Hotline:0755-22277778

Tel:0755-22277778

Mobile:13826586185(Mr.Duan)

Fax:0755-22277776

E-mail:duanlian@xianjinyuan.cn

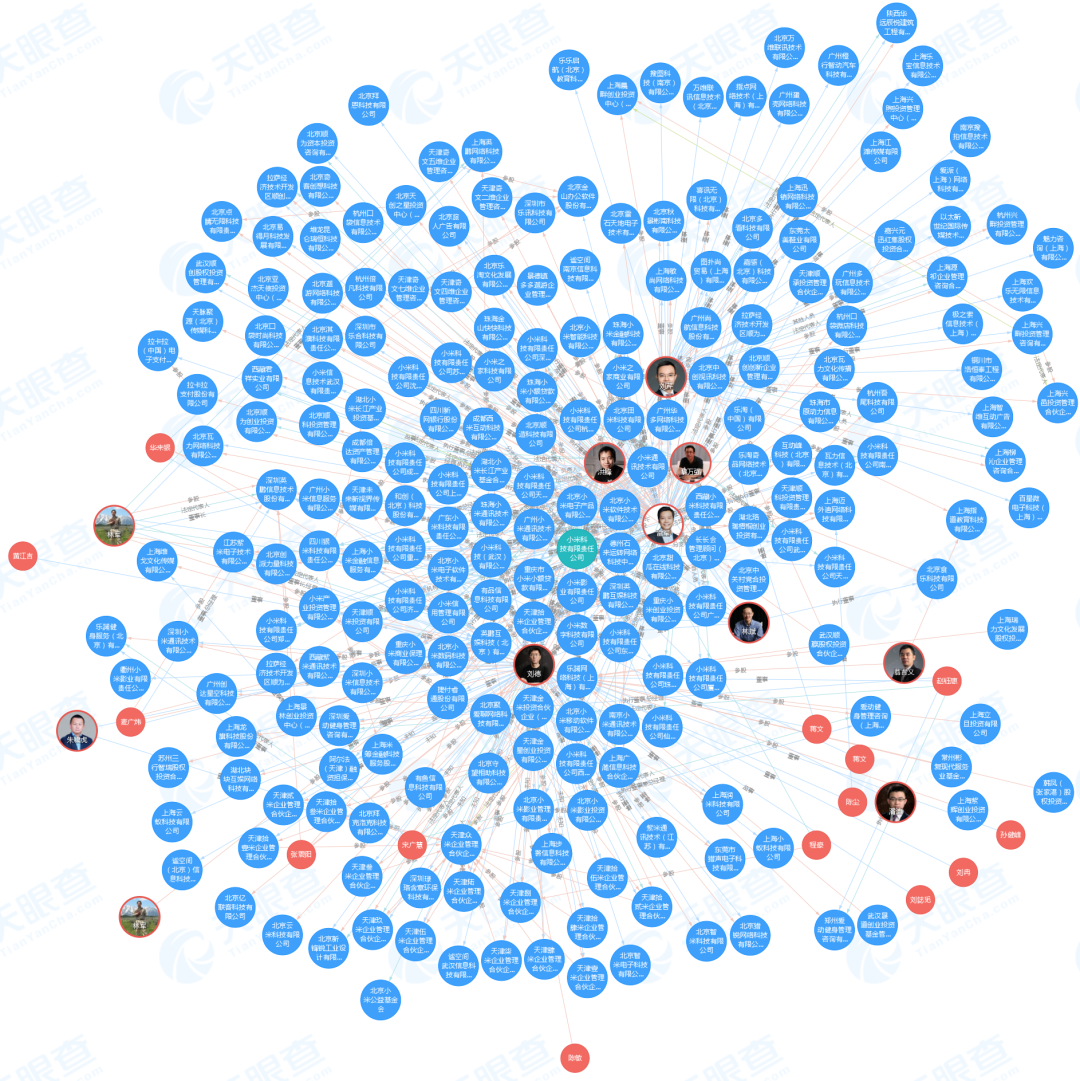

Many people who know very little about Xiaomi may think that it is just a mobile phone manufacturer, but later it went on to make cars. In fact, Xiaomi can already be called an "empire". How big is this empire? Take a picture and feel it.

Due to space limitations, this image still cannot fully summarize the full picture of the Xiaomi Empire. According to incomplete statistics, Xiaomi has invested in over 400 companies.

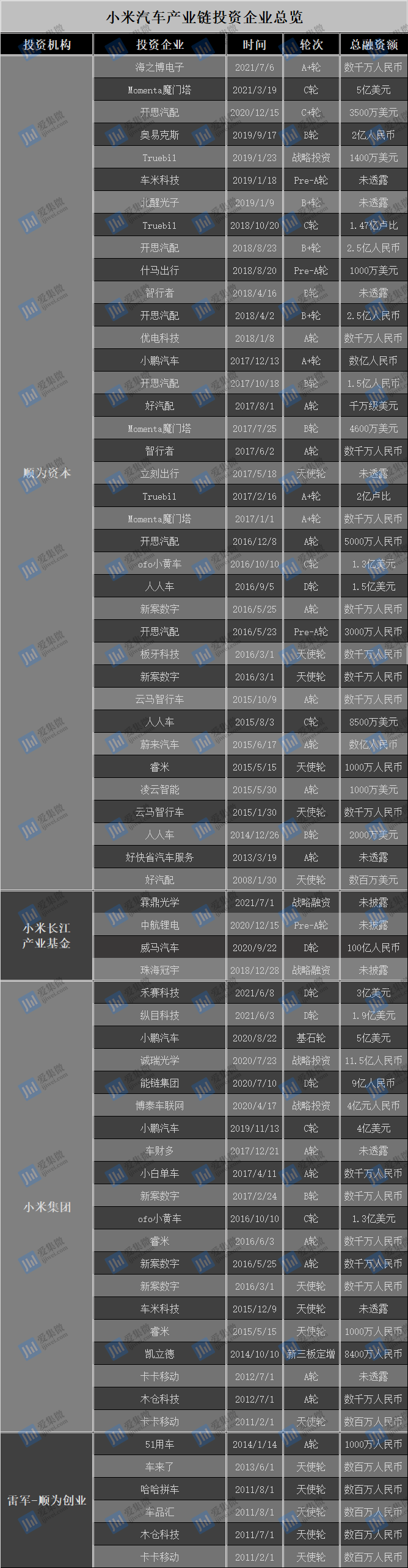

Xiaomi accelerates car manufacturing: cumulative investment in over 30 automotive industry chain enterprises

According to incomplete statistics, as of now, several investment institutions including Lei Jun's personal angel investment institution Shunwei Entrepreneurship, Xiaomi Group, Xiaomi Changjiang Industry Fund, and Shunwei Capital have invested in about 35 automotive industry chain enterprises, mainly covering the fields of complete vehicles, upstream and downstream supply chain, transportation, and automotive aftermarket.

Among them, Xiaomi's investment in the automotive field is more from Shunwei Capital. The platform focuses on mobile Internet, Internet of Things, intelligent hardware, intelligent manufacturing and other fields. According to the official website, its investment portfolio covers the entire ecosystem of autonomous driving, whole vehicle, in car intelligence, and automotive aftermarket, including front-end car manufacturers NIO and Xiaopeng Motors; Yunma Electric Bicycle, Lingyun Intelligent Two Wheel Electric Vehicle; Developing Momenta and Zhixing Technology for autonomous driving; In car intelligent hardware manufacturers Ruimi and Xincase Digital; Automotive electronic control manufacturer Ouaikes, board tooth technology for in car intelligent products, solid-state laser radar developer Beixing Photon, map navigation manufacturer Kailide, etc.

In the automotive aftermarket, it covers areas such as automotive parts trading and sales, car insurance platforms, second-hand buying and selling, and automotive maintenance and repair, such as Youdian Technology, Shima Travel, Chepinhui, Renrenche, Cheche Auto Insurance, Kaisi Auto Parts, Haoauto Parts, etc. Among them, Kaisi Auto Parts has invested 6 times in the B2B trading platform for automotive parts, and Renrenche, a C2C trading platform for second-hand cars, has also received 3 investments.

Xiaomi Yangtze River Industry Fund is also an indispensable investment platform in the automotive industry chain. Recently, on July 1st, it invested in optical manufacturing and measurement manufacturer Linding Optics. Tianyancha shows that Linding Optics has added a new shareholder, Hubei Xiaomi Yangtze River Industry Fund Partnership Enterprise (Limited Partnership). At the same time, the registered capital has increased from RMB 12 million to about RMB 12.6316 million, an increase of about 5.26%. It also participates in lithium battery and new energy power battery suppliers Zhuhai Guanyu and AVIC Lithium Battery.

Based on Xiaomi Group's recent investments in Zongmu Technology and Hesai Technology, Xiaomi may first enter the fields of autonomous driving sensors, machine vision algorithms, LiDAR, etc. Overall, Xiaomi Group's investment targets include new digital solutions that provide intelligent travel products, Kaka Mobile, a company in the automotive consumer sector, Botai, a car networking company, and Chemi Technology.

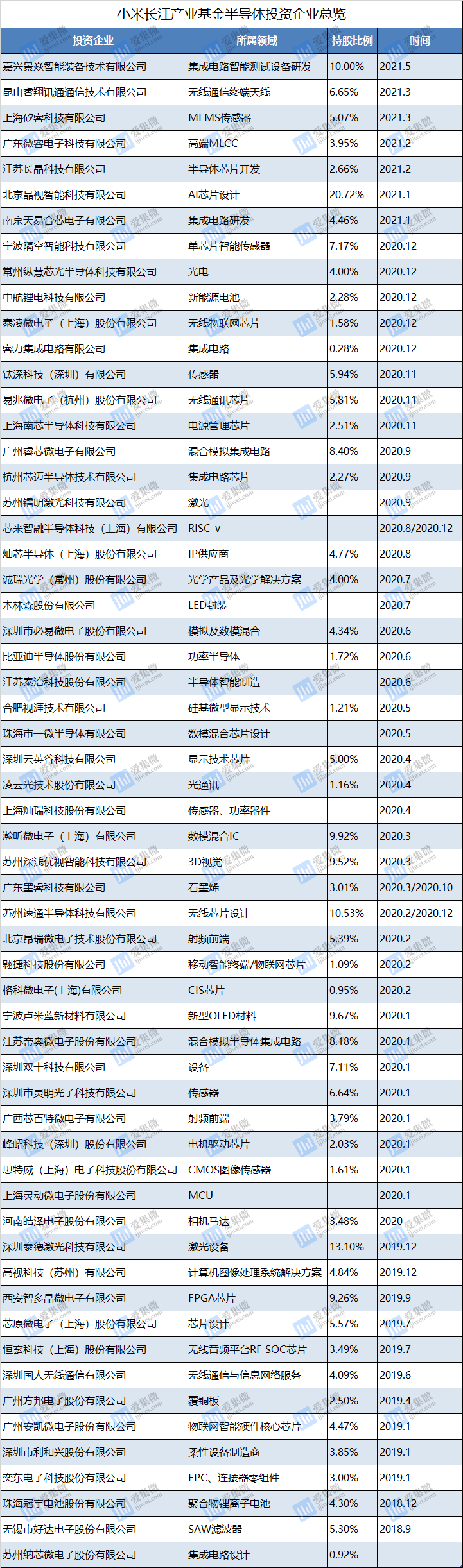

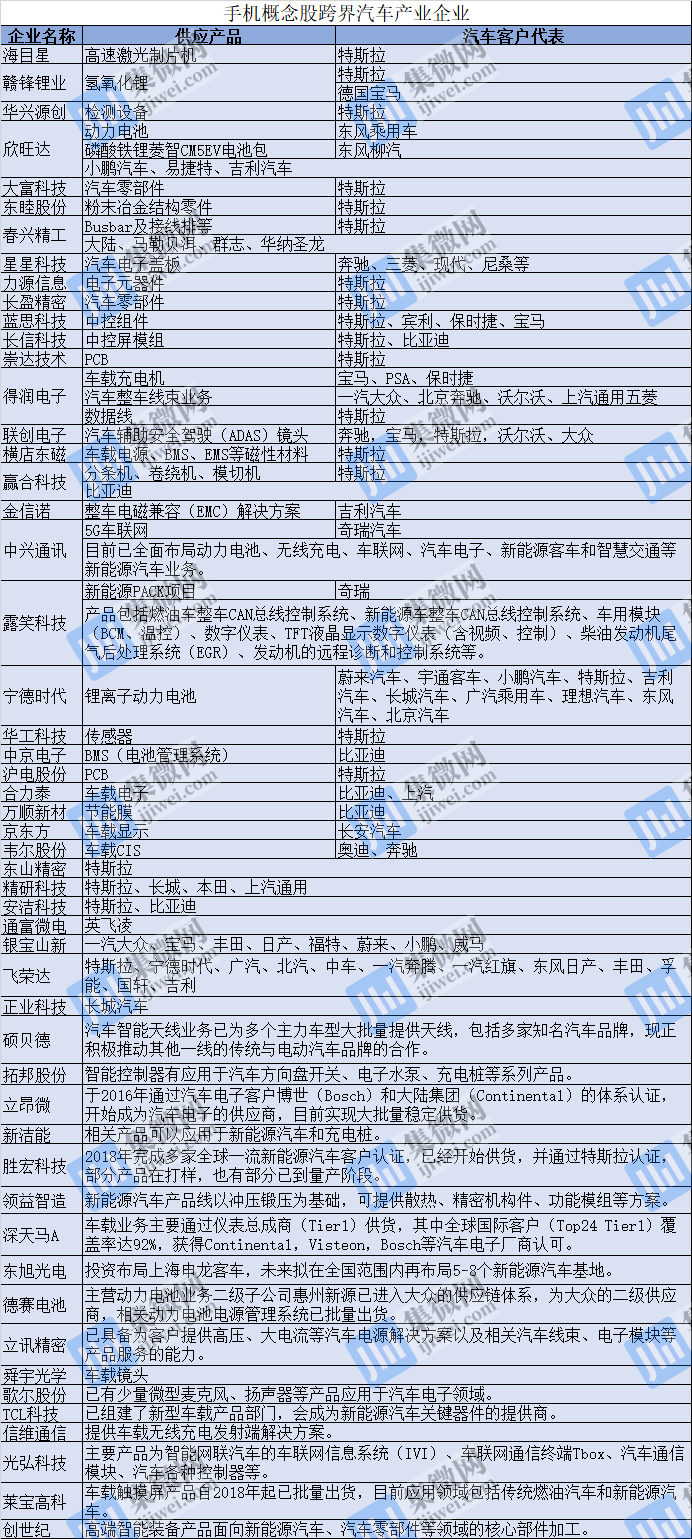

Xiaomi's cross-border expansion drives supply chain: suppliers coincide with it

Looking back at Xiaomi's investment in the mobile phone industry chain and semiconductors, according to the author's previous statistics, the Xiaomi Yangtze River Industry Fund, which specializes in the semiconductor field, has successively invested in companies such as Naxin Microelectronics, Lingdong Microelectronics, Xinbaite, Di'ao Microelectronics, Geke Microelectronics, Aojie Technology, Sutong Semiconductor, Hanxin Microelectronics, Yiwei Semiconductor, BYD Semiconductor, Canxin Semiconductor, Xinmai Semiconductor, and Micro Rong Electronics in recent years. So far, Xiaomi's investment layout in the semiconductor field has reached as many as 59 companies, involving RF/display chips MCU、 Multiple fields such as filters, storage, laser equipment, and materials have gradually achieved coverage from the semiconductor materials, design, and components industry chain.

To a certain extent, Xiaomi's investment in consumer electronics industry chain enterprises such as smartphones is also a win-win situation for the supply chain. With the continuous increase in shipments of Xiaomi's smart terminal products such as smartphones, this has also strongly promoted the development of the industry chain. In addition, for Xiaomi, the integration of the Xiaomi ecological industry chain has also played a great role!

In fact, while Xiaomi accelerates its car manufacturing plan, mobile phone supply chain manufacturers have long been focusing on the in car market. According to incomplete statistics from Jiwei Network, in car lenses are mainly produced by Lianchuang Electronics and Sunny Optics; Power battery suppliers include leading lithium battery companies such as Xinwangda and CATL; In the central control components, there are Lansi Technology and Changxin Technology, which provide central control components and central control screen modules respectively.

Advanced Institute (Shenzhen) Technology Co., Ltd, © two thousand and twenty-onewww.avanzado.cn. All rights reservedGuangdong ICP No. 2021051947-1 © two thousand and twenty-onewww.xianjinyuan.cn. All rights reservedGuangdong ICP No. 2021051947-2