capacity on the supply side was limited, and the mismatch between supply and demand led to the continued prosperity of titanium dioxide throughout the year. At the same time, the company's vertically integrated full industry chain competitive advantage is fully demonstrated, effectively avoiding raw material price risks and promoting significant net profit growth.

It is worth mentioning that while Longbai Group is actively laying out lithium battery materials, it has not forgotten to increase its focus on traditional main businesses such as titanium dioxide.

On January 17, 2022, Longbai Group announced that its wholly-owned subsidiary Longbai Xiangyang plans to invest in the construction of a titanium dioxide post-treatment project with an annual output of 200000 tons, with a total investment of 1 billion yuan; On the same day, the company also announced that its subsidiary Yunnan Guotai plans to invest in the construction of a 10kt/a sponge titanium production line upgrade and renovation innovation project, with a total investment of 440 million yuan.

Advanced Institute (Shenzhen) Technology Co., Ltd, © two thousand and twenty-onewww.avanzado.cn. All rights reservedGuangdong ICP No. 2021051947-1 © two thousand and twenty-onewww.xianjinyuan.cn. All rights reservedGuangdong ICP No. 2021051947-2