Hotline:0755-22277778

Tel:0755-22277778

Mobile:13826586185(Mr.Duan)

Fax:0755-22277776

E-mail:duanlian@xianjinyuan.cn

1.1. The retirement trend of power batteries is approaching, and there is a vast space for battery recycling

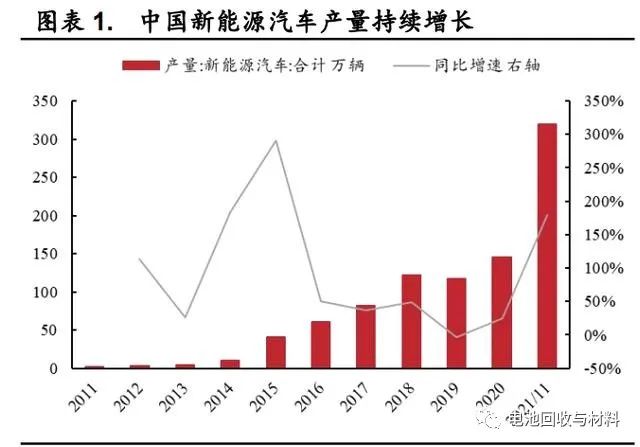

China's new energy vehicles have rapidly increased in volume since 2015. 2015 was the first year of explosive production and sales of new energy vehicles in China, with a production of 401300 units, a year-on-year increase of 291% compared to 2014, and a sales volume of 331100 units, a year-on-year increase of 342.9%. The year-on-year growth rate of production and sales has significantly increased compared to previous levels. As of November 2021, the annual cumulative production of new energy vehicles in China has reached 3.193 million units, and the cumulative sales volume has reached 2.9895 million units. The production and sales level of new energy vehicles has continued to rise since 2015.

The high increase in production and sales of new energy vehicles has driven up the installation volume of power batteries, which will face a significant retirement scale in the future. According to the statistics of the China Automotive Power Battery Industry Innovation Alliance, the installed level of power batteries in China has shown a gradual improvement trend in recent years. As of November 2021, the monthly installed level of power batteries in China has reached 20.82 GWh, a historic high. Against the backdrop of a continuous increase in the installation volume of power batteries, the new energy vehicles sold in the early stages will gradually be scrapped, and the retirement volume of power batteries may form a large scale in the future.

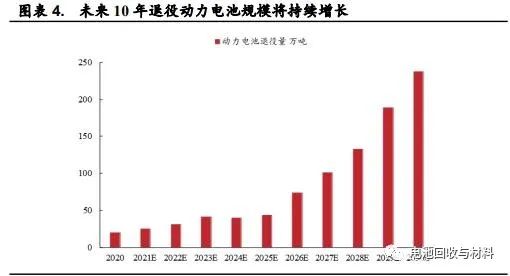

2021 is the early stage of power battery retirement, and the scale of power battery retirement will continue to increase in the future. Based on the previous sales of new energy vehicles in China, Li Yuke mentioned in his "Economic Study on Recycling and Utilization of Vehicle Power Batteries" that the lifespan of new energy passenger vehicles is around 4-6 years. If we assume that the retirement age of power batteries in China is 5 years, the expected retirement level of power batteries in 2021 will be 252000 tons. By 2030, the expected retirement level of power batteries in China will be 2.373 million tons, with a 9-year CAGR of about 28.3%.

The demand for retired battery recycling is strong, but the supply of recycling enterprises is still relatively weak. The battery recycling track will continue to thrive in the future. Under the expectation of continuous growth in the retirement scale of new energy power batteries, multiple enterprises have entered the battery recycling industry. In 2020, the registered number of power battery recycling enterprises in China was about 2579, an increase of about 253.3% compared to 2019. However, most of the registered enterprises mentioned above belong to small and medium-sized enterprises, with about 25% of them having a registered capital of less than 1 million, and about 35% having a registered capital between 1 million and 5 million. On the other hand, according to the "Industry Standard Conditions for Comprehensive Utilization of Waste Power Batteries for New Energy Vehicles" issued by the Ministry of Industry and Information Technology of China, there are currently only 27 enterprises that meet the standards of China's battery recycling industry. Therefore, overall, there are many small and medium-sized competitors in the battery recycling industry, and the supply level of the industry is relatively limited.

1.2. The prospect of recycling is broad, and the future of battery recycling is promising

The main means of recycling retired power batteries are hierarchical utilization and scrap recycling. There are certain differences in the service life of power batteries made of different materials. For example, lithium iron phosphate batteries have a longer cycle life, and their relative capacity will be significantly higher than that of ternary batteries under the same number of cycles. Therefore, there are currently two recycling methods for power batteries made of different materials. The first method is scrap dismantling, which directly disassembles batteries with short service lives and extracts recyclable metals inside; The second method is hierarchical utilization and recycling, which involves reusing retired batteries with higher remaining capacity in low demand battery fields.

1.2.1. Tiered utilization and recycling: With continuous technological breakthroughs, the future space is vast

The process of battery cascading utilization is relatively long and involves multiple steps such as monitoring, packaging, and reassembly. Due to different requirements for cascaded utilization of batteries in different application scenarios, it is necessary to first monitor the performance of each individual battery during the cascaded utilization of waste batteries. However, due to the fact that waste batteries often flow into the market in the form of battery packs, each inspection of individual batteries requires dismantling the batteries first. In this situation, the steps and technologies involved in the hierarchical utilization process of retired batteries are also relatively complex.

Retired batteries for cascading utilization are currently mainly used in energy storage, telecommunications base stations, low-speed electric vehicles, and other fields. In the field of energy storage, one of the most successful projects in China currently is the battery pack cascade utilization project launched by BAK Battery in August 2019. This project combines retired lithium iron phosphate batteries and ternary batteries, and has a leading demonstration significance in China; In terms of base station power supply, retired lithium iron phosphate batteries have advantages over ordinary lead-acid batteries in terms of volume and outdoor efficiency. China Tower has started to purchase cascaded utilization batteries for its base stations since 2018; In terms of low-speed electric vehicles, Hangzhou Luobu Technology and State Grid Zhejiang Electric Power Company have taken the lead in applying cascaded batteries to electric tricycles and electric bicycles.

The hierarchical utilization technology can break through many fields and has a broad future space. There are five key technologies in the hierarchical utilization process of batteries, including health status and residual value evaluation, rapid sorting, effective balancing, application scenario analysis, and re retirement evaluation. For now, the hierarchical recycling technology of power batteries still has certain technical limitations, so its economic benefits are not obvious. In the future, with breakthroughs in the above technologies, the economic viability of hierarchical utilization and recycling of power batteries will gradually become prominent.

1.2.2. Scrap, dismantle and recycle: the scale may reach billions by 2030

The scrap dismantling and recycling process is relatively simple and is currently the main technical means of battery recycling. In the process of scrapping and recycling power batteries, the industrial process mainly includes pre discharge, disassembly, screening, peeling, purification, and production processes. Compared with the hierarchical utilization of batteries, this process eliminates many processes such as testing, repair, reassembly, and certification. Due to the relatively simple process of scrapping and recycling technology, and the fact that batteries after hierarchical utilization still need to be disposed of through scrapping and dismantling, many battery recycling companies are currently engaged in dismantling and recycling.

The sales of new energy vehicles will continue to grow, creating significant space for the recycling of power batteries. The State Council proposed in the "Development Plan for New Energy Vehicle Industry (2021-2035)" that the proportion of new energy vehicle sales in China will reach 20% of the total car sales by 2025. As of November 2021, the proportion of new energy vehicles has reached about 17.8% of the total car sales. Therefore, we have adjusted the proportion of new energy vehicle sales in 2025 to a certain extent. If we assume that the sales of new energy vehicles in China will reach 35% of the total national car sales in 2025, the corresponding sales of new energy vehicles in 2025 will be 9.16 million units, and the installed capacity of power batteries will reach more than 3 million tons. With the continuous increase in the installation volume of power batteries in China, more power batteries will face retirement in the future.

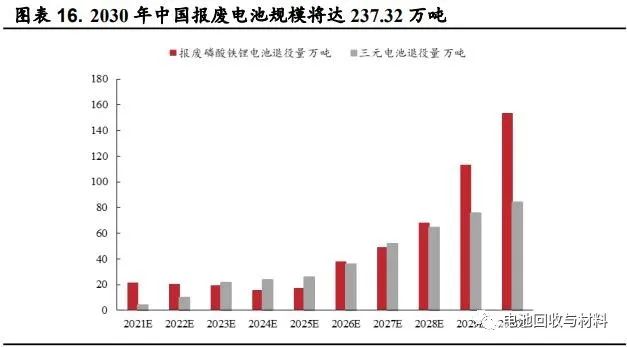

Based on a 5-year lifespan, the total amount of retired power batteries in China is expected to reach 2.3732 million tons by 2030. Assuming that the proportion of sales of new energy passenger vehicles in China's new energy vehicle market will remain at 96% from 2022 to 2025, and the application rate of lithium iron phosphate batteries in passenger vehicles will reach 65% in the future, while the power battery selection for commercial vehicles will be lithium iron phosphate. On the other hand, the single vehicle charge of new energy vehicles and the energy density of new energy power batteries in China have maintained a stable upward trend, while the average service life of various batteries is 5 years. By 2030, the scale of retired lithium iron phosphate power batteries in China will reach 1.531 million tons, and the scale of retired ternary batteries will reach 842000 tons.

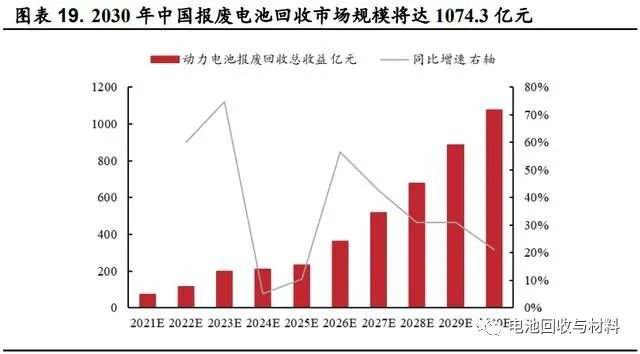

The prices of new energy materials continue to rise, and the benefits of power battery recycling are expected. According to the study by Hou Bing et al. in the article "Research on Recycling Mode of Electric Vehicle Power Batteries", there are many high-value metal elements in new energy power batteries, such as lithium, cobalt, nickel, etc. With the gradual maturity of future power battery recycling technology, it is expected that the proportion of recyclable metals will further increase. According to data from China Research Network, the current recovery rates of cobalt metal and lithium carbonate can reach 95% and 85% respectively. Conservatively, it is expected that the future recovery rate can reach 95%. Moreover, after removing the impact of the cascading utilization of lithium iron phosphate batteries, it is expected that by 2030, the total mass of recyclable iron phosphate, lithium carbonate, nickel sulfate, cobalt sulfate, and manganese sulfate in the entire industry will reach 1.039 million tons, 193000 tons, 699000 tons, 290000 tons, and 154000 tons, respectively. From the price changes of various new energy materials, it can be seen that in recent years, the prices of various materials have shown an upward trend, and the increase in their prices will also make power battery recycling more profitable.

Conservatively estimated, the total scale of China's power battery recycling industry will reach over 100 billion yuan by 2030. Based on the recycling volume and price changes of various new energy materials mentioned above, the prices of new energy materials have generally increased in the past few years. Among them, the CAGR of the average prices of iron phosphate, lithium carbonate, and cobalt sulfate in the past four years were 8.7%, 12.8%, and 7.6%, respectively. Based on conservative assumptions, if the prices of various materials increase by 2% annually on the basis of 2021 in the future, the total scale of power battery recycling in 2030 will reach 107.43 billion yuan.

1.3. Strong resource recovery benefits and sufficient industry development momentum

Waste batteries contain various metal resources, and recycling has economic benefits. From the main materials and chemicals contained in lithium batteries, it can be seen that power batteries contain a large amount of recyclable high-value metals, such as lithium, cobalt, nickel, etc. In nickel hydrogen batteries, nickel content accounts for up to 35%; In ternary batteries, the proportions of nickel, cobalt, manganese, and lithium are approximately 12%, 5%, 7%, and 1%, respectively. The recycling of waste power batteries will achieve the reuse of the above-mentioned metal materials and create higher recycling profits.

There is a large-scale production stoppage in Australian mines, and there may be restrictions on the supply of lithium mines in the future. According to UGSG data, three of Australia's seven major lithium mines were shut down in mid-2020, namely Pilgangoora (AJM), Mt Wodgina, and Bald Hill, with a total of 330 million tons of shut down resources and a production capacity of 1.125 million tons. In the future, with the continuous increase of new energy vehicles, there may be certain obstacles to the supply of lithium mineral resources.

Indonesia's nickel ore export policy has tightened, and there are also uncertain expectations for nickel supply. Since the promulgation of the Mineral and Coal Mining Law in Indonesia in 2009, the Indonesian government has continuously tightened nickel ore exports. As of January 1, 2020, all grade nickel ores have been officially banned from export. The tightening of policies has affected the global supply of nickel resources. In the future trend of high nickel development in ternary batteries, the supply and demand of nickel resources may continue to be tight.

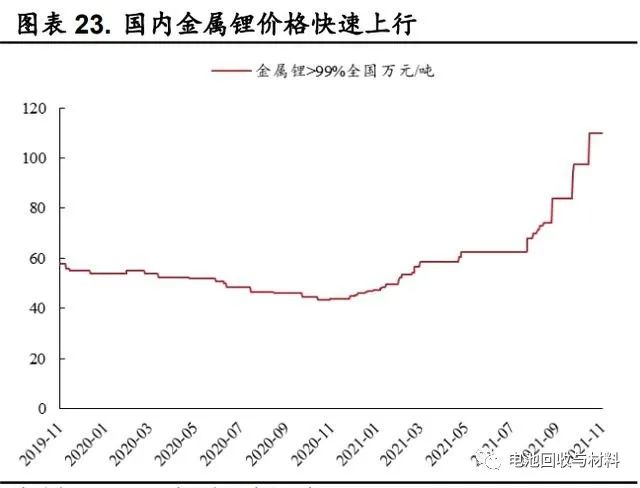

Due to the tight supply of resources, the prices of metals such as lithium and nickel have risen, and battery recycling is expected to achieve high economic benefits. Driven by the current high production and sales of new energy vehicles and relatively tight supply of resource goods, the prices of metals such as lithium and nickel have shown varying degrees of upward trend. As of December 21, 2021, the price of metallic lithium (>99% nationwide) in China was reported at 1.19 million yuan/ton, an increase of about 164.44% compared to the same period last year. The average price of electrolytic nickel market was about 147500 yuan/ton, an increase of about 15.09% compared to the same period last year. Against the backdrop of the continuous rise in lithium and nickel prices, the metal obtained from battery recycling may achieve high economic benefits, while also improving the current situation of tight metal supply.

1.4. With strong policy support, battery recycling is poised to take off

Waste power batteries contain numerous heavy metal substances, which have a serious impact on the environment. The main pollutants contained in lithium-ion batteries are their positive electrode materials and electrolytes. Among them, cobalt element in the ternary positive electrode is a toxic substance in the positive electrode material, and metal elements such as nickel and manganese can also cause soil pollution; In electrolytes, the commonly used electrolyte lithium hexafluorophosphate produces hydrogen chloride upon contact with water, causing environmental pollution, and DMC in organic solvents is also harmful to the environment. Therefore, if retired batteries are not recycled, it will cause serious environmental problems, which will also force the country or relevant enterprises to pay attention to battery recycling.

In recent years, China has frequently introduced relevant policies to assist in the recycling and utilization of power batteries. Since 2012, China has successively introduced a number of important laws and regulations related to the recycling of power batteries, among which the most crucial one is the "Interim Measures for the Management of Recycling and Utilization of Power Batteries for New Energy Vehicles" issued by the Ministry of Industry and Information Technology and other departments in 2018. In this law, the Chinese government has made clear requirements for the production responsibility system of power battery recycling, proposing that automobile production enterprises bear the main responsibility for power battery recycling. In the same year, seven departments including the Ministry of Industry and Information Technology and the Ministry of Science and Technology jointly issued the "Notice on Doing a Good Job in the Pilot Work of Recycling and Utilization of New Energy Vehicle Power Batteries", requiring strengthening experience exchange and cooperation with pilot areas and enterprises, promoting the formation of cross regional and cross industry cooperation mechanisms, and starting the promotion of power battery recycling projects. In 2020, the Ministry of Industry and Information Technology issued the "Key Points for Energy Conservation and Comprehensive Utilization in 2020", requiring in-depth pilot work, accelerating the exploration and promotion of market-oriented recycling and utilization models with strong technical and economic feasibility and environmental friendliness, and cultivating a number of backbone enterprises for power battery recycling and utilization. In the future, leading companies in the industry may continue to receive policy support.

2. Mature technology and simultaneous advancement of the three major technologies

The mainstream recycling methods for retired batteries include physical recycling, wet recycling, and thermal recycling. Physical recycling is the use of fine disassembly and material repair techniques for recycling, which can be fully automated and pollution-free, with good economic efficiency. Wet recycling mainly includes three methods: chemical precipitation, solvent extraction, and ion exchange. Its reaction rate is slow and the process is relatively complex. However, due to its low requirements for equipment and high product purity, this method is currently the mainstream battery recycling process. Thermal recovery mainly includes mechanical sorting and high-temperature pyrolysis, which are methods for directly recovering various battery materials or valuable metals. The process is relatively simple, but there are problems such as low recovery rate, high energy consumption, and pollution.

2.1. Physical recycling has high economic efficiency

The physical recycling process is divided into two stages: automated disassembly and recycling remanufacturing. Automated dismantling is the process of selling or recycling the internal components of discarded lithium-ion batteries obtained through discharge and dismantling. The battery cell pack obtained from disassembly is finely crushed and classified through a series of methods to obtain valuable products such as positive electrode powder and negative electrode powder. Recycling and remanufacturing is the process of remanufacturing batteries by adjusting the composition and repairing materials of valuable products from automated decomposition.

The physical recycling process of ternary batteries has high returns. According to the research results and calculations in the "Economic Study of Power Battery Cascade Utilization Scenarios and Recycling Technology", under physical recycling technology, the average cost of recycling and dismantling waste ternary batteries and lithium iron phosphate batteries is 13264 yuan/ton and 8364 yuan/ton, respectively; The revenue is 16728 yuan/ton and 7703 yuan/ton respectively. Based on this set of data, the recycling benefits of physical methods will reach the highest level among all three process technologies. On the other hand, the data in this group is relatively old. With the general increase in prices of new energy metals in recent years, the recycling revenue of ternary batteries will further increase. In terms of lithium iron phosphate batteries, with the advancement of technology and the rise in prices, the profit space for recycling and utilization will gradually open up.

2.2. Wet recycling has the widest application range

Wet recycling technology mainly refers to the extraction of solid metal substances from electrode materials using acid-base solutions. In the wet recycling process, the waste lithium-ion batteries are first sorted and classified, shell removed, and dissolved in an acidic or alkaline solution. Valuable metal elements are then extracted from the solution. Finally, valuable metals such as cobalt sulfate and lithium carbonate are extracted through ion exchange and electrodeposition methods.

The advantages and disadvantages of wet recycling technology are obvious, and it is the main power battery recycling process in China. From the advantages of wet recycling technology, this process is relatively more mature and has a higher efficiency in recovering metal substances from batteries; In terms of disadvantages, the wet recycling process is relatively long and involves the use of corrosive solvents such as hydrochloric acid, resulting in high costs in pollution control. Due to the lack of standardization in China's battery recycling industry and the large number of small and medium-sized production capacities, there are currently no strict control measures for pollution control in the industry. Wet recycling technology has become the main current technology for power battery recycling in China due to its simple process advantages.

2.3. The thermal recovery process is relatively simple

The thermal recovery process mainly extracts metals and their compounds from waste batteries through high-temperature means. Through high-temperature incineration, the organic binders in waste power batteries can be converted into gaseous form for removal, while the metals and various compounds in the batteries will undergo oxidation-reduction reactions at high temperatures and gradually be classified through condensation. The waste battery residue after high-temperature incineration will be further purified through magnetic separation and other methods.

The pretreatment process of thermal recovery is mainly divided into two forms: high temperature and low temperature. High temperature calcination can reduce various metal oxides in batteries to elemental metals or alloys, facilitating subsequent separation and treatment. Low temperature calcination is mainly used to treat various organic compounds in batteries. Through low-temperature calcination, the oxides in the electrodes will undergo redox reactions and be removed.

The thermal recovery process is simple and suitable for large-scale processing. From the perspective of the advantages of thermal recycling, the process flow of thermal recycling is relatively short and the operation is relatively simple, and it is also suitable for the treatment of large-scale waste batteries. Therefore, this process has been widely studied in the market. However, from a disadvantage perspective, the thermal recycling process is prone to emitting certain harmful gases when processing waste batteries on a large scale, and requires corresponding exhaust gas recovery equipment for recycling. In addition, thermal recovery technology also has certain requirements in terms of electricity consumption.

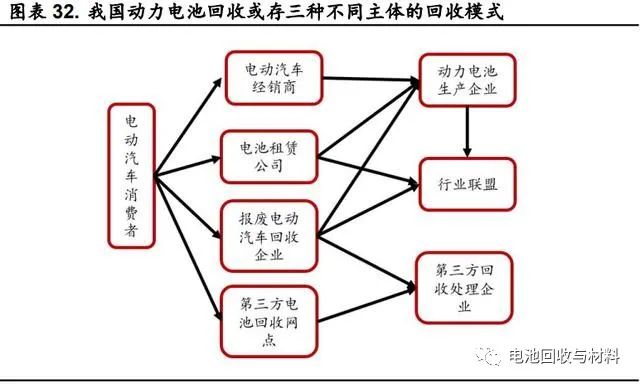

The recycling model of waste power batteries in China is still in the early stages of exploration, and there may be three commercial models in the future. There are three main ways to achieve the recycling and utilization of heavy waste batteries starting from electric vehicle consumers. The first mode is for power battery companies to recycle through existing distribution, sales, and service network channels; The second mode is to form an industry alliance consisting of battery manufacturers, electric vehicle manufacturers, or battery rental companies within the industry, jointly responsible for the recycling of batteries; The third method is to entrust third-party recycling companies for recycling.

Power battery production enterprises are one of the important responsible parties for battery recycling, but the recycling model based on them has scale limitations. The business model dominated by power battery manufacturers has a relatively diverse range of battery recycling channels. Power battery manufacturers can rely on the channels built by electric vehicle dealers for battery recycling. At the same time, battery manufacturers can also cooperate with car dismantling companies and battery rental companies to complete battery recycling. In this mode, due to the different technical specifications of the products produced by various battery manufacturers, the operation efficiency of the industry in this mode may also have some obstacles, which is difficult to form a scale effect.

The third-party recycling model is currently the mainstream recycling model, but its development has channel limitations. With the gradual start of the retirement trend of new energy power batteries, more and more professional battery recycling enterprises have been registered and established. Due to the fact that third-party companies specialize in battery recycling, their expertise in recycling may be stronger than that of battery or automotive manufacturers. However, due to the lack of professional and efficient battery recycling channels in the early stages of the industry, this business model may face more intense competition in the future, and most third-party recycling companies may be eliminated by the industry.

Under the industry alliance recycling model, each enterprise can achieve complementary advantages. Industry alliance refers to the formation of a unified recycling organization by uniting important entities such as power battery production enterprises, new energy vehicle production enterprises, and third-party power battery recycling enterprises. In this alliance, power battery manufacturers can provide batteries and provide sales channels for new batteries, automobile manufacturers can provide recycling channels for waste batteries, and third-party recycling companies can achieve efficient recycling of power batteries through their own technological advantages. With the complementary advantages of all parties, the industry alliance battery recycling model may become the main business model for the future power battery recycling industry.

Each of the three industry models has its own strengths, and industry alliances may become the main business model in the future. From the comparison of the three business models, it can be seen that the industry alliance model will have significant advantages in the recycling of power batteries, and at the same time, risks can also be diversified through cooperative risk-taking in terms of operational risk. Although there may be some communication barriers in the early stages of the development of this model, with the gradual improvement of relevant information infrastructure, this business model may become one of the most efficient models in the future.

Advanced Institute (Shenzhen) Technology Co., Ltd, © two thousand and twenty-onewww.avanzado.cn. All rights reservedGuangdong ICP No. 2021051947-1 © two thousand and twenty-onewww.xianjinyuan.cn. All rights reservedGuangdong ICP No. 2021051947-2