Hotline:0755-22277778

Tel:0755-22277778

Mobile:13826586185(Mr.Duan)

Fax:0755-22277776

E-mail:duanlian@xianjinyuan.cn

After the Winter Solstice, it is already a hundred feet of ice on the cliff, but there are still beautiful flowers and branches.

In a few days, photovoltaics will bid farewell to the "silicon king" of 2021. No matter how turbulent the industry may be, we will always feel grateful for the past year and prepare for the new year.

After a year and a half of intense competition, the photovoltaic market has broken the "critical point" of the game. In just half a month, the prices of the industrial chain have continued to decline.

Wang Bohua, Honorary Chairman of the Photovoltaic Industry Association, recently lowered the expected installed capacity for this year from 55-65GW to 45-55GW, and is more optimistic about 2022- the new installed capacity of photovoltaics will increase to over 75GW, which is related to the reserve of large-scale photovoltaic projects in China.

In the past year or so, the biggest gain of photovoltaics has actually been the "consensus". Once the consensus is reached, various trivial issues will inevitably be resolved.

Photovoltaic has become a definite competition track, and there is no doubt about the overall trend and development. Next, it depends on how various enterprises and capital respond to the competition in the new era.

It can be expected that during the 14th Five Year Plan period, especially in the past two to three years, the environment that photovoltaic companies need to cope with will become more complex, and the competitive landscape of the industry will also face significant changes.

Based on various factors, the author believes that the photovoltaic industry will face the most complex and fierce competition from the end of 2022 to the whole year of 2023.

How to prepare in advance, how to make strategic layouts, how to coordinate vertically and horizontally, how to grasp the speed of advance, and so on, all greatly test the skills of photovoltaic enterprises. Of course, this is just one opinion, for friends' reference only. The competition in the industry and market is ultimately dynamic, and we welcome everyone to discuss and make bricks together.

The silicon wafer process has been crazily 'involuted'

By the end of 2022, the production capacity may exceed 500GW, at least theoretically, indicating a large-scale absolute overcapacity in this sector.

The silicon wafer industry was originally led by the "dual leaders", with Longi (601012. SH) and Zhonghuan (002129. SZ) having a clear first mover advantage. The second tier players are eyeing the market, and more competitors are eager to try.

According to publicly available data, some companies have planned to invest in over 300GW of silicon wafer projects since 2020.

In addition to Longi and Zhonghuan, the representative companies for expansion include JA Solar (002459. SZ), CNC (603185. SH), JinkoSolar (JKS. US), Gaojing Solar, Shuangliang Energy Saving (600481. SH), and so on. Especially for the new player Gaojing Solar, they are preparing to increase their silicon wafer production capacity by 50GW, shocking the industry.

On March 12, 2021, the 50GW monocrystalline silicon rod project in Qinghai Gaojing Photovoltaic Technology Industrial Park, with a total investment of 18 billion yuan, officially started construction; On June 28th, less than four months later, Qinghai Gaojing's first monocrystalline silicon rod officially made its debut.

So, by the end of 2022, how much silicon wafer production capacity will China have domestically? Zhonghuan Shares alone will have 135GW of production capacity realized next year, while Longi Shares will reach 120GW next year.

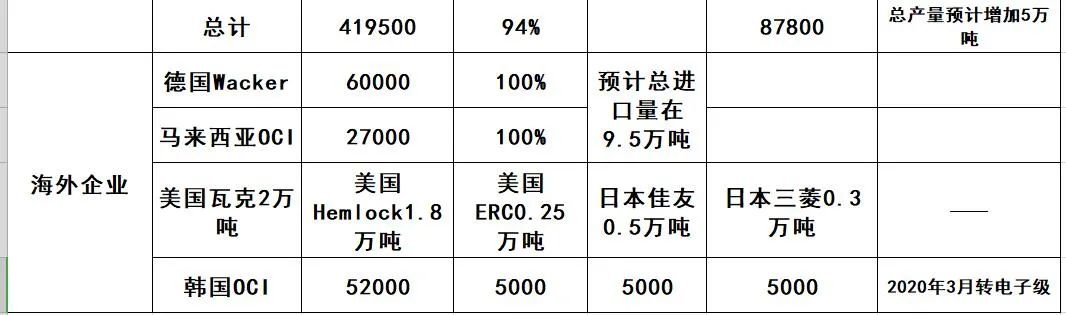

The silicon wafer production capacity of the two leading companies exceeds 250GW. As shown in the table above, referring to the data compiled by "Energy One", incomplete statistics indicate that by the end of 2022, the silicon wafer production capacity may reach over 500GW.

Of course, overcapacity ≠ product overcapacity, but the influx of so much capital into the silicon wafer sector will inevitably lead to a temporary "absolute overcapacity". The competition between Longi and Zhonghuan, as well as the competition between new and old forces, will be very fierce.

The technical barriers in this process have been basically eliminated, and everyone is in a stable position in competition management, supply chain, and finance. Observers have been asking: Will any companies be unable to withstand the end of this round of competition?

The silicon material process is accelerating towards' involution '

The end of 2022 to the beginning of 2023 may be a point of sharp price decline; The role played by the technological revolution of granular silicon led by Poly Xiexin (03800. HK) in this industry cycle deserves special attention.

Profitable, a large amount of capital enters the polysilicon sector. The latest news is that on December 27th, Dongfang Risheng announced its intention to invest in the second phase of the Guyang Jinshan Industrial Park incremental distribution network source grid load storage integration demonstration project in Baotou, with a preliminary estimated total investment of 44.65 billion yuan.

The project is divided into two major sections, in the manufacturing section, which includes an annual output of 200000 tons of metallic silicon, 150000 tons of high-purity silicon, 10 GW of N-type high-efficiency crystal pulling, and 3 GW components on the load side. The construction period is four years.

In the power generation sector, namely the power end, Dongfang Risheng (300118. SZ) will invest in 3.5 GW photovoltaic power plant projects, 1.6 GW wind power plant projects, and energy storage projects.

On the evening of December 20th, Daquan Energy announced that it had signed an agreement with the Baotou Municipal People's Government to invest 33.25 billion yuan in the construction of 300000 tons/year high-purity industrial silicon and other projects.

Previously, on December 14th, it was reported that Jiangsu Sunshine Group had invested 35.1 billion yuan in Bayannur, and would invest in the construction of 100000 tons of polycrystalline silicon and 15GW pull rods, components, etc.

At the same time, Hesheng Silicon Industry plans to invest 35.5 billion yuan in the construction of a silicon-based new material industry integration project in Ganquanbao Economic and Technological Development Zone, Urumqi in March 2022. It is expected to be fully completed and put into operation by 2024.

Surprisingly, as a photovoltaic glassConductive silver paste shielding materialOligopoly, Xinyi Solar has also made a big investment in the silicon material sector: On December 13th, the Yunnan government signed a contract with Xinyi Solar to produce 200000 tons of polycrystalline silicon and 20000 tons of white carbon black annually, melt 1400 tons of float glass and 2400 tons of photovoltaic cover plates per day, with a total investment of 23 billion yuan for the three projects.

Looking back at this year, the polycrystalline silicon industry has become increasingly lively. In addition to the "Five Tigers of Polycrystalline Silicon" making large investments in production capacity, capital from "cross-border" industries is also eager to move. The future price trend of silicon materials is also the most concerning. What will be the price of polycrystalline silicon?

After the main theme of "silicon is king" in the second half of 2020 and throughout 2021, the photovoltaic industry will finally welcome the large-scale and sustained release of silicon material production capacity.

The latest statistics show that there are over 25 projects under construction and planned for polysilicon in China in 2021. If all of them are put into operation, China's polysilicon production capacity will reach around 3.3 million tons by 2025. 3.3 million tons of polycrystalline silicon can produce over 1100GW of silicon wafers.

Now, including glass oligarchs such as Xinyi, they are still entering the field of polycrystalline silicon. In the near future, more capital may enter this sector, and it won't be long before polycrystalline silicon also enters a frenzy of internal competition.

This also means that, firstly, the industry will fall into absolute surplus; Secondly, there is fierce competition between established old companies and between new and old forces; Thirdly, the industry may eventually engage in malicious price wars, and prices are likely to experience a significant decline by the end of 2022 to early 2023.

According to industry observer Zhang Zhiyu, at least 600000 tons of polysilicon production capacity will be added in 2022, and by the end of 2022, the silicon material production capacity in China will increase from 500000 tons to 1.1 million tons.

It is normal for crazy profits to lead to crazy capacity expansion. After the industrial silicon supply returns to normal, it is also expected that the price of silicon materials will be below 100 yuan by the end of 2022.

In 2022, there will be a significant increase in demand, but at this point in December 2022, facing a monthly output of up to 100000 tons of silicon materials, terminal demand needs to grow to 33GW per month to effectively digest, with an annualized demand of 360GW.

The role played by the technological revolution of granular silicon led by Poly Xiexin in this industry cycle deserves special attention.

Not long ago, on December 15th, Poly Xiexin announced that the company plans to issue and distribute no more than 2.037 billion shares, equivalent to 8.13% of the company's existing issued share capital. The placement price is HKD 2.49, which is the intraday price on December 14th, with a discount of only about 2.4% compared to the closing price of HKD 2.55 on the same day.

Poly GCL stated that it plans to use the net proceeds from the placement for capital expenditures and general operating funds. However, considering that Poly Xiexin is expanding its FBR granular silicon production capacity on a large scale, the proceeds from the allocation will mainly be used for granular silicon projects.

According to the observation of rain control, the emergence of the technological revolution of granular silicon may further exacerbate the capacity expansion of the polycrystalline silicon material industry.

The underlying logic is that if Poly GCL's granular silicon is a true revolution with low costs and good quality, then its capacity expansion pace will be cyclical and no longer worry about overcapacity.

Based on publicly available information, Poly Xiexin will have a production capacity of 260000 tons of granular silicon by the end of 2022, making it the largest enterprise in terms of new production capacity. Whether its production capacity comes out depends on the true cost and quality of granular silicon.

If this technological revolution can really be accepted by downstream, the expanded 260000 ton production capacity will greatly change the balance of supply and demand, accelerating the arrival of a rapid decline in silicon material prices at some point in 2022.

Of course, observers will inevitably have different perspectives and opinions on the direction of silicon material prices and changes in the competitive landscape. One reader expressed that they do not agree with the view that silicon material prices may collapse, mainly for two reasons:

Firstly, silicon material production is not equivalent to production capacity, and it cannot be compared to planned production capacity. As mentioned in the article, the existing major silicon material factories have survived in a fierce competition amidst mountains of corpses and seas of blood. Can the lesson of blood be repeated for the second time.

It is obvious that several top silicon material players plan their production capacity in two or even three phases, as the saying goes, taking one step at a time, if there are problems in the market (such as changes in supply and demand).

2、 The third phase project can be temporarily suspended or put on hold at any time. Even for operational projects, production capacity can be reduced under the guise of maintenance and project optimization (which has been done this year). In my personal opinion, due to the high concentration of silicon materials, several major oligarchs may have reached a tacit understanding.

Secondly, the time cycle from planning to forming production capacity for new silicon manufacturing forces will far exceed the budget. From environmental impact assessment and energy assessment, to bidding and construction, and capacity ramp up, it takes no more than two years to land, and there are various variables such as policies and markets in between.

At the same time, the focus of competition in the silicon material market will increasingly be reflected in the competition for advanced production capacity (with a focus on cost reduction), which requires a long accumulation of time, technology, and talent. From this perspective, I do not believe that new players entering the silicon material market will do better than the current few oligopolies.

Players like Sunshine, even though they were once giants in polysilicon, should not forget that they were failures back then, and I don't think they can stand out today without occupying financial and technological advantages.

Advanced Institute (Shenzhen) Technology Co., Ltd, © two thousand and twenty-onewww.avanzado.cn. All rights reservedGuangdong ICP No. 2021051947-1 © two thousand and twenty-onewww.xianjinyuan.cn. All rights reservedGuangdong ICP No. 2021051947-2