Hotline:0755-22277778

Tel:0755-22277778

Mobile:13826586185(Mr.Duan)

Fax:0755-22277776

E-mail:duanlian@xianjinyuan.cn

Since the beginning of this year, with the strong driving force of the electric vehicle and power battery industries, the demand for battery aluminum foil has rapidly increased. However, the overall production capacity of the industry is tight, which has driven the continuous increase in processing fees for lithium battery aluminum foil.

Industry insiders say that the average processing cost of battery aluminum foil in 2021 was about 15000 yuan/ton, and the average processing cost increased to around 16500 yuan/ton in the first quarter of this year. Recently, the average price has further risen to around 17000 yuan/ton.

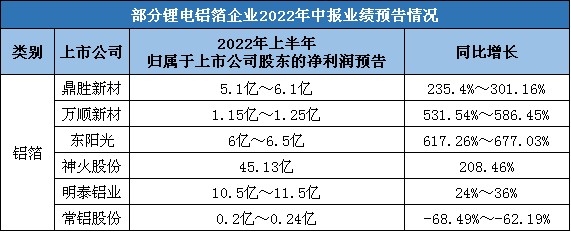

The increase in processing fees has driven the performance of industry enterprises to rise, and most companies have seen a significant increase in net profit, as evidenced by the 2022 interim performance forecasts of some listed companies.

Among the companies that have released performance forecasts mentioned above, except for Changlv Co., Ltd. which is expected to suffer losses, all other companies are expected to increase their performance. Among them, Dingsheng New Materials, Wanshun New Materials, Dongyangguang, and Shenhuo Shares saw a year-on-year increase of 2-6 times in net profit (attributable to shareholders of listed companies) during the reporting period.

For the significant increase in performance, most companies attribute it to the sustained strong downstream demand for battery aluminum foil and the high prices of their products.

Among them, as a leading enterprise in the industry, Dingsheng New Materials also stated that during the reporting period, due to the continuous acceleration of the transformation of traditional production lines to battery aluminum foil, its battery aluminum foil production and sales volume increased significantly year-on-year, further consolidating its market share and helping its overall performance to rise.

Dongyangguang, whose net profit increased by more than 6 times year-on-year, stated that its core product gross profit has improved. At the same time, it has sold some assets in other fields at the end of December 2021, which is conducive to its focus on advantageous industries.

Whether it is Dingsheng New Materials or Dongyangguang, they have expanded their production capacity or shifted their traditional production capacity to battery aluminum foil, which indirectly reflects the high prosperity of the battery aluminum foil track.

As for the expected loss in performance, Changlv Group explained that it was caused by multiple factors. Among them, in the new energy business, although some progress had been made, the overall business was still in the early stage of product improvement, mass production ramp up or market expansion during the reporting period. Coupled with the rapid changes in downstream market demand, its contribution to the current performance was not as expected.

Changlv Corporation announced in August last year that its monthly production capacity of battery aluminum foil was about 350 to 400 tons, with major customers including Guoxuan High tech and BYD. The 30000 ton power battery aluminum foil project announced in December last year is currently underway.

Overall, leading companies in battery aluminum foil have been certified by multiple battery companies and have obtained long-term supply agreements with them. In terms of globalization, Dingsheng New Materials stated that the company maintains good cooperative relationships with large domestic and foreign battery manufacturers, and closely follows the overseas business layout of mainstream battery factories. Based on the company's existing overseas production bases, it will gradually increase the proportion of battery aluminum foil exports in the future. In terms of technology, according to Wanshun New Materials, its battery aluminum foil can be applied to the positive electrode current collector of CATL Kirin battery technology.

In terms of the market, data shows that China's aluminum foil production totaled 4.55 million tons in 2021, compared to 2.52 million tons in 2012, with an average annual compound growth rate of 6.8%. Among them, the proportion of battery aluminum foil in the overall aluminum foil production increased from 1.7% in 2020 to 3.1% in 2021. Although the proportion is relatively small, the production in 2021 reached 140000 tons, a year-on-year increase of 100% from 70000 tons in 2020. It is a sub category of aluminum foil products with explosive demand growth.

In the future, not only will the strong demand for lithium batteries continue to drive the production and sales of battery aluminum foil, but battery aluminum foil will also benefit from the mass production and landing of sodium ion batteries.

Both positive and negative electrode current collectors of sodium ion batteries use aluminum foil, which is more than twice the amount used in lithium batteries. At present, Ningde Times' sodium ion battery production capacity plan has been implemented, and it is expected to achieve mass production in early 2023. Coupled with the follow-up of other enterprises' sodium ion battery production capacity, the demand for battery aluminum foil market will further benefit at that time. Institutions predict that by 2025, the global demand for battery aluminum foil will reach around 740000 tons, with a compound annual growth rate of 37%.

Based on the expectation of sustained demand growth, on one hand, leading companies are continuing to expand production, and on the other hand, non battery sector companies are also accelerating their entry.

Dingsheng New Materials is expected to have a battery aluminum foil production capacity of approximately 150000 tons this year, with an additional expansion plan for the "Annual Production of 800000 Tons of Battery Foil and Supporting Materials Project"; The annual production capacity of Wanshun New Materials is about 40000 tons, and there is also a project capacity of about 130000 tons under construction; The annual production of 60000 tons project of Huabei Aluminum entered the trial production stage in May this year; The 21000 ton power battery foil dedicated production line of Nanshan Aluminum Industry was completed for trial production last year, and this year we will focus on accelerating the release of production capacity; Shenhuo Group's 55000 ton production capacity is undergoing certification process, with an additional 60000 ton expansion plan; Mingtai Aluminum plans to produce 100000 tons of battery aluminum foil blanks.

On July 14th, Tian Shan Aluminum announced that its wholly-owned subsidiary Jiangyin Xinren plans to build a phase one project with an annual output of 200000 tons of battery aluminum foil, and implement a technological transformation project with an annual output of 20000 tons of battery aluminum foil, starting from the non battery field. The planned production capacity scale announced by it is already a relatively large scale in the domestic market, which also proves that this track is quite attractive.

It is understood that the process requirements for battery aluminum foil are very high. Dingsheng New Materials recently revealed to the public that "the company started making battery aluminum foil in 2010, with an initial yield rate of 40% -50%. After spending a lot of research and development and funding, it gradually increased to the current 73%. The existing manufacturers of ordinary aluminum foil actually do not have the ability to switch to battery aluminum foil. If manufacturers who originally did not make aluminum foil want to enter such a high threshold field, the actual results still need to be considered

In addition, the certification cycle for battery aluminum foil generally takes 2-3 years, which not only slows down the growth of production capacity, but also makes it difficult to improve the yield rate. In the first half of this year, the sales of electric vehicles exceeded expectations, and it is expected to continue to be prosperous in the second half of the year. The tight supply of battery aluminum foil may last throughout 2022, and the processing fee for battery aluminum foil may remain high. In the long run, according to the production capacity planning of relevant enterprises, there may be overall production capacity process risks.

Advanced Institute (Shenzhen) Technology Co., Ltd, © two thousand and twenty-onewww.avanzado.cn. All rights reservedGuangdong ICP No. 2021051947-1 © two thousand and twenty-onewww.xianjinyuan.cn. All rights reservedGuangdong ICP No. 2021051947-2