Hotline:0755-22277778

Tel:0755-22277778

Mobile:13826586185(Mr.Duan)

Fax:0755-22277776

E-mail:duanlian@xianjinyuan.cn

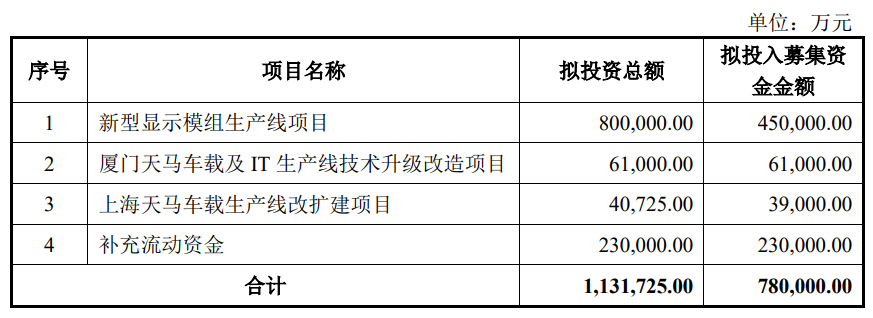

According to Shi Yin Film Chain, on the evening of September 16th, Shenzhen Tianma released its plan for non-public issuance of A-shares in 2022, proposing to raise no more than 7.8 billion yuan for the new display module production line project, Xiamen Tianma car and IT production line technology upgrade and renovation project, Shanghai Tianma car production line renovation and expansion project, and to supplement working capital.

The announcement shows that the target of this issuance is no more than 35 specific investors, including AVIC International Industry Holdings Co., Ltd. (hereinafter referred to as "AVIC International Industry"). AVIC International Industry will not participate in the market inquiry for the pricing of this issuance, but promises to accept the market inquiry results of this issuance and subscribe at the same price as other investors, with a proposed subscription amount of 980 million yuan.

Shentianma A stated that the professional display modules and IT display modules covered by this fundraising project can complement the company's existing panel production line, alleviate production capacity pressure in some areas, increase product diversity, achieve comprehensive coverage of small and medium-sized businesses, and continuously improve product specifications and competitiveness, supporting industry leadership in various business fields. In addition, by configuring and optimizing the dedicated line for vehicle mounted modules, the quality of materials and processes can be controlled, ensuring quality delivery and long-term stable quality supply; By configuring and optimizing high-end IT module dedicated lines, we can accurately grasp customer needs and forward-looking technological directions, respond quickly, and facilitate the expansion and capture of the IT market.

It is reported that Shentianma A currently has production lines for 2nd to 6th generation TFT-LCD (including a-Si and LTPS), 5.5th generation AMOLED, 6th generation AMOLED, as well as TN and STN production lines. Recently, new layouts have been made on the 8.6th generation a-Si&IGZO production line, new display module production line, and Micro LED test line. The company's products are currently mainly aimed at the mobile intelligent terminal display market represented by smartphones and smart wearables, including in car, medical POS、HMI、 The professional display market represented by smart homes and industrial control handheld devices, as well as the IT display market represented by laptops and tablets, are accelerating their layout, and expanding non display businesses based on TFT panel driver technology.

Source: Tianma

Under the rapid growth trend of new energy vehicles. Industry companies such as Shentianma, BOE, and Vixinnuo generally consider in car displays as a new growth point.

According to Omdia data, with the development trend of intelligent and visualized automobiles and the rapid popularization of new energy vehicles, the average annual compound growth rate of market demand for in car displays will remain at around 5% -6%. By 2026, the global shipment of in car displays will reach 240 million pieces.

It is reported that with the increasing penetration rate of flexible OLED panels in the mobile phone market, Shentianma has shifted its application of LTPS (low-temperature polycrystalline silicon) - LCD (liquid crystal) panels more towards the automotive, tablet, and laptop markets. In the investor communication record released on July 29th this year, Shentianma stated that the evolution of the trend of "electrification, intelligence, networking, and sharing" in automobiles has higher requirements for the high-definition, large screen, multi screen, personalized, interactive upgrade, and integrated capabilities of in car displays.

At present, Shentianma's in car display panels include various intelligent cockpit products such as instruments, central control, HUD (head up display), rearview mirrors, rear seat entertainment, etc., covering from 2 inches to 40 inches, providing multiple display solutions such as single screen, dual screen, triple screen, etc. Shentianma announced this year that it will invest in the construction of an 8.6th generation line and a new module production line, targeting the incremental market including the automotive industry, equipped with a dedicated line for large-sized displays in the automotive industry.

Shentianma's Wuhu Automotive Display R&D Center and Xiamen Micro LED Full Process Test Line both consider automotive displays as one of their important application directions. Compared with consumer electronics screens, the in car display business has a longer order cycle and a more stable gross profit margin.

Recently, according to the investor relations activity record released by Shentianma A, the company announced the construction of several important projects in the first half of this year, including the in vehicle display research and development center (Wuhu), the 8.6th generation new display panel production line (TM19, Xiamen), the new display module production line (TM20, Wuhu), and the Micro LED full process testing line (Xiamen), all of which are progressing smoothly as scheduled, in accordance with strategic needs. Among them, the 8.6th generation line is currently fully preparing for the official piling construction. The production line is expected to reach its H2 peak in 2023 and begin mass production of H2 points in 2024.

Shentianma A stated that the investment and construction of TM19 was based on the company's full consideration of the overall development trend of downstream markets and the specific needs of clients. Among them, the car market will remain strong in the medium and long term, and the company's car business orders will be full. In the future, the order volume and amount will continue to break through at a high level. TM19 will work together with the company's existing production lines to better serve customer needs according to project pace.

2. How far does Xiaomi car go from mass production?

Recently, the topic of "Lei Jun claims financial freedom at the age of 37" has topped the trending list on Jiwei Network.

The subsequent statement that "Xiaomi's car making was a forced decision" has also attracted high attention. For Xiaomi Group, whose stock price continues to be sluggish, "making cars" is a concept that can attract investors' sustained attention. Recently, ST Dawn achieved 18 daily limit ups within 22 trading days based on rumors of Xiaomi taking over the market. The skyrocketing stock price of ST Dawn also exposed investors' attention to Xiaomi's car manufacturing qualifications. So, how far is Xiaomi's car, which was forced out, from mass production?

Is Xiaomi's car making a 'forced decision'?

On September 15th, CCTV released a pilot film for "Cloud Top Dialogue: Lei Jun". Lei Jun said in an interview that the reason for founding Xiaomi was actually very simple. After leading Kingsoft to complete its IPO, he semi retired for three to four years and became a "rising star" in the investment circle. At the age of 37, he was financially free, but he remembered the book "Silicon Valley Fire" he read when he was 18 years old, hoping to start a technology company and influence the world.

When talking about Xiaomi's entry into the automotive industry in recent years, Lei Jun said, "At this moment, the trend is in smart electric vehicles, because it has become the integration of the automotive industry and consumer electronics. If you don't do it, you will fall behind, so Xiaomi's decision to make cars is a forced one

"If this is a forced decision, it is Lei Jun's own will to force him to take action early. Lei Jun's personal speech in 2022 revealed his regret for missing the Internet vent at that time," according to industry insiders. Lei Jun and Xiaomi have enjoyed the dividends brought by the smart phone tuyere in the mobile Internet era; However, the lack of innovation and declining sales of mobile phones have also made Lei Jun feel the crisis of being "outdated". Therefore, the regrets of the past and the current sense of crisis have forced Lei Jun towards the trend of new energy vehicles.

The progress of Lei Jun's car making also indicates that this "forced decision" is something he wants to do. According to Xiaomi's 2021 fiscal year report, the size of Xiaomi's car development team has exceeded 1000 people, and the first car will also be mass-produced in the first half of 2024.

Lei Jun's view on the timing of entering the field of new energy vehicles is consistent with that of smartphones, which is to enter when the relevant industry trends are formed and the supporting industrial chain is mature. On September 9th, Lei Jun posted on social media, "Tesla entered the electric vehicle industry more than 10 years ahead of Xiaomi, and some people believe that Xiaomi has missed the window of entry into the electric vehicle industry. I disagree with this, the competition has just begun, and I think Xiaomi still has many opportunities

It is worth mentioning that Xiaomi cars have also become one of the few bright spots in Xiaomi Group that can stimulate investors' enthusiasm for Xiaomi stocks. Since reaching a new high of 35.9 yuan per share on January 5, 2021, Xiaomi's stock price has been declining to around 10 yuan per share. Set a new low in two years. In the current sluggish consumer electronics market, Xiaomi Group urgently needs the concept of "cars" to boost its stock price.

Behind the skyrocketing stock price of ST Dawn: The problems of Xiaomi's car manufacturing factory are highlighted

It is interesting that recently, companies related to Xiaomi's car manufacturing have been hyped up in the secondary market. On the evening of September 13th, Liaoning Shuguang Automobile Group Co., Ltd. (600303, hereinafter referred to as "ST Shuguang") hit 18 limit up boards within 22 trading days. On September 14th, ST Dawn continued to hit the daily limit up, closing at 7.58 yuan per share. Since August 12th, the stock price has risen by 115.34% over 23 trading days. Subsequently, the Shanghai Stock Exchange quickly issued a regulatory letter, and ST Dawn began to suspend trading on September 15th.

Behind the speculation of ST Shuguang, there are rumors in the market that Xiaomi and Ganfeng Lithium may hold controlling stakes in ST Shuguang. On September 15th, ST Dawn told the media that the rumors were not true. After verification, the board of directors of the company has confirmed that there are no other significant information that should be disclosed but has not been disclosed, including but not limited to major asset restructuring, issuance of shares, acquisition of listed companies, debt restructuring, business restructuring, asset divestiture, and asset injection.

However, the rumors also reveal Xiaomi's current predicament: building its own factory may not be able to achieve mass production in the first half of 2024; The cost of purchasing production qualifications from other automobile factories is too high, and the money is not worth it.

In fact, since Xiaomi announced its car manufacturing plans, rumors have been circulating about which car brand or factory it plans to acquire in order to obtain car manufacturing qualifications and factories. These may not all be rumors, some may actually be in talks, "industry insiders pointed out, including Evergrande Auto, Baowo Auto, ST Shuguang, BAIC, and others.

Regarding Xiaomi's current predicament, the person believes that "Xiaomi will still insist on building its own factories, and is unlikely to obtain car manufacturing qualifications through acquisition. Instead, it will mainly apply for qualifications on its own. In order to acquire a car manufacturing qualification, it may spend a lot of money to obtain a factory that has not been used for several years, and may even come with a large number of employees with high salaries, unreliable abilities, and potential debts. This money is not worth it, and given the current development of the mobile phone industry, Lei Jun and Xiaomi are reluctant to spend this money

If it's not through acquisition, how should the qualification for car manufacturing be solved?

Xiaomi definitely wants to build its own factory and successfully obtain the qualifications. Complete the factory construction on schedule, promote the design, release, and pre-sale of the first car, and obtain the license plate in a compliant manner. Although there are many restrictions now, for Xiaomi, the factory, production capacity, technology, and other aspects can meet the standards, and production qualifications can still be obtained, "said a person from a car company.

And Xiaomi has the support of Beijing Economic Development Zone behind it. The Xiaomi car project is another major project layout after Xiaomi Technology completed and put into operation the Xiaomi Smart Factory in Beijing Economic Development Zone. At that time, Beijing Economic and Technological Development Zone announced that it would mobilize the entire district to provide guarantee services for Xiaomi's automobile project, promote the early start and production of the project, collaborate and build an industrial ecosystem, and build Xiaomi Automobile into a globally influential national brand of new energy vehicles.

There are still nearly 2 years left until the previously scheduled time. If we really can't obtain the production qualification at that time, it's still possible to acquire a qualified factory at the appropriate time. The Great Wall Euler took only about 40 days from the completion of the factory building and equipment to the production of the first Euler. After obtaining the qualification, even if Xiaomi's first car production may not be so fast, if we make sufficient preparations, a few months should be enough, "the aforementioned person added.

When the first car for young people will be mass-produced will determine whether Lei Jun's last entrepreneurial venture, in which he invested all his wealth, can succeed; In the context of the sluggish smartphone market, whether Xiaomi Auto can save the current low stock price of Xiaomi has become a highly concerned topic for investors.

Advanced Institute (Shenzhen) Technology Co., Ltd, © two thousand and twenty-onewww.avanzado.cn. All rights reservedGuangdong ICP No. 2021051947-1 © two thousand and twenty-onewww.xianjinyuan.cn. All rights reservedGuangdong ICP No. 2021051947-2