Hotline:0755-22277778

Tel:0755-22277778

Mobile:13826586185(Mr.Duan)

Fax:0755-22277776

E-mail:duanlian@xianjinyuan.cn

If 2021 is the year of photovoltaics, then the key word for this year must be 'price increase'. The price of photovoltaic modules increased from 1.6 yuan/watt in January to 2.2 yuan/watt in October, and only slightly decreased to below 2.0 yuan/watt at the end of the year.

At least as of the end of November, many countries have been stuck in pipelines and have yet to start power plant projects due to various reasons, such as high costs.

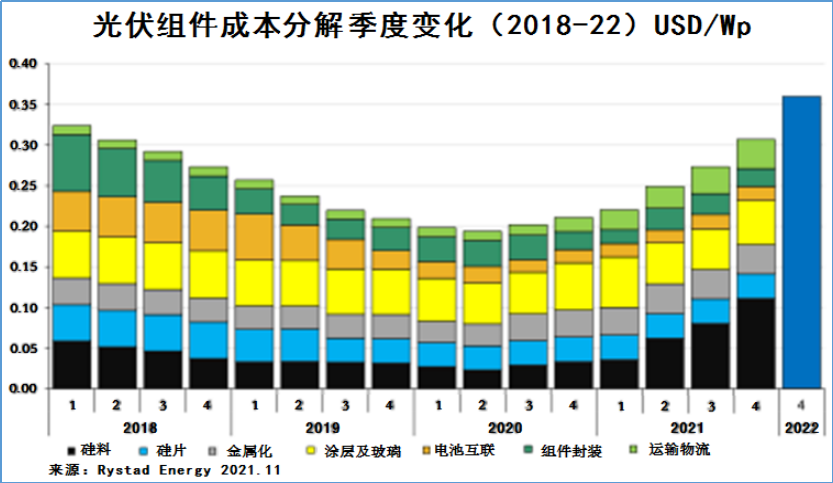

Who exactly acted as the driving force behind the increase in photovoltaic prices? In November 2021, Rystad Energy researchers drew a BOM cost change chart that has affected the cost of photovoltaic modules every quarter since 2018, detailing the seven links that have the greatest impact on module costs: silicon materials, silicon wafers, silver paste, glass, string soldering, packaging, and logistics.

Over the past 18 months, the culprit behind the increase in component prices has finally been revealed, and various efforts to stabilize component prices are also evident.

It is well known that the culprit driving up component prices is silicon materials, but Rystad Energy has provided a quantitative answer to the extent to which silicon materials affect component prices.

The change in silicon material cost can be divided into two stages. One is that it decreased from around 0.065 USD/watt at the beginning of 2018 to 0.025 USD/watt in Q2 of 2020, a decrease of 60%; The second increase was from 0.025 USD/watt at the beginning of Q3 2020 to 0.11 USD/watt in Q4 2021, with a growth rate of 340%.

This increase is consistent with the change in silicon material prices. In June 2020, silicon material prices were around 60 yuan/kg, and around 270 yuan/kg in November 2021. After deducting cost lag factors, the increase is about 340%.

The second major factor affecting component procurement costs is freight. As the component costs provided by Rystad Energy are mainly for overseas component procurement, sea freight is the main component of the shipping cost.

From the BOM cost chart, it can be seen that transportation costs remained basically unchanged in 2018 and 2019, at around 0.01 US dollars per watt. However, since 2020, transportation costs have started to rise, especially from Q4 2020, with a significant increase. By Q4 2021, the cost has increased by 300%, both in absolute value and proportion, second only to silicon materials.

For countries such as Europe and the United States, in addition to rising sea freight rates and difficulty in finding a container, the shortage of truck drivers has resulted in no one unloading at the port, and the increase in inland freight rates may also push up the purchase price of components.

The third culprit is metalization

The "metallization" reflected in the BOM cost chart usually refers to the silver paste and aluminum paste used in the production of photovoltaic cells.

From 2018 to Q2 2020, the cost of metallization has slightly decreased, but not significantly; The cost of metallization has significantly increased since Q3 2020, and has reached a new level since Q2 2021.

From the perspective of the global economic situation, starting from Q3 2020, the pandemic began to affect the global economy, and precious metals began to experience a safe haven market. It is reasonable for silver paste prices to rise. Starting from Q2 2021, during the implementation of the monetary policy after the new US president took office, global inflation and energy shortages inevitably led to the rise in prices of precious metals and high-energy consuming metals. Silver paste and aluminum paste are important raw materials in battery metallization processes, and rising costs have pushed up component prices.

The fourth culprit is glass

Compared to silicon materials and shipping costs, glass has not been at the forefront of price increases in 2021, but the BOM cost chart does not ignore the existence of glass. The bright yellow bars in the figure have not shown significant changes over the past four years, but an increase in costs can still be seen from the second half of 2018, and a decrease in costs can still be seen from the first half of 2020. After that, there have been ups and downs, which are normal fluctuations.

And those familiar with this period of history naturally know that since the second half of 2018, almost only glass in the entire industry has been rising, until the end of 2019, when glass production capacity was released and prices began to fall. Since the end of 2020, with the rise in silicon material prices, bulk raw materials have been on the rise, and the glass market has temporarily recovered.

If we only look at the BOM cost chart, glass is not yet qualified to be the culprit of the price increase of multiple components in the past year. However, no one can forget the "one glass hard to find" situation in 2019. Some industry associations even carried the suspicion of "monopolizing the market" in order to coordinate the supply and demand of glass.

Despite the fact that silicon materials, shipping costs, metallization, and glass are the culprits behind the rise in module prices, it is not difficult to find that in the process of widespread raw material price increases, silicon wafers, battery interconnection, and module packaging have made significant contributions to cost reduction in photovoltaics.

The cost of silicon wafer in the module has decreased from 0.05 US dollars/watt in 2018 to around 0.03 US dollars/watt at the end of 2019, and seems to have increased in early 2021, but overall it still maintains a downward trend. Analysis suggests that although the cost of silicon wafers has been continuously increasing due to the rise in silicon material prices, since the second half of 2020, there has been a clear trend of thinning silicon wafers under the pressure of rising silicon material prices. Therefore, the cost of silicon wafers in the BOM of components has stabilized the pressure of rising silicon material prices. Mainstream silicon wafer manufacturers such as LONGi and Zhonghuan have played an indispensable role in this regard.

For battery interconnection, there was a significant decline after Q2 2019, from $0.05/watt to around $0.015/watt in Q3 2020, and then gradually stabilized. The main factors affecting battery interconnection are the cost of solder strips and string soldering processes. In Q3 2019, Longi produced 166 silicon wafers, while Zhonghuan launched 210 silicon wafers; And in Q3 2020, it was also the time when Longi's 182 silicon wafer and Zhonghuan's 210 silicon wafer began mass production, and large silicon wafers brought significant cost reduction in the serial bonding process.

For the component packaging process, there has been a significant decline since 2018, with a noticeable cost reduction step in the first half of 2019, and another significant decline step in Q4 2020. This corresponds to the transition of the industry from 158.75 size to 166 size since 2018. Then, in the first half of 2019, LONGi launched 166 silicon wafers as the industry standard size, and 166 components began large-scale production and promotion. In addition, the large-scale production and promotion of 210 and 182 components from Q4 2020, the cost reduction in the component packaging process is still a profitable effect brought by large silicon wafers.

【 Summary 】

After a detailed breakdown of Rystad Energy's component BOM cost changes, we can see that the biggest change in component costs comes from the artificial shortage of silicon materials caused by the crazy expansion of downstream production capacity. Once the industry realizes that silicon materials are not in short supply (if silicon material production capacity is fully utilized), reasonable arrangements for safety stock in each link will inevitably lead to a gradual decrease in silicon material prices. As for how to reduce the silicon material from 270 to 70, Global Photovoltaic will interpret it in conjunction with the progress of global installed capacity in the near future.

The shipping and metallization costs that have driven up component prices are basically the global impact brought about by the pandemic, which may take more than a year to fully digest, and there will not be a significant cost reduction in the short term.

Advanced Institute (Shenzhen) Technology Co., Ltd, © two thousand and twenty-onewww.avanzado.cn. All rights reservedGuangdong ICP No. 2021051947-1 © two thousand and twenty-onewww.xianjinyuan.cn. All rights reservedGuangdong ICP No. 2021051947-2